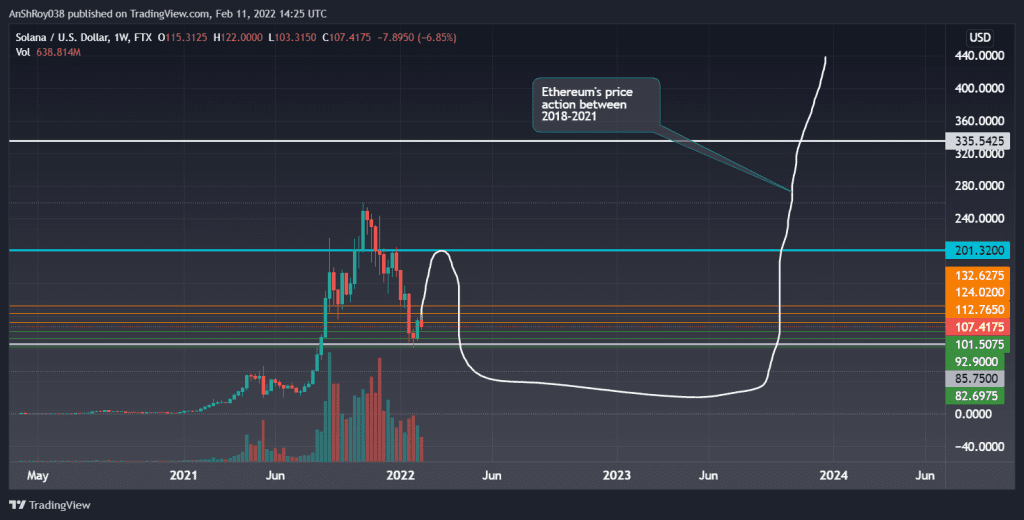

Blockchain platform Solana appears to be tracking Ethereum’s 2018-19 price action, according to Twitter-based crypto trader known as Moon Overlord it seems.

“I can see SOL diverging as ETH did in 2018-2019, there are many similarities not only in price action but also in community building.”

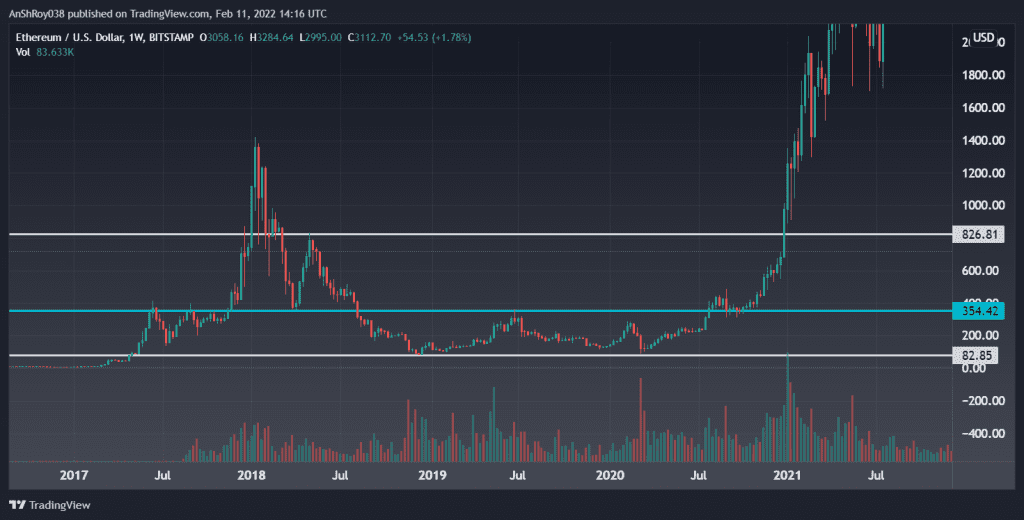

In 2018-19, the price of Ethereum (ETH) peaked at $1,420 at the beginning of the year before prices started to drop, but then lost 94% of its value. ETH prices traded between $80 and $354 between January 2019 and July 2020 before bursting upwards in 2021.

If Moon Overlord’s forecast holds, Solana could see a downside move before climbing up in late 2023 and gain around 213.6% to reach $335.50 before resuming the uptrend. However, the price target is tied to Solana, which reflects the price action of ETH.

In the short term, Solana could climb as high as $201 before prices drop. Moreover, if Solana succeeds in her Moon Overlord prediction, many investors will buy SOL when prices hit the bottom in 2022-23.

Also, Solana’s alleged 65,000 tps transaction speed and low transaction fees make it a prominent name on the “Ethereum Killer” list. The DeFi and NFT sectors are also expanding on the Solana network. As both the DeFi and NFT sectors expand, Solana will likely grow with them.

Latest Status on SOL Price

SOL prices failed to hold above the $110 price level as the upside lost strength around February 8th. Also, the dynamic resistance of Solana’s 26-day EMA has proven too tough for the Solana token.

The critical resistance for the SOL is near its 26-day EMA at $112.8. If the price breaks and manages to stay above the resistance, the SOL will aim $124 as the next resistance.

On the other hand, initial support for SOL is around $101.5. If the bears continue to increase their pressure, we could see the token price drop to the $93 support. Also, a sustained sell-off could enable the $87 support to kick in.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.