shiba inu (SHIB) has been stuck in a downward ‘spiral’ this month, but this has not stopped investors from buying.

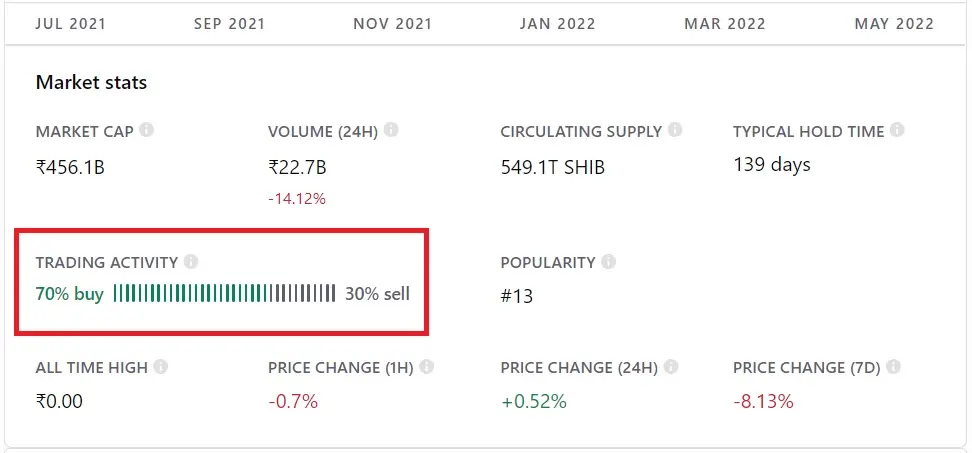

Native token SHIB surpassed the 70% ‘buy’ rate on Coinbase for the second time in two weeks, speeding up trading operations. Buying pressure in meme coin has not been able to rise above 70% since March, but in the last week of May, it unexpectedly increased the pressure by 77%.

Buy orders at Shiba Inu saw a decline in the first week of June, holding between 53% and 61%. This was clear evidence that investors did not want to trade the token. Despite all these developments, buyers have recently increased again, creating a 70% ‘buying’ pressure.

Also, the typical “wait time” of the Shiba Inu has increased slightly from 133 days to 139 days. Therefore, investors have been on average for more than four months. SHIBHe’s holding them.

Additionally, European Robinhood-like exchange Bitstamp has this week listed the Shiba Inu, allowing its users to trade dog-themed tokens.

Should You Buy the Shiba Inu on the Bottoms?

bitcoin The crypto market has turned green today as indexes are up about 5%. This helped the markets make profits for traders who traded. However, the market is likely to drop again as BTC is currently heading towards the red. On the other hand, the Shiba Inu is barely 1% higher today and is still struggling to stay strong in the green.

Markets are quite pessimistic and could fall again in light of weak global economic developments. Some analysts predict that Bitcoin will drop below the $20,000 level. Therefore, caution is advised when purchasing SHIB as the token may drop further in line with the market decline.

At press time, the Shiba Inu was trading at $0.000001078 and was up 1.03% in the 24-hour daily trading hour. You can follow the current price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.