Bitcoin entered this week at just over $57,000 and is about 15 percent behind its high. Leaving the macro market movements and the US dollar, Bitcoin once again seems to be the gold alternative that investors want.

Altcoins lag behind Bitcoin season

Things look rosy as the week begins for Bitcoin traders – four-month highs bounced back and broke last week. Now apparently targeting the recent resistance below the all-time high of $64,500, the price action of BTC is pleasing to market participants. However, there is another factor behind Bitcoin’s strength that could protect it further in the short term.

Altcoins are underperforming, leading to predictions of a “Bitcoin season” before some kind of altcoin season re-emerges later on. This is especially visible in Ether (ETH), the largest altcoin by market cap, and is currently at its lowest level against BTC since early August. Michaël van de Poppe “ETH/BTC is collapsing while Bitcoin is consolidating. “I assume bitcoin is going on, but altcoins just don’t understand the game yet,” he said.

Ambitious Bitcoin predictions

How high the BTC price can go up is a topic of intense debate, and while some claim that $200,000 or even $300,000 is “programmed”, others are already losing faith, claiming that this halving cycle cannot be like the last two cycles. All these findings from popular trading account TechDev point to this year’s peak being an order of magnitude higher than the previous one. The analyst argues that a six-digit increase, technical or not, is logically warranted.

New record levels in network fundamentals

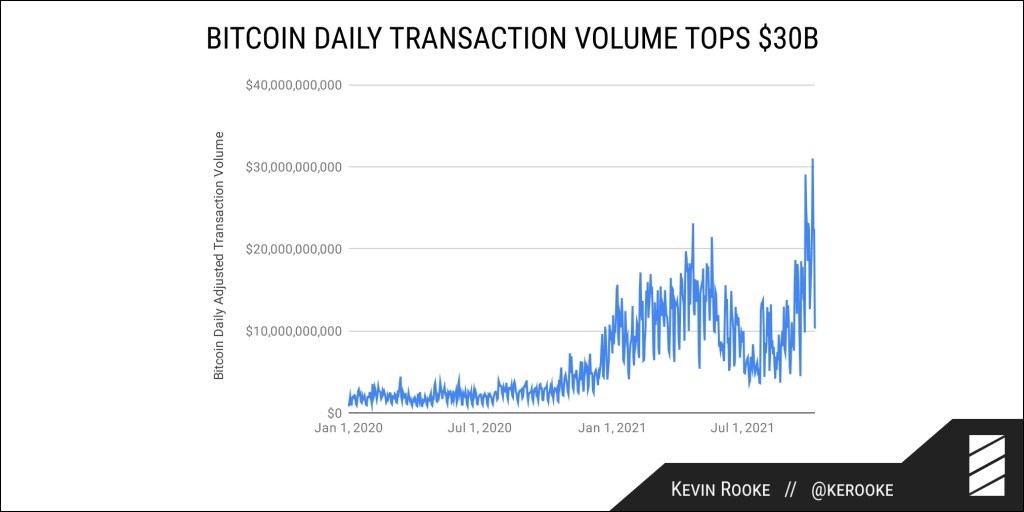

While the hash rate and mining difficulty on the BTC network are approaching all-time highs, new data shows that other aspects of Bitcoin are breaking their own records. In a single day over the past week, the BTC network has capped over $30 billion in value. The impressive conversion was accompanied by consistency in cost – Bitcoin transaction fees remain low.

Problems with GBTC

cryptocoin.com As we reported, the countdown to the Bitcoin exchange-traded fund (ETF) decision continues to be exciting this week – but is a confirmation already “priced in” in the market? The US regulator, the Securities and Exchange Commission, has delayed the deadline until November to decide the fate of spot-based Bitcoin ETFs, but this month will see a “yes” or “no” in futures-backed ETF products.

While the latter attracted praise and criticism in equal measure, questions have arisen regarding existing institutional Bitcoin instruments, particularly the market weight Grayscale Bitcoin Trust (GBTC). Against the rapidly rising Bitcoin price, GBTC continues to trade at a significant spot discount and this trend has only deepened in recent weeks. If ETFs continue to move forward, analysts argue, more capital will flow into them long before Grayscale converts its funds into ETFs.

“Greed” in the crypto fear and greed index

The Crypto Fear and Greed index is closely tied with the BTC price increase. BTC is close to $57,000 so far, while the index is at 71 points out of 100. So the market is not “overly greedy”, just “greedy”. October, however, produced major changes in sentiment. For example, on September 30, just two weeks ago, the index was at 20 points—measuring “extreme fear”.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.