We have witnessed many times that major and old altcoins take the stage before the big rallies in Bitcoin and altcoins.

last week LTC And bitcoin cashThe rises in ‘ reminded us of these rallies.

Bitcoin Cash has increased by 200% from $100 to $320 in the past two weeks, while those betting against BCH have suffered huge losses.

During the rise in BCH, liquidations in the futures markets hit the highest level in the past two years, according to data analysis companies.

The rise in BCH was mainly related to demand from South Korean exchanges. During this rise, investors who opened short positions by saying “it will return from here” lost about 30 million dollars.

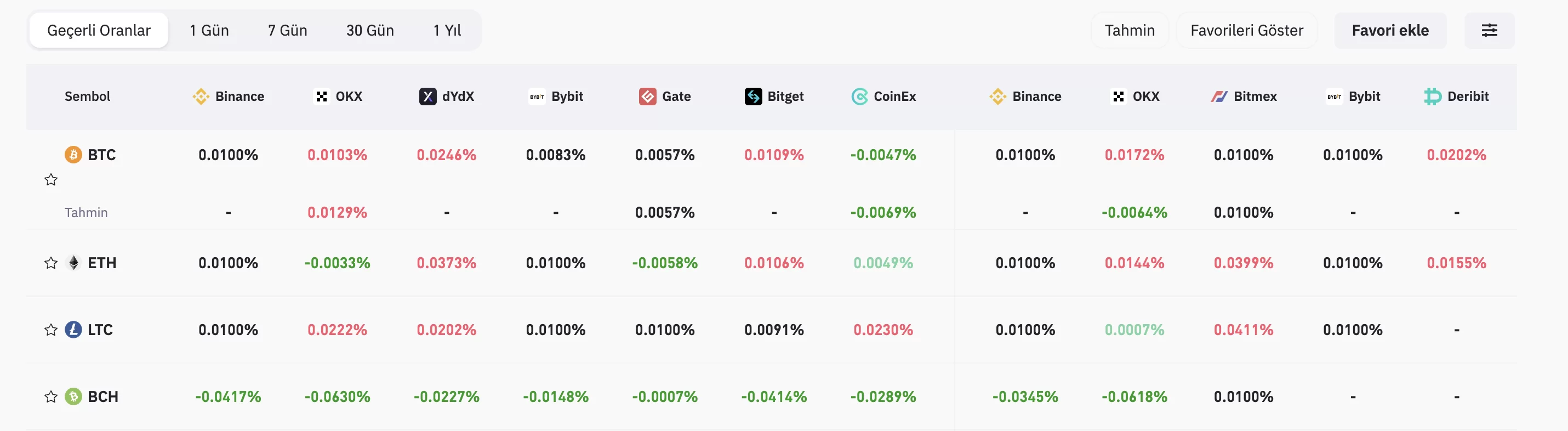

When we look at the funding rates in the stock markets, we see that the funding rate in BCH is negative and short positions are dominant. Although the bears’ losses are at the top of two years, signaling that the price may pull back a little, the still negative funding rate indicates that there is still a bullish area for the bulls.

While BCH continues its sideways movements in the $300 region, we will be watching whether investors who are waiting for a correction will be wrong again.

Among the reasons for the rise in LTC and BCH are the new exchange EDX Markets, backed by Fidelity Digital Assets, Charles Schwab and Citadel Securities, supporting Litecoin (LTC) and Bitcoin Cash alongside Bitcoin (BTC) and Ethereum.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!