Providing liquid staking service since the first days of 2023 cryptocurrency projects show significant increases. While the crypto market is stagnating, altcoins that promise liquid savings to their users have all gained from 18% to 57% in the last week.

What is Liquid Staking? What Does It Do?

Projects that have recently provided liquid staking services Ethereum It became widespread with the transition to the Proof-of-Stake system. Liquid Staking projects issue a tokenized receipt that users can use to trade, to ensure liquidity of cryptocurrencies locked into the network to generate income from proof-of-stake.

To put it simply, Liquid Staking projects come into play if you want to both stake and trade your Ethereums. Today, there are 7 different altcoins of different projects operating in this field.

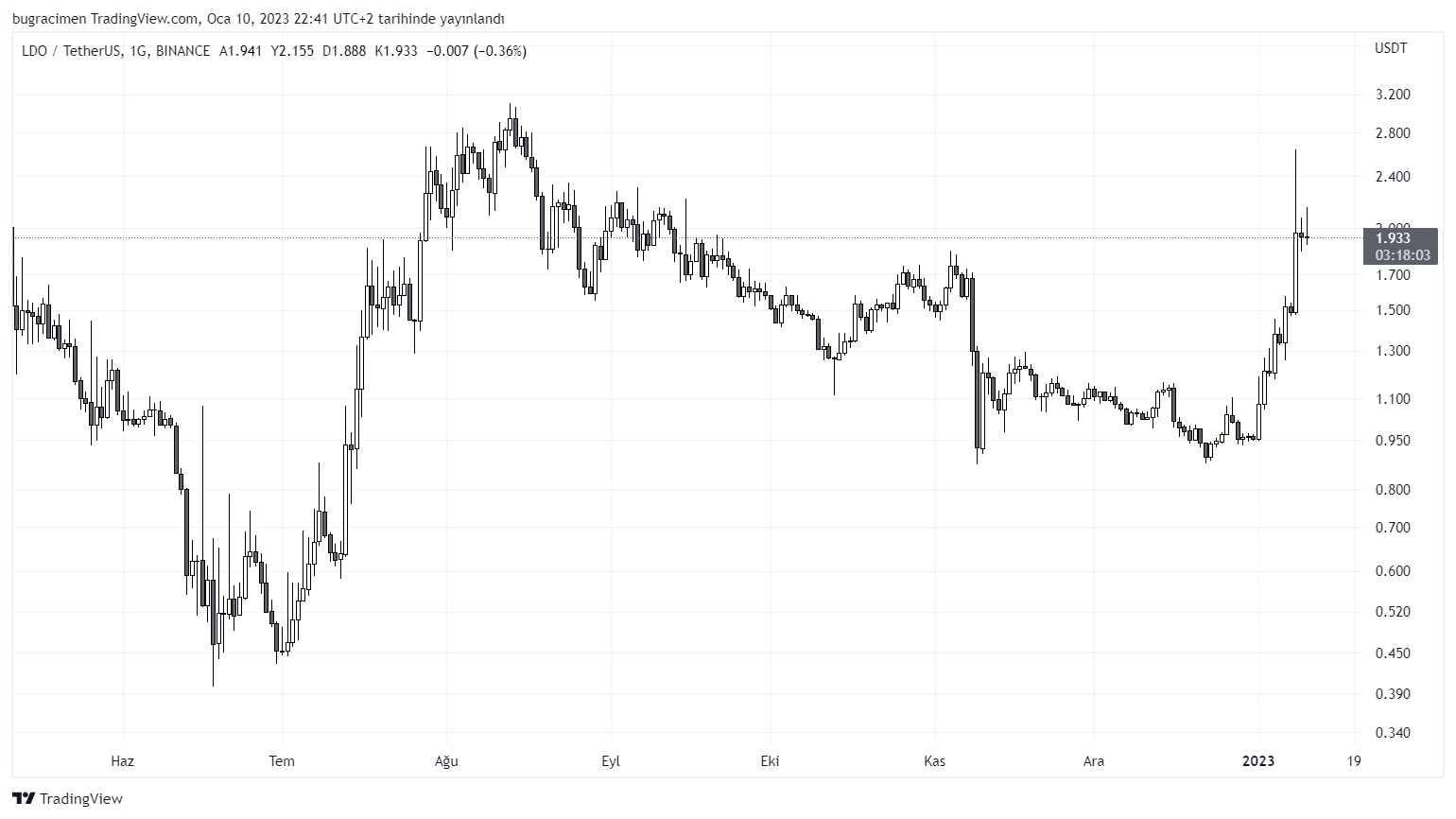

The largest cryptocurrency in the industry by market share Lido Finance (LDO)gained 58% value within a week and attracted all the attention.

LDO, which fell to $0.45 in the summer months, is currently trying to exceed the $2 psychological limit.

Why Are They Rising?

The biggest reason for the rise in altcoins of liquid staking projects is an upcoming new update in Ethereum. In the past hours, upward movements came with the confirmation that the Ethereum Shanghai update will take place in March 2023.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!