According to Matthew Hyland, a well-known cryptocurrency analyst, Bitcoin (BTC) price is on its way to reach $250,000. PlanB’s S2F model predicts that BTC will hit $100,000 by the end of the year, which could fuel another explosive rally. However, the analyst also points out that another prominent Bitcoin price pattern could be invalidated.

Bitcoin price could easily reach $250,000 by early 2022, according to Matthew Hyland

cryptocoin.com As you can follow from our news, Bitcoin price recently recorded an all-time high of around $69,000 on November 10, fueled by constant inflation. The argument that the leading cryptocurrency is a hedge against rising cost pressures has been fueled by inflationary fears. With BTC skyrocketing to a new record high, a prominent analyst believes the flagship digital asset could reach $250,000 by January 2022. According to the stock-to-flow model for bitcoin price, $1 million for 2025 will be the focus, while the leading cryptocurrency could easily reach $250,000 by early 2022, according to analyst Matthew Hyland.

The analyst also points out that only one of the Bitcoin stock-to-flow models, which is the (S2F) model instead of the Stock to Flow Asset (S2FX) model, will survive after 2022. Matthew Hyland emphasizes that the BTC market is not yet enthusiastic, but he thinks that this stage may come when Bitcoin price rises above $100,000. According to PlanB’s S2F model, the major cryptocurrency will already have reached $100,000 by December this year.

When the S2F model is confirmed with Bitcoin price reaching $100,000 in December, Matthew Hyland says “all eyes will be on the S2X model” and predicts the flagship cryptocurrency will reach $288,000 for this bull run. According to the analyst, since PlanB correctly predicted BTC price in the S2F model, the S2X model could be a catalyst for the late stages of the enthusiastic run, and investors are likely to believe the $288,000 target for fear of missing out (FOMO) is on the radar.

However, Bitcoin price may face a pullback as Matthew Hyland believes this could be a “sell the news” event. Because larger players can provide liquidity for other large investors to sell at higher prices. The analyst says that while the target price is $288,000, BTC will fall short of $250,000.

According to the analyst, although the S2X model will be superseded, S2F will remain intact. The model predicts that the price of Bitcoin will reach $1 million by 2025. Matthew Hyland also states that venture capitalist Tim Draper predicts BTC will reach $250,000 in 2018 by 2022.

According to crypto analyst Sarah Tran, in the coming years, Bitcoin will continue to cut the block reward in half, which could lead to insufficient supply in the leading cryptocurrency and lead to a sharp increase in the price of a leading digital asset.

BTC technical analysis: Signals more bullish after pullback

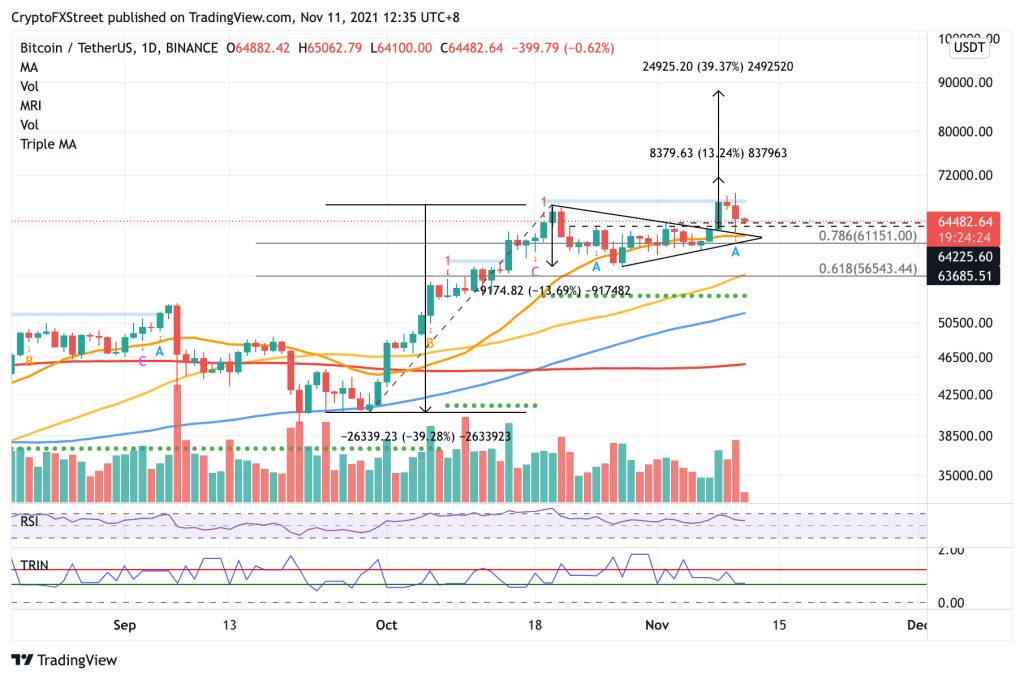

Analyst Sarah Tran states that the price of Bitcoin presents a bullish pennant pattern on the daily chart, signaling that BTC may continue to rise even higher once it finishes the pullback. Sarah Tran continues her analysis:

Bitcoin price’s initial target to the upside is $71,658 as measured by the symmetrical triangle forming the pennant of the dominant chart pattern. If BTC can break above this level, the coin’s below target is $88,117, which marks a 39% climb from the upper bound of the governing technical pattern. As Bitcoin pulls back, investors seem to be seizing the opportunity to buy the dip, as the Arms Index (TRIN) suggests there are more buyers than sellers in the market.

However, the analyst reminds that before Bitcoin price hits optimistic targets, the coin’s first line of defense could retest key support levels at $64,225 on November 2, then at $63,685 on October 22. The analyst draws attention to the following technical levels:

If the selling pressure builds, bitcoin price could tag the upper bound of the governing technical pattern at $62,301, coinciding with the 21-day Simple Moving Average (SMA). A break below this level could create problems for the bulls as the bullish view may be invalidated.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.