A layer-1 blockchain Terra (Luna)was among the cryptocurrencies that left the crypto world astonished this year due to its impressive development. Designed in 2018 and launched on the mainnet in mid-2019, the platform has since expanded its DeFi ecosystem and total value locked in domain (TVL).

In fact, over the past 12 months, the total value locked in Terra has grown from $300 million to nearly $30 billion. That’s an incredible 100x growth. The 8th-ranked blockchain according to CoinGecko is currently the second largest DeFi chain behind Ethereum, with around 26 protocols on its network.

Crypto experts say the secret to Terra’s recent success is TerraUSD (UST), a decentralized and algorithmic stablecoin at the center of its ecosystem. TerraUSD (UST), like most algorithmic stablecoins, works using mechanisms such as minting and burning.

Since UST is backed by LUNA, Terra’s native currency, it is possible to mint UST by burning LUNA. The opposite is also true for fixed money.

From a network perspective, the price of UST is always 1 USD. This system sets the stage for an excellent arbitrage opportunity. If UST is worth more than one US dollar, people will burn the LUNA for one dollar to print UST and sell it for profit on the secondary market. This selling pressure will push the UST price back to one US dollar.

Conversely, if UST is trading below one dollar, the market will be encouraged to buy UST on the secondary market and burn it to acquire LUNA. This is because in this case you can buy 100 UST for 98 USD and burn it for 100 USD worth of LUNA. Buying pressure means the price goes up. This is how the stability of this algorithmic stablecoin is maintained.

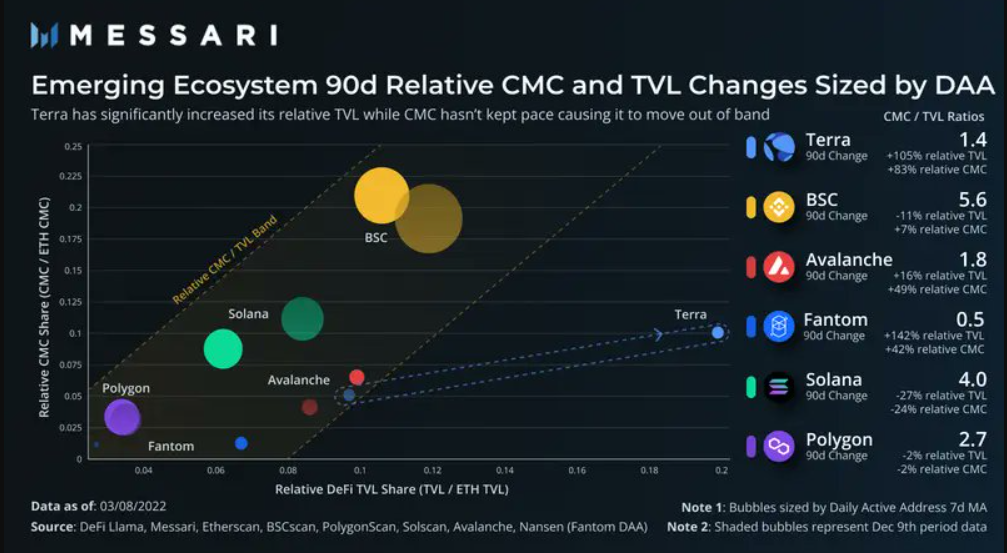

Evaluating the role Terra plays in the overall DeFi ecosystem, Messari analysts also pointed out some numbers. According to the platform’s data, in the last few months, LUNA has managed to break its relationship with the general market.

According to Messari, the average price of smart contract tokens dropped 12 percent in March. During this time LUNA price grew by more than 70 percent. This growth followed an increase in TVL.

“LUNA has challenged the weight of price fluctuations experienced by mainstream smart contract platforms and firmly placed itself on the Moon. Terra’s ultimate success is in the thriving Terra ecosystem, CEXs and other chains around the world. [platformun stablecoin’i olan] There was the adoption of the UST.

In various categories, UST leads the way in stable and clearly decentralized platforms:

+Biggest supply

+Fastest growing circulating supply

+Fastest growing usage”

Terra’s TVL, which placed itself in the undisputed second place after Ethereum; BSC has become as big as Avalanche and Solana’s TVL combined. Interestingly, LUNA’s price increase hasn’t kept pace with Terra’s growing TVL. This is also a bullish sign as it shows that the LUNA is actually undervalued.

The existence of a decentralized and scalable stablecoin has always been a need in the industry. Since the use of centralized tokens in decentralized finance is against the decentralized nature of the platform, Terra was able to capitalize on this need and build an entire ecosystem around it.

As a result, the platform already has a name and presence in the crypto world. Messari analysts also argue that if the network continues to perform as well as it is now, this LUNA could be just the beginning for its price performance.

Intense institutional Bitcoin buying came from Terra this year

As a result of the recent heavy LUNA uptake, Terra and the Luna Foundation Guard (LFG), a non-profit organization designed to support the Terra network, have become the newest major BTC buyer on the market.

The foundation’s short-term reserve target for Bitcoin is reportedly $3 billion. They even claimed that they could increase this to $10 billion in the near future by using the protocol fees and continuing to buy the coin. As a result of continuous purchases by the company, Terra has so far accumulated 42,530 BTC worth approximately $1,733 billion – just 700 BTC less than Tesla’s corporate treasury allocation.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.