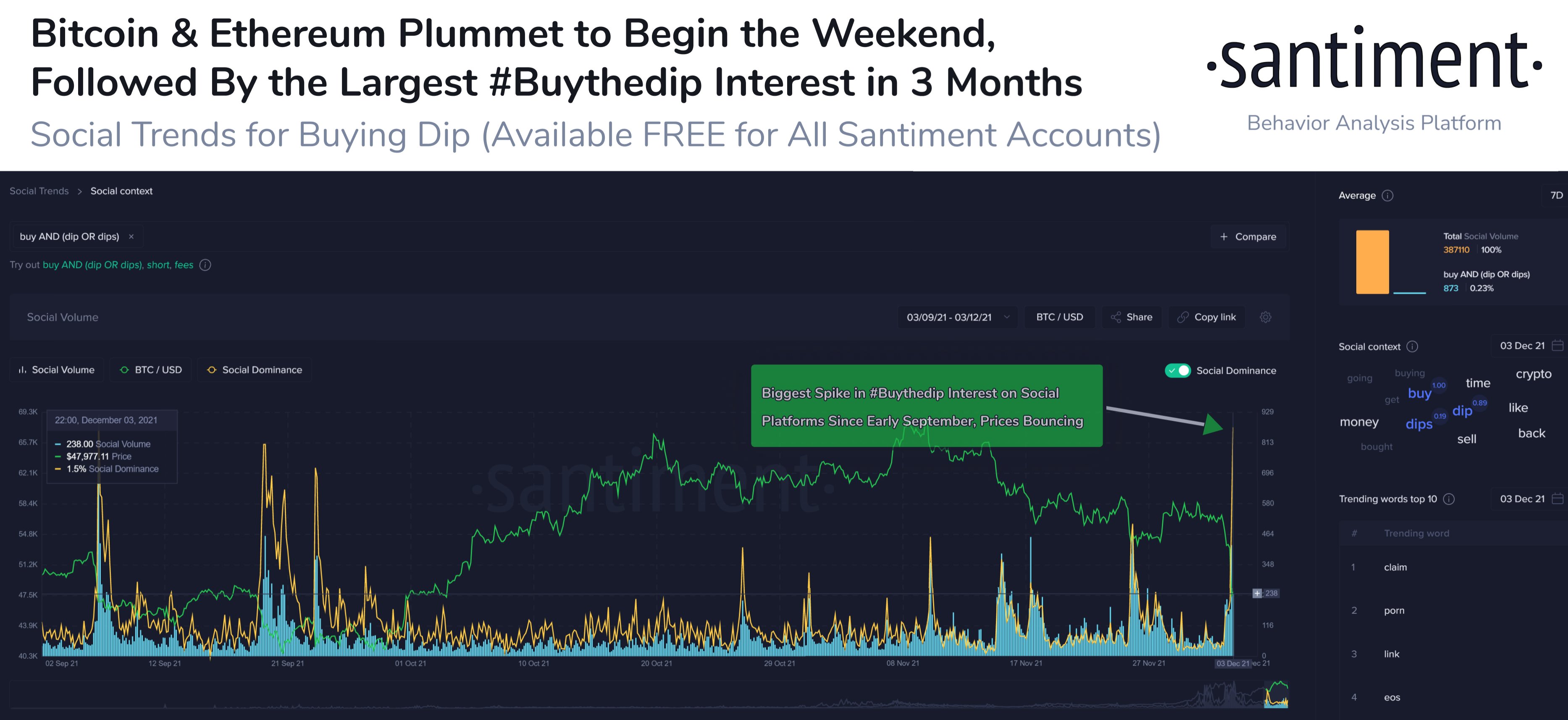

In the new analysis he published, Santiment stated that the price of Bitcoin (BTC) and Ethereum (ETH) found support more easily with the help of the “buy from the bottom” phrase that has been seen since the beginning of September. Let us summarize the company’s statements for you, stating that the company’s analyzes were published during the declines.

“Bitcoin dropped as low as $43,500 about an hour ago and Ethereum dropped to $3,540. However, prices have bounced with the increase in ‘buy-bottom’ interest, the biggest in 3 months.”

Santiment noted that with the exception of three decentralized finance (DeFi) focused cryptocurrencies, the entire top 100 cryptocurrencies list took a significant hit the day the market crashed, with nearly $600 billion liquidated from the digital asset market.

Santiment added that market catalysts include sentiment to the COVID-19 pandemic, as well as the ratio between “long” and “short.”

“With the exceptions of ATOM, NEAR, and DFI, the top 100 assets in crypto, all markets were in the red (bearish). This weekend, key factors to watch were fears of the global pandemic and the ratio between bottom traders and market exposures.”

An important player that publicly announced that it was buying from the bottom was the government of El Salvador. The country’s president, Nayib Bukele, announced the acquisition on Twitter.

“El Salvador just bought bottom! We bought 150 BTC with an average of $ 48,670.” statement was made.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.