Ethereum (ETH) The price ‘was dead’ so to speak at the end of January and has since increased by over 34%. This rise is actually not bad at all, but as long as the bulls continue to hold the dips from last week and they manage to keep the price above $3000, it is quite possible that the rises will come again.

Ethereum price Although it is under quite strong pressure at the moment, the bulls will start to move more comfortably from next week and start to gather strength for the rise again.

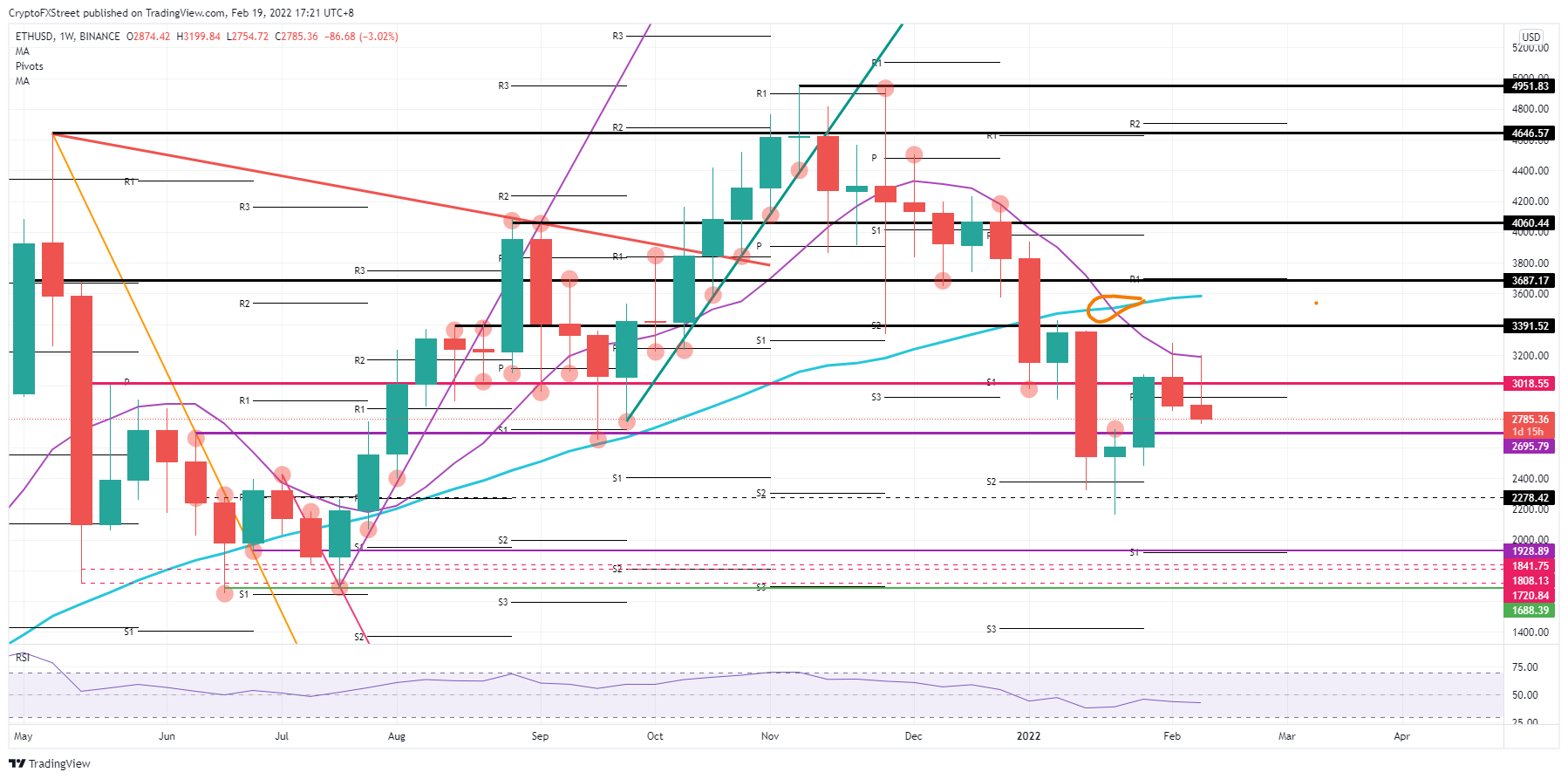

The bearish elements continue to erode as Ethereum price climbs above the 55-day simple moving average this week as well. Although the pressure on the price chart tries to create a bearish, bulls will often have a chance to break out of this pressure.

With this week’s bullish candle, the 55-day simple moving average has already started to ‘flatten out’, which will not only lead to a 16% rise in the coming week, for example with a break of $3391, if another rise occurs, but the price can also be expected to rise to the 200-day simple moving average.

If some positive headwinds are also added, for example, if the US dollar pulls back a bit and weakens further into next week, expect those headwinds to increase if the stock markets turn to the forefoot and back to the green for 2022. You can expect ETH price to bounce back and break above the February high near $3,272. The Relative Strength Index (RSI) is currently flat, with no real risk of hitting the oversold or overbought barrier any time soon. So as we enter next week, some gains will be on the table for the bulls.

Investors remain vigilant as tensions persist in Ukraine. Even though the markets are closed for the weekend, the crypto markets continue to be traded, so any negative news could trigger a drop in prices.

Although this technical analysis of Ethereum was completed when ETH was above $2750, overall the numbers remain largely valid. If the tension continues, the price could decline below $2695. A drop below $2200 is predicted as the worst-case scenario.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.