I think everyone knows that the 7.5% inflation rate in the US is the highest inflation rate in the last 40 years.

At the same time, if we compare it with the last year on an annual basis, we can see that there is a serious inflation data difference compared to last year.

In other words, we are talking about a very high inflation rate on an annual, monthly and historical basis.

Well, if we think about what are the causes of inflation;

- Uncontrolled money printing by central banks.

- Supply chains deteriorating in the world with Covid

- The prevalence of working from home, but thus the necessity of meeting everyone’s accommodation needs individually rather than in offices or common working areas.(Electricity-Natural Gas-Water-food…)

- Unemployment and an effort to ensure the survival of the citizen sitting at home, again with uncontrolled distribution of money.

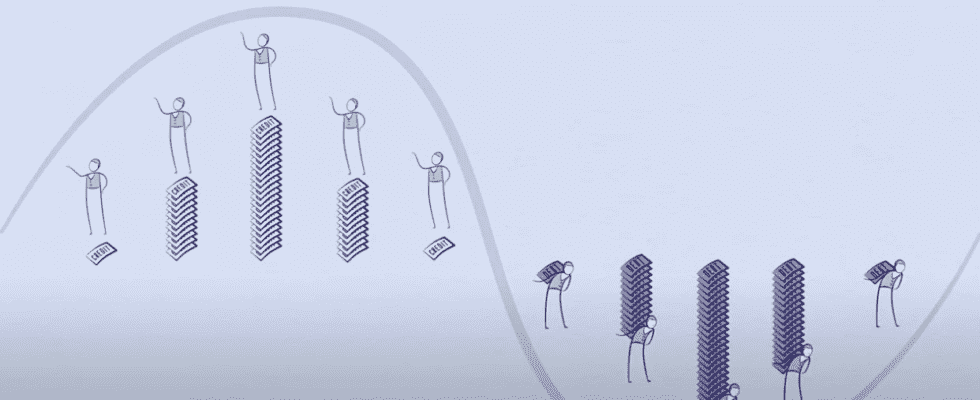

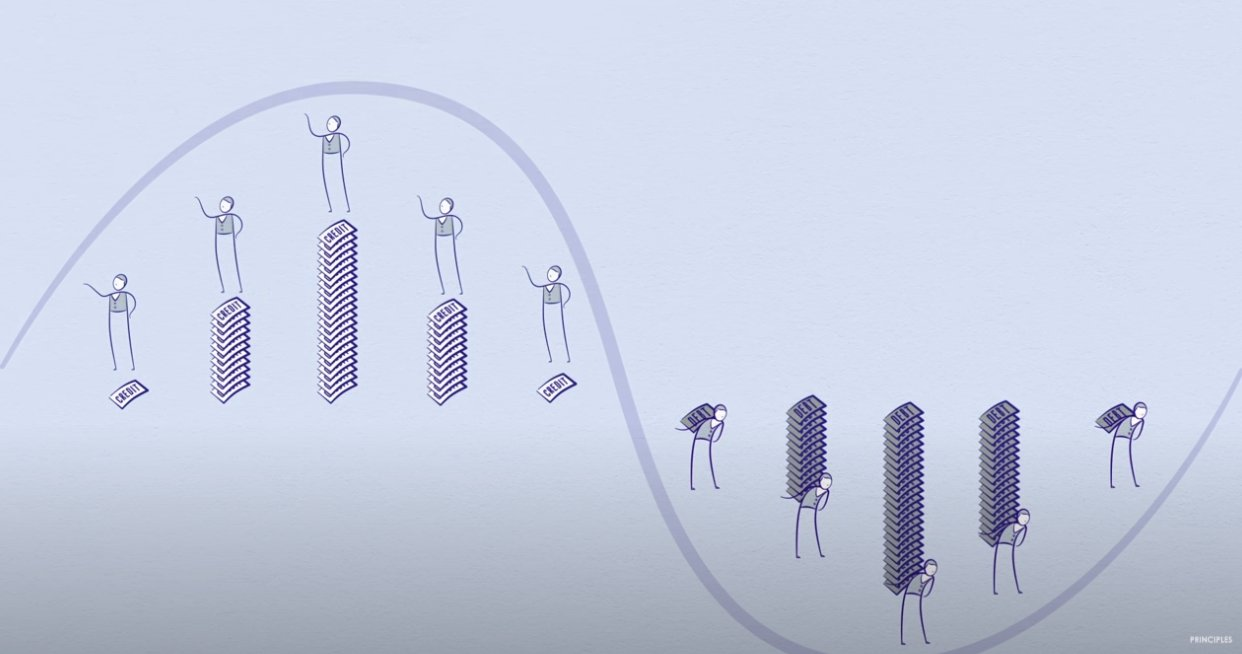

- In an environment where money printing and interest rates are 0%, the minority with money tends to risky investments, the indirect increase in prices and the resulting inequality of income distribution.

There is a belief among fund managers, traders and economists in financial markets for the year 2022, which is the understanding that inflation is temporary and the FED’s interest rate hikes will be limited and will affect the markets for a limited time.

Another camp, which talks about a serious economic-social transformation on a more global scale and the effects of the long-term debt crisis. The expectation of this camp is that inflation cannot be solved with an interest rate hike, that the Fed should implement a serious monetary tightening program, and that it will be difficult to reach and earn money in this program.

A long-term period in which the income distribution will be normalized again, at the time of the repayment of the money and debts (which are difficult times for risky investments). Of course, if we want to take a reference, Ray Dalio’s latest book The Changing Order of the World is definitely a must-read.

Ray Dalio in his book of such periods; He explains by showing that the collapse of empires, the change of reserve money in the world, the change in the balance of power in the world, important diseases, wars, and civil wars have followed in the past maybe 1000 years. We may not need to make the situation so dramatic, but I think we should keep in mind the fact that the monetary expansion that has been going on since 2008 will come to an end and we will experience a period when the easy access to money and credit will be reversed.

Frankly, I define the coming period as follows; The Fed is quite late for rate hikes and monetary tightening. When we look at it today, the FED’s asset purchases are still continuing until March, even this is an indicator of how late the FED is. It would have been a much more effective solution if at least the beginning of this year had ended its asset purchases, entered the year 2022 with interest rate hikes, and had the details of monetary tightening announced for March.

He continued this period by saying that the FED inflation is temporary and that their 2021 target is 2% inflation and that they will reach this target as well. At this point, inflation is 7.5%. In other words, the attitude that we have seen from the FED in recent months has only been able to become a very hawkish one, and 1-2 slight interest rate hikes cannot solve this situation.

In other words, in this case, the FED will have 2 choices, and while it will please one side in the election, it will make the other side unhappy. The Fed’s consumer finance surveys show that 40% of U.S. people have savings of less than $1,000 and are also renters. These people have nothing to do with the stock market, they have nothing to do with crypto, they have nothing to do with risky markets. These people are trying to survive and they are trying to survive with the rents and living expenses increasing day by day. So inflation affects them the most. Let’s not forget that in November 2022, there will be a by-election in the USA, and this by-election will be a very valuable election so that the democrats do not lose their majority in the senate. You have no chance to ignore this 40%.

In other words, the election of the FED will be largely political;

- Either you will prioritize a segment that we can call the rich 10% maximum, who has risky products, who trusts their investments in the stock market, who watches the price of the houses they buy increase every day, who focus on the increase in their rents.

- Or you will try to normalize income inequality by doing your best to suppress inflation for the 40% who are trying to survive under the pressure of inflation. At least you’ll look like you’re doing it.

Another camp thinks that we can solve 40% of the problem by printing more free money and distributing this money, which I didn’t want to go without saying even though it was quite wrong. As you issue money to the market and distribute it freely, you normalize the prices in the market. In other words, if someone buys bread for 3 TL today, if the price has increased to 5 TL, with the effect of inflation, if you print some more money, that price will inevitably increase to 7 TL. You will throw some more wood-coal into the inflation fire and you will be fueling the income injustice. This is not a solution, but it would be an invitation to a much bigger crisis in the future.

I would like to end my article with the relationship between Interest-Inflation-Crypto market. Please look carefully at the table below;

The period I first circled is between 2017-2018 and the period that resulted in BTC peaking at the beginning of 2018 and falling sharply. The 2nd larger round is between 2021-2022, the years when BTC made its last peaks.

The lines you see in blue in the table are the Fed rates. The lines you see in yellow are the Fed’s balance sheet. The lines you see in orange are US inflation. Of course, you will also see the BTC chart above.

We can see that from 2017-2018. Inflation has increased at an acceptable level as of 2016. The Fed increases the interest rates between 2017-2018, in the face of this inflation, but there is no movement towards monetary tightening in the balance sheet before the beginning of 2018. As you can see, there is a stable balance sheet between 2017-2018. You can examine the breaking point in the graph below.

Well, if we look at the graph from 2020; Inflation is at its peak. The balance sheet is at its peaks, but the Fed rates have remained at “0” since March 2020.

In other words, we understand that BTC can live with interest increases and it has experienced it before and even peaked in 2017-2018. It can survive in an inflationary environment, but the balance sheet of the FED, that is, whether we are in a monetary tightening period or in a monetary expansion period, will be very important for BTC and risky products.

Therefore, it is necessary to proceed without forgetting how risky the markets are for the upcoming period. FED can’t do anything, its effect has already been priced in, nothing will come out of this, you’ll see, they will come back and so on. It is necessary to prioritize risks, to be patient, without making predictions and without making assertive sentences, and I think we should not forget what an important period we have entered.

I will continue to wait and chase plans for monetary tightening rather than interest rate hike decisions in the upcoming meetings because I think that is the main factor that can affect the crypto market and risky markets.

Finally, I wanted to put the above sentence in quotation marks; “Ray Dalio; the collapse of empires in the past maybe 1000 years, exchange of reserve money in the worldHe explains by showing that the change in the balance of power in the world, important diseases, wars, civil wars follow.”

If such a period is entered, it should not be forgotten whether Bitcoin can be a possible reserve currency.