The US government has shocked the crypto market as it prepares to potentially sell $246 million worth of Bitcoin. This seismic event may have been triggered by the recent transfer of more than 9,825 BTC linked to Silk Road addresses currently under the control of the US Department of Justice.

Are these early signs of Bitcoin selling?

cryptocoin.comAs you follow, the US government has been moving its Bitcoins in recent days. The US Department of Justice (DOJ) moved 8,200 BTC to Coinbase in a meticulous operation. The federal agency used a labyrinthine funding route by shuffling assets via the Bitcoin address 361yogPsasxJz6JAaFskmWZes14Gs38ikj. DOJ distributed 8,200 BTC to more than 100 different Coinbase addresses. Thus, each address received 79.2 BTC.

This complex scheme could result in the liquidation of these BTCs. It should be noted that the collected Bitcoin corresponds to an astronomical figure of $ 246 million. We derive this figure at the market price of $30,000. Currently, the Bitcoin price is higher as it exceeds $31,000.

It is possible that this news will cause shocks in the crypto market. However, experts at on-chain analytics firm CryptoQuant remind that these actions of the government are not necessarily related to the drop in Bitcoin’s price. In this context, CryptoQuant shares the following assessment:

It is important to be aware that the impact of the news may not always be in line with your expectations. If you try to overreact to such news and expect a significant market crash, you may face significant losses.

This high-profile Bitcoin sale by the US government will be an important test. Especially for the stability of the crypto market, which is going through a liquidity crisis.

Volatility, volatility and bull market

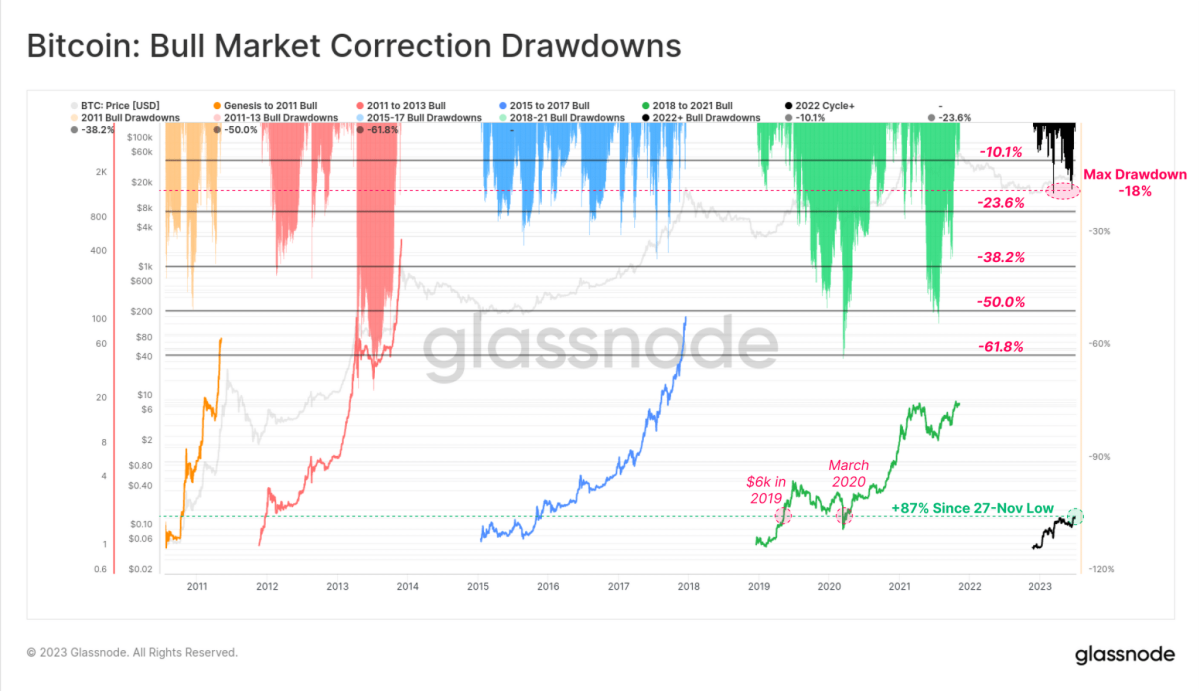

Glassnode evaluated the depth of “bull market corrections” so far this year. It also compared with previous cycles. The on-chain data provider stated that “the highest decline in 2023 was only -18%. He found that this is quite shallow compared to all previous cycles.” According to Glassnode, this indicates “relatively strong demand underlies the asset.”

The report also evaluated the recovery from the lows of the bear market in November 2022, when BTC fell as low as $15,000. He noted that its value has increased by 91% since then. According to Glassnode, this recovery “has a remarkable resemblance to the recovery rallies of previous cycles. Looking at these findings, it seems that despite the price volatility and fluctuations experienced so far this year, the BTC market continues to exhibit signs of resilience and strength in the current cycle.

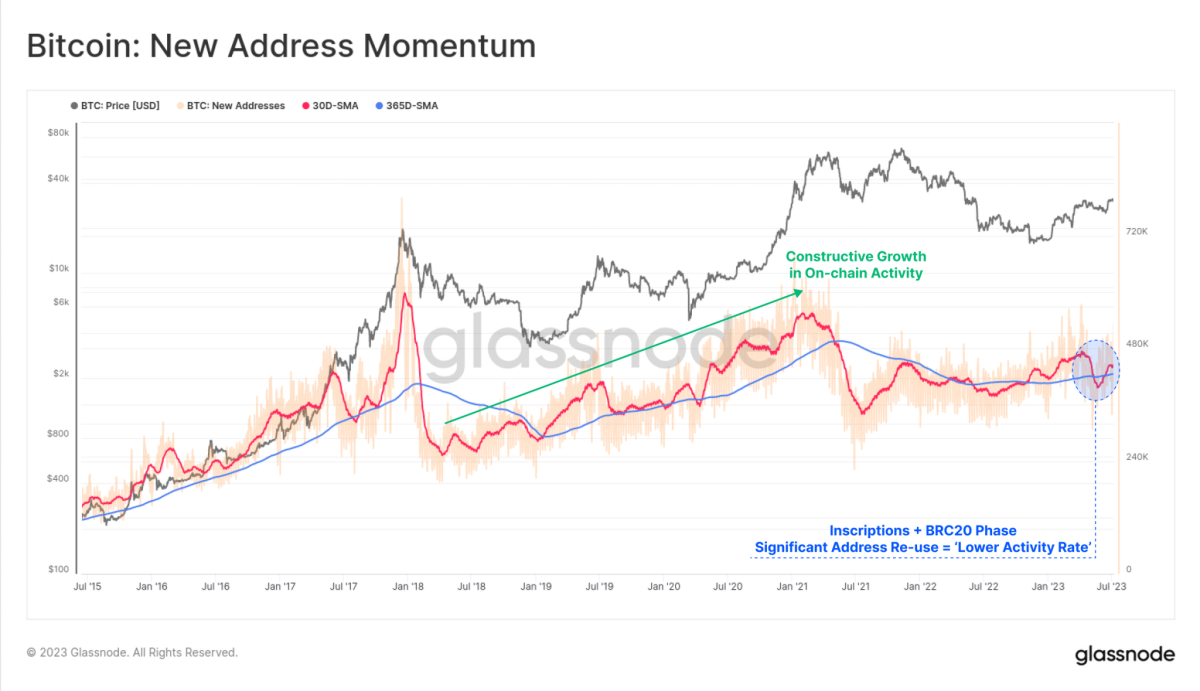

Also, Glassnode drew attention to the impact of Inscriptions on on-chain activities in the Bitcoin network. The inscriptions sparked a spike in BTC network activity a few months ago. Typically, an increase in this metric is a positive signal of increased adoption and a healthy network. However, the significant reuse of addresses and the presence of inscriptions containing small transfer volumes require a more nuanced interpretation. Active address momentum has started to pick up again over the past few months, with inscriptions falling. Glassnode interprets the current situation as follows:

The traditional interpretation would see the last 2-3 months as an implied decline in Bitcoin network activity. However, the correct interpretation is that this is simply a product of significant address reuse by inscription merchants, and network activity is actually booming as blocks are full.

It is a stereotypical view that steady growth in the number of active addresses in a coin’s network heralds a steady increase in the coin’s value. As long as the sentiment remains positive, it is possible for the price of BTC to rise further.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.