Spot Bitcoin ETF flows are slowing. However, analysts at Bernstein see this as a short-term pause. In this context, analysts predict that the leading cryptocurrency will run towards the $150,000 price target. Analysts also argue that spot Ethereum ETF rejection could be bullish for ETH. Moreover, they predict that this will trigger 3 Tier-2 altcoins.

Bitcoin ETF slowdown is a short-term pause!

cryptokoin.comAs you follow from , there is a slowdown in spot Bitcoin exchange-traded fund flows. However, analysts at research and brokerage firm Bernstein are not worried about this. Analysts say the trend is a “short-term pause.” Following this, they predict that Bitcoin will continue its bull run towards their target of $150,000 by the end of 2025. Analysts Gautam Chhugani and Mahika Sapr make the following assessment:

Bitcoin ETF flows slowed with the ‘halving’ catalyst and successful ETF launch, pulling forward YTD returns (up 46%). We do not expect the Bitcoin ETF slowdown to be a worrying trend. But we believe this is a short-term pause before ETFs become more integrated with private bank platforms, wealth advisors and even more brokerage platforms.

Bernstein analysts maintain $150,000 price target for Bitcoin

As Bitcoin approached its all-time high of $73,836, inflows into spot Bitcoin ETFs peaked on March 12 with daily net inflows of $1.05 billion. However, ETF inflows have slowed significantly since then.

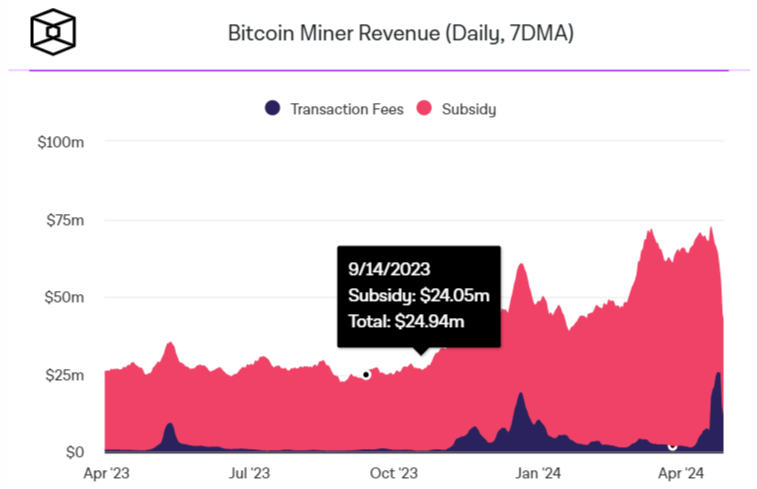

Analysts say time is needed for Bitcoin to become an acceptable portfolio allocation proposition. They also note that it will take time for platforms to establish compliance frameworks for selling ETF products. However, they note spot Bitcoin ETF net inflows of $12 billion so far and the healthy post-halving position of leading Bitcoin miners in an environment where market consolidation and transaction fees have normalized at around 10% of miner revenues. These reasons maintain their cycle target of $150,000 for Bitcoin by the end of 2025.

Analysts note that Bitcoin has been trading in a range of $62,000 to $72,000 since late February. They also note that so far there is no clear momentum on either side of this.

“Spot Ethereum ETF rejection would be bullish for ETH and these altcoins!”

Bernstein analysts say the US Securities and Exchange Commission may reject spot Ethereum ETFs by May 23, citing unreliable correlation between the spot and futures market. However, they note that this will “likely be disproved” in court, similar to the Grayscale Bitcoin ETF case. Alternatively, analysts are talking about the possibility of the SEC rejecting ETH on the grounds that it is a security. But they add that this would create an “awkward” situation with the Commodity Futures Trading Commission, which views ETH as a commodity and that CME currently trades ETH futures without any security implications.

Regardless, Chhugani and Sapra say the SEC’s rejection will likely lead to a lawsuit. They also predict that it will shift the market narrative back to Ethereum. Meanwhile, they note that the risk-reward is attractive due to its underperformance against Bitcoin so far. They predict that such superior performance for Ethereum will also bring “ETH-beta” Layer 2 tokens such as Arbitrum (AR), Optimism (OP) and Polygon (MATIC) back to life.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!