Bitcoin (BTC) continues to face selling pressure around $19,000. On the altcoin front, significant developments continue to occur. According to the data released by Santiment, while the accumulation frenzy continues in the two altcoins, there is a decline on the Ethereum front.

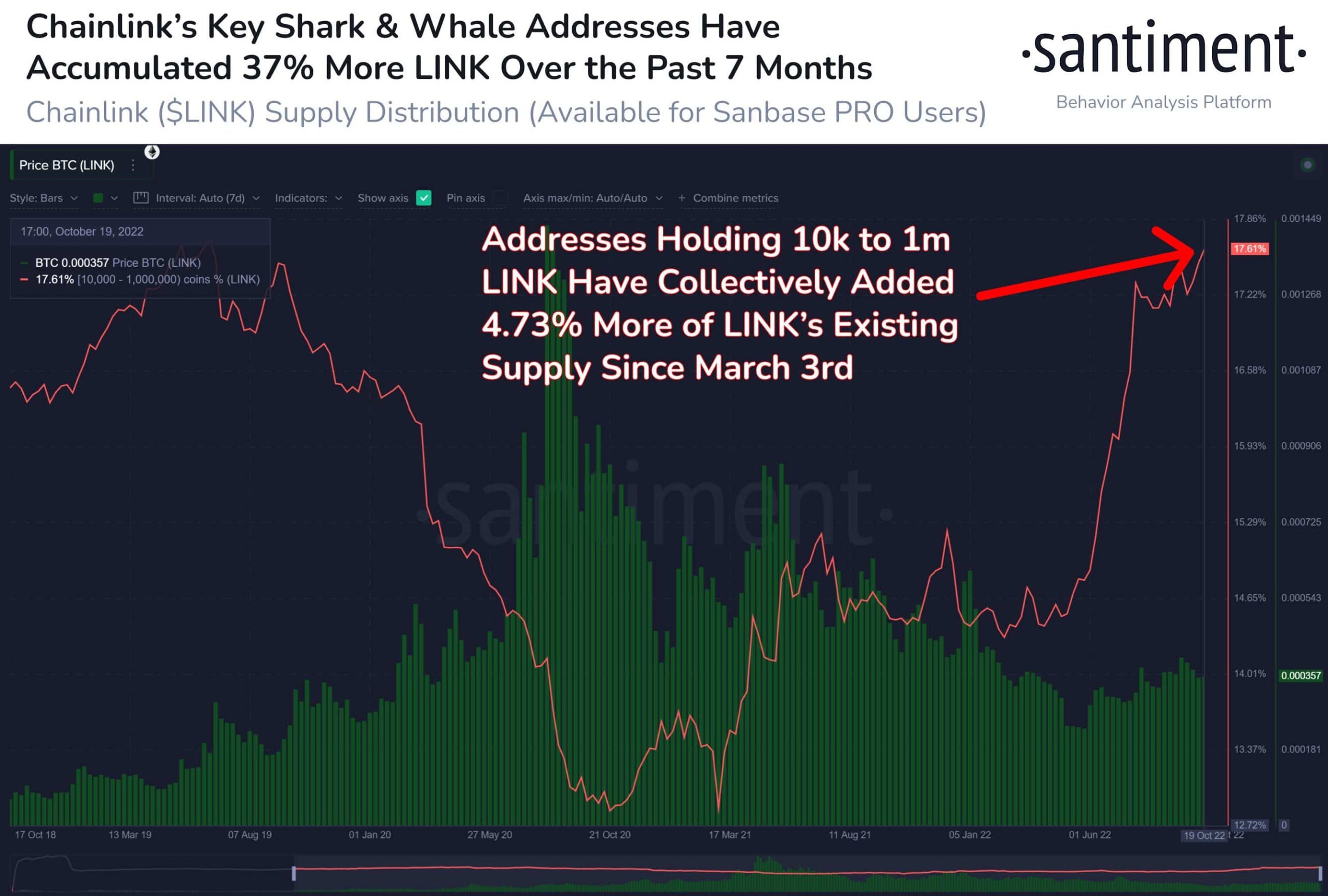

Oracle service provider chainlinkwas one of the coins accumulated by investors during the 2022 bear market. LINK price is trading in the $6-$8 price range, which is seen as a major accumulation zone. On-chain data provider Santiment commented on the subject:

“Chainlink’s shark and whale addresses were busy accumulating during the 2022 bear market. Since March 3, these addresses have collectively added 47.31 million LINK to their wallets. This represents an investment of more than $312.7 million.”

As Koinfinans.com previously reported, Chainlink’s social dominance has also increased recently. This detail shows that more investors are getting active in the altcoin.

The Forgotten Name of the Altcoin Front Has Also Moved

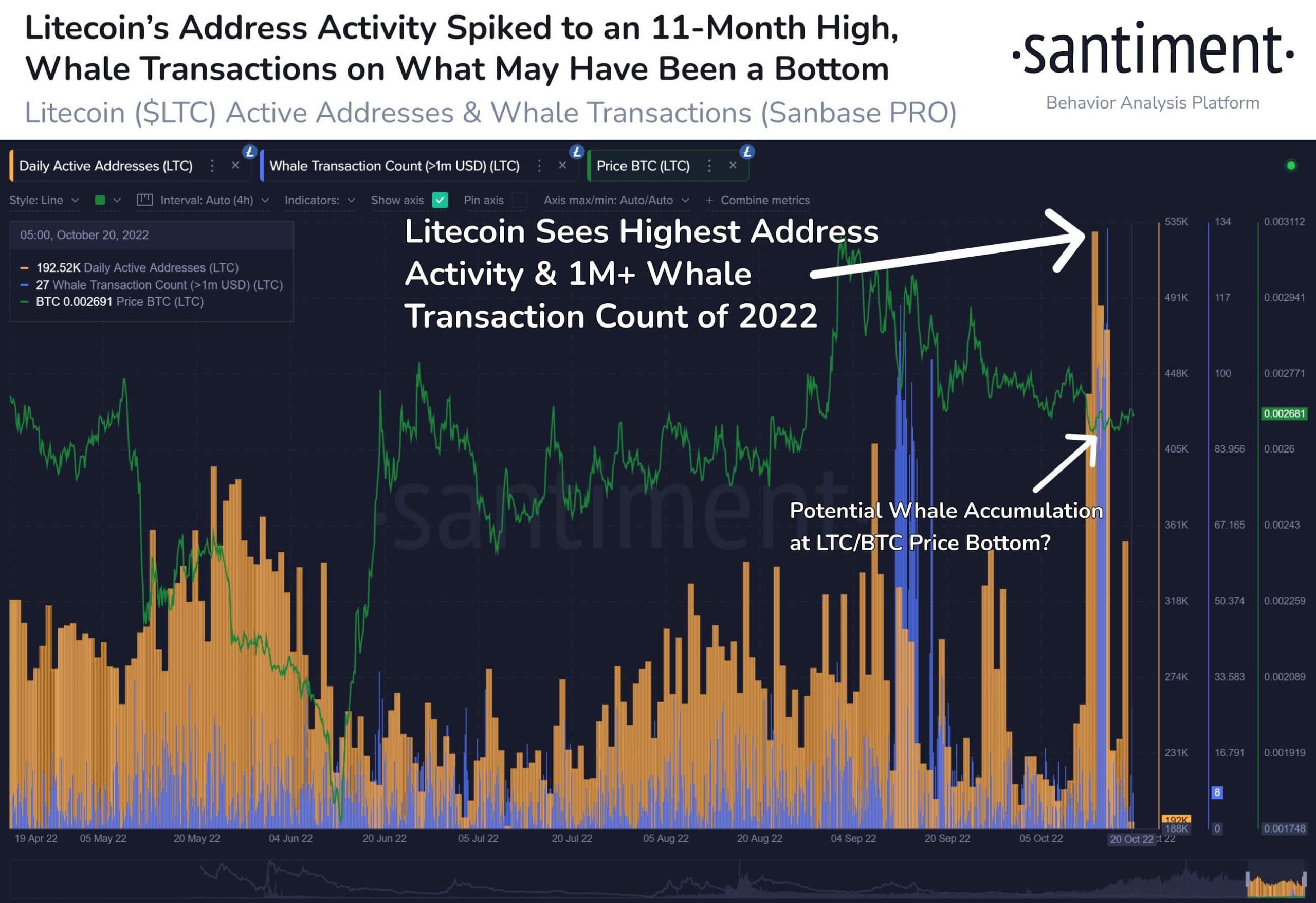

Another altcoin that saw high whale activity last week is Litecoin. Santiment included the following words in its report:

“Litecoin was quietly under the radar in 2022, but address activity and whale transactions have exploded this week. Especially with over $1M worth of transactions on the network, the timing of these spikes was just as LTC started to rise against $BTC.”

Ethereum Address Count Drops

Ethereum (ETH) faced strong selling pressure after the Merge update. At the time of writing, ETH is trading at $1,238 with a market cap of $157 billion. Data from Santiment revealed that Ethereum’s address activity has dropped to its lowest level since June 2022.

“Ethereum’s active addresses are down to 4-month lows with weak hands that continue to drop post-Merge, and apathy is at a high as prices stagnate. Monday was the first day since June 26 with less than 400,000 addresses on the network.”

However, the broader altcoin market is also facing selling pressure with short positions opened significantly over the past week.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.