With the bears increasing their dominance in the market, the fear of collapse in the markets is also growing. Bitcoin (BTC)It is trading at 2.15% compared to the previous day and is located around $39,986. Ethereum (ETH), on the other hand, lost 0.14% compared to the previous day. The negative atmosphere prevailing in the markets also caused a decrease of 300 billion dollars.

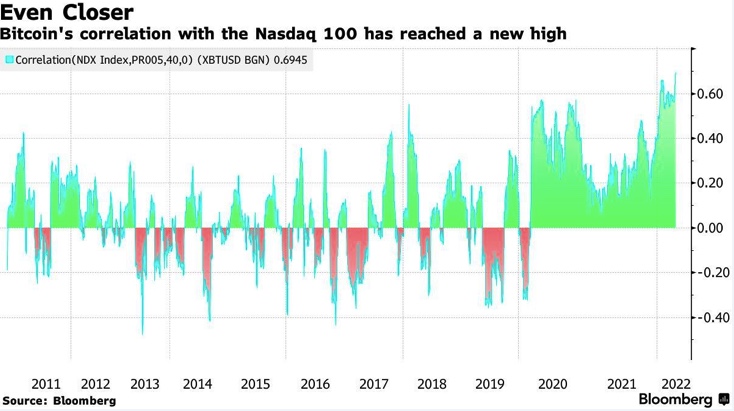

While all these declines are happening, Bloomberg analysts Nasdaq with bitcoin price found the highest correlation of all time between Stating that this correlation has continued for 40 days, analysts continued as follows:

“The increase undermines/erodes the argument that Bitcoin works well as a diversifier, which is considered by the community to be the key to attractiveness.”

The above chart has raised growing concerns about an emerging pattern that has emerged in recent months. The model began to be accompanied by selling pressure of crypto assets after the FED increased interest rates.

Bitcoin Investors Are Changing

Another notable observation is that Bitcoin and Nasdaq have shown strong signs of correlation since 2020. Anthony Pomplianothinks this is the result of a shift in the conservative base of Bitcoin investors.

According to Pompliano, there are two major groups currently holding Bitcoin. First, the ‘Wall Street corporate world’. This group considers Bitcoin to be their riskiest asset. Second, the “average everyday citizens” holding Bitcoin as a reserve asset.

BitMEX Co-Founder Arthur Hayes also shared a similar view about the growing correlation between Bitcoin and Nasdaq.

“Many crypto market experts think the worst is over… I believe crypto markets are currently ignoring the S&P 500 and Nasdaq as an indicator and not trading on the fundamentals of being peer-to-peer.”

Does the Issue of Increasing Liquidations Matter?

Pompliano suggested that there are two groups of owners who view Bitcoin as a risk asset and a reserve asset. This distinction is important to understand the following dataset.

According to Crypto Whale, over $460 million in crypto has been liquidated in the last 24 hours, with over 90% of them in long positions. These data show signs of a weak market that will collapse soon.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.