After Bitcoin recently hit an all-time high of $69,000, a sideways movement started to follow. As of press time, Bitcoin is trading at $63,823 with a market cap of 1.203 trillion.

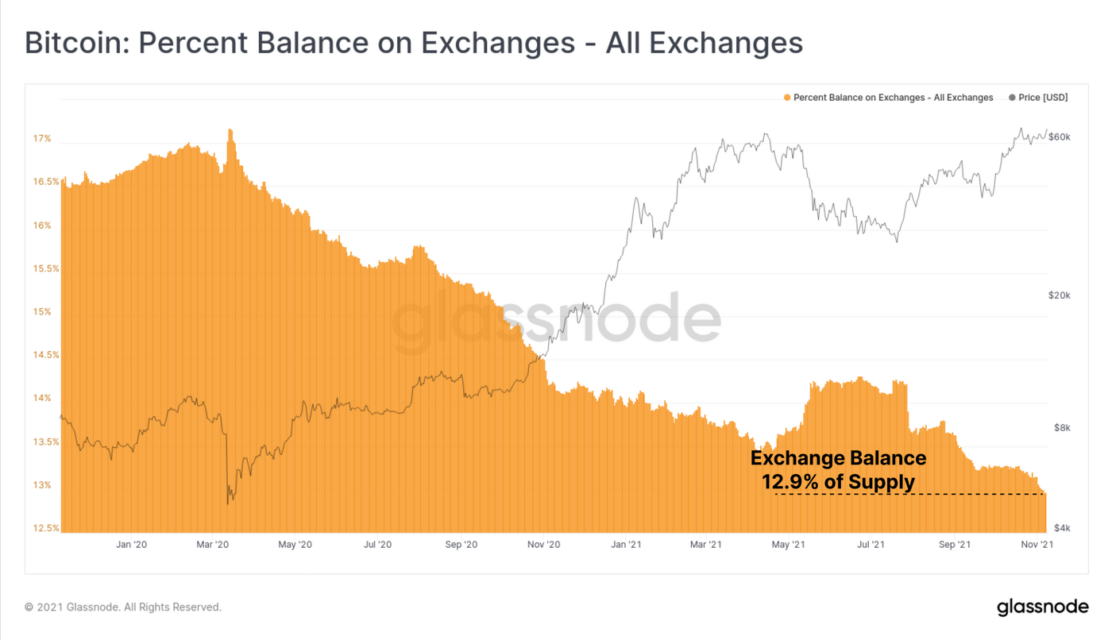

Bitcoin investors seem to continue to hold the cryptocurrency, predicting that its price will continue to rise more than altcoins. Research firm Glassnode revealed in its latest report that only 12.9 percent of the total Bitcoin supply is circulating on various crypto exchanges.

The total number of Bitcoin tokens currently procured is over 18.8 million, which makes up 90 percent of the 21 million tokens predestined to be created by Bitcoin’s anonymous creator, Satoshi Nakamoto.

Glassnode’s report says that as Bitcoin hits an all-time high, the supply held by its “long-term holders” (LTHs) has reached “peak HODL.” It was also reported that this long-term investor group moved a very small portion of the Bitcoins in their hands to the stock markets.

“During this period, long-term investors moved only 0.73% of their assets into liquidity”

As it is known, the expression hodl means that investors hold their coins instead of selling them.

Basically, the analysis says that if investors weren’t satisfied with holding their Bitcoin holdings, they would hold more tokens available for sale on exchanges, but that may not be exactly the case right now.

“Despite hovering just below all-time highs, on-chain activity remains only marginally above bear market levels,” Glassnode added.

In another observation, the report says that the rate at which new wallets send or receive Bitcoin has also increased recently.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.