- A robot notorious for outperforming the markets has announced its latest altcoin allocations during a stagnant period for the crypto market, with most cryptocurrencies giving up on their recent gains.

Real Vision Bot, once a week hive mind a bot that conducts surveys to generate algorithmic portfolio assessments that reveal consensus (a conceptual entity made up of large numbers of people who share knowledge or opinions with each other and are deemed to produce uncritical relevance or collective intelligence).

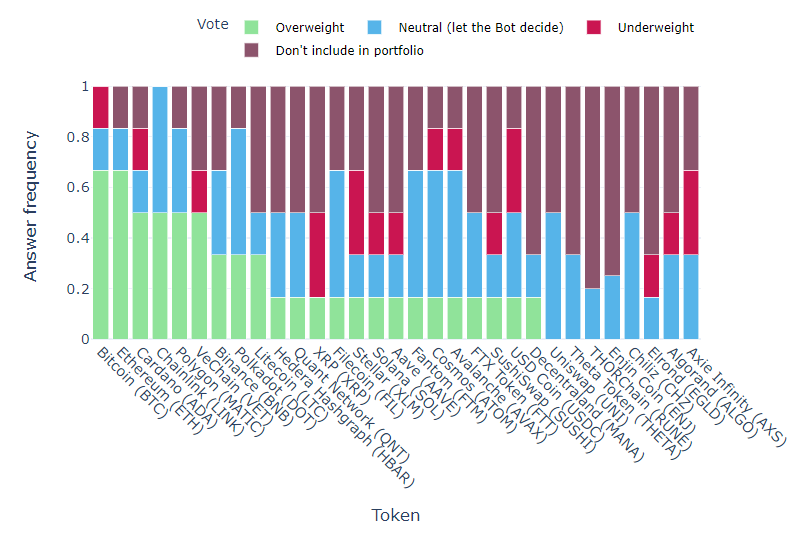

The Real Vision Exchange Crypto Survey allows participants to rate 30 tokens and each coin overweight (in which the investor thinks the coin will outperform other coins in the market sector) or underweight It is designed to monitor sentiment among investors by allowing them to choose whether to classify as (this classification indicates that this coin may not be a good investment).

The newest bot datasindicates that traders’ risk appetite remains aggressive; According to the platform, most market participants vote to replenish their portfolios with an additional 21 altcoins, with the largest cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) both weighing 67%.

Koinfinans.com As we reported, ETH rival smart contract platform Cardano (ADA)decentralized oracle network Chainlink (LINK) and layer-2 scaling solution Polygon (MATIC) 50 percent overweight ranks third by allocation.

“Latest RealVision Exchange cryptocurrency survey findings. Cardano, Chainlink and Polygon surprised owerveight with equal percentage votes.

1. Bitcoin 67%

2. Ethereum 67%

3. Cardano 50%

4. Chainlink 50%

5. Polygon 50%”

Supply chain management blockchain VeChain (VET) ranks sixth with a rate of less than 50 percent. popular cryptocurrency exchange Binance‘s native token BNB 30 percent overweight allocator rank cross-chain interoperability protocol Polkadot (DOT) and decentralized peer-to-peer cryptocurrency Litecoin (LTC) shared with.

Participants also developed a decentralized application creation protocol. Hedera Hashgraph (HBAR)enterprise-grade interoperability solution provider Quant Network (QNT)distributed ledger technology XRPdecentralized storage network Filecoin (FIL)decentralized payment network Stellar (XLM)Ethereum competitor Left (LEFT)lending and borrowing protocol AAVE (AAVE)enterprise-grade blockchain platform Phantom (FTM)scalability and interoperability ecosystem Cosmos (ATOM)tier-1 smart contract platform Avalanche (AVAX)native token of FTX cryptocurrency exchange FTX Token (FTT)automatic market maker SushiSwap (SUSHI)dollar-pegged stablecoin US Dollar Coin (USDC) and virtual reality world Decentraland (MANA) Voted 14 more cryptocurrencies, including

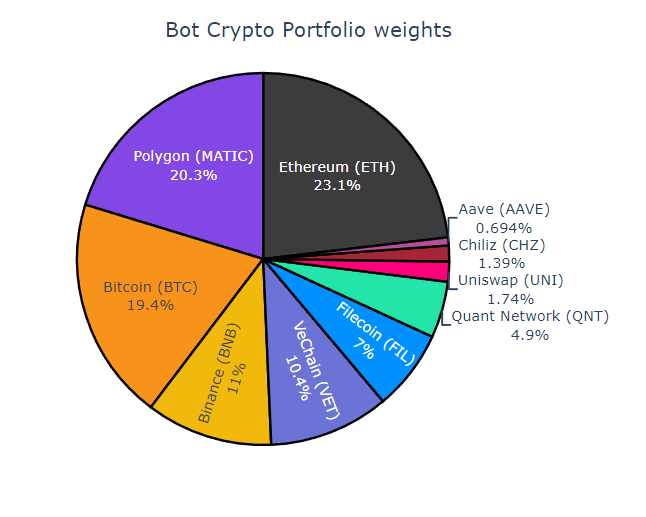

The latest exchange portfolio allocation, based on the survey, was 17.1 percent. chainlink led by LINK with 14.3 percent Ethereumwith 12.2 percent polygonwith 11.9 percent bitcoin and with 8.57 percent polkadot following. The other eight cryptoassets have an allocation of between 2% and 7%.

The bot itself compiles a portfolio of its own, and Real Vision shares with its followers four digital assets that make up about 75 percent of its weekly assets:

“The latest weights of the RealVision Exchange crypto portfolio this week. It was rebalanced on Saturday. Chainlink weight in the exchange portfolio was staggering.

The bot only deals very closely with Ethereum, Polygon, Bitcoin and Binance.”

Real Vision Bot is a collaborative project developed by quantitative analyst and hedge fund CEO Moritz Seibert and statistician Moritz Heiden.

Real Vision founder and macroeconomics expert Raoul Pal described the historic performance of the bot as “astonishing” and claimed that it outperformed the top 20 cryptoassets in the market combined by 20 percent.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.