Bitcoin has literally been on a roller coaster ride this month. It started October on a high note and consolidated reasonably in the second week before continuing its uptrend.

After setting a new high of $67K on October 20, Bitcoin continues to trade at around $60K to $63K. The last few trading sessions have been pretty quiet, with the leading cryptocurrency gaining only 0.17% in the last 24 hours.

It’s not surprising that there’s been a stagnant movement at this point. Prices usually hit the brakes and calm down before they rise, and what’s happening now may be a harbinger of such a situation.

Besides, all three Sundays in October, 3, 10, 17, were kind of monotonous, less volatile and sluggish compared to the other six days of the week. Considering the fact that today is Sunday, an undramatically calm trading session makes perfect sense. So, if the weekly tradition is followed this time, Bitcoin should continue to trade around its current range throughout Sunday.

Do the metrics confirm the claim?

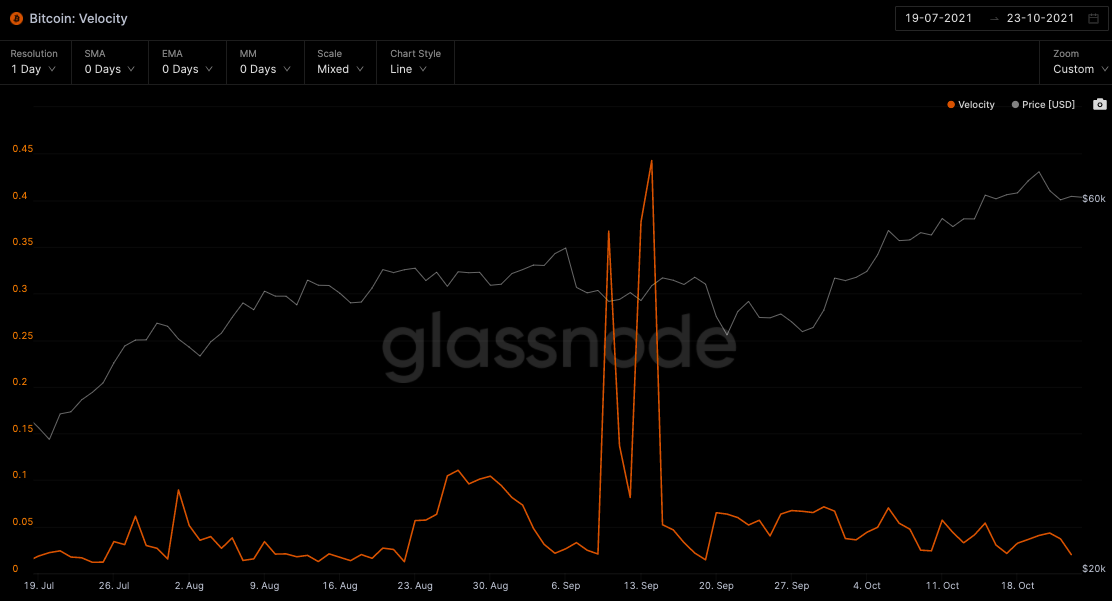

At this stage, it could be argued that the less dramatic Sunday may have been just a coincidence. But Bitcoin metrics also confirm the claim. First of all, the velocity chart is not messy at the time of writing. While a rally is usually accompanied by a steady pace, a turbulent landscape paves the way for corrections to begin. Considering the calm and balanced state of this measurement, the probability of a large pump is also very low.

Another key factor at play remains BDD (Day of Destroyed Bitcoin), which explains the estimated volume of transactions, or “the speed of money,” flowing into Bitcoin. A low BDD is a direct indicator that investors are saving. At press time, BDD is nowhere near its September 27 high and is showing signs of accumulation. Thus, non-negligent sell-side pressure reasonably eliminates the possibility of a weekend crash.

What about next week?

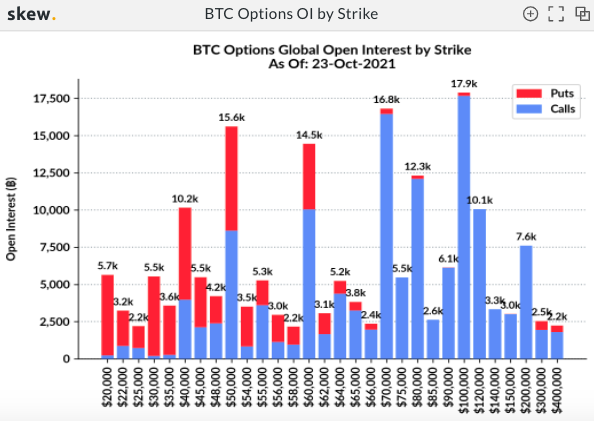

The week following Sunday can be quite interesting. In terms of derivatives, there is a large options expiry lined up for October 29. According to data from Skew, more than 57.4k BTC will expire on Friday. Given the fact that this is the largest maturity before December 31st, it has the potential to destabilize the market and initiate a change in the monotonous trend.

Purchases (calls) made at a strike price of 60 thousand dollars and above largely eclipse sales. Therefore, if BTC stays in the $60,000 range or manages to rise even higher, callers can be expected to exercise their options to buy their own Bitcoin. Moreover, a buying spree may be triggered and long green candles may start to sprout on the charts.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.