Spot Bitcoin The volatility following the false news regarding ETF approval resulted in BTC price consolidating above $28,000. On the one hand, concerns about macro developments continue, on the other hand, optimism that the spot BTC ETF will be approved continues.

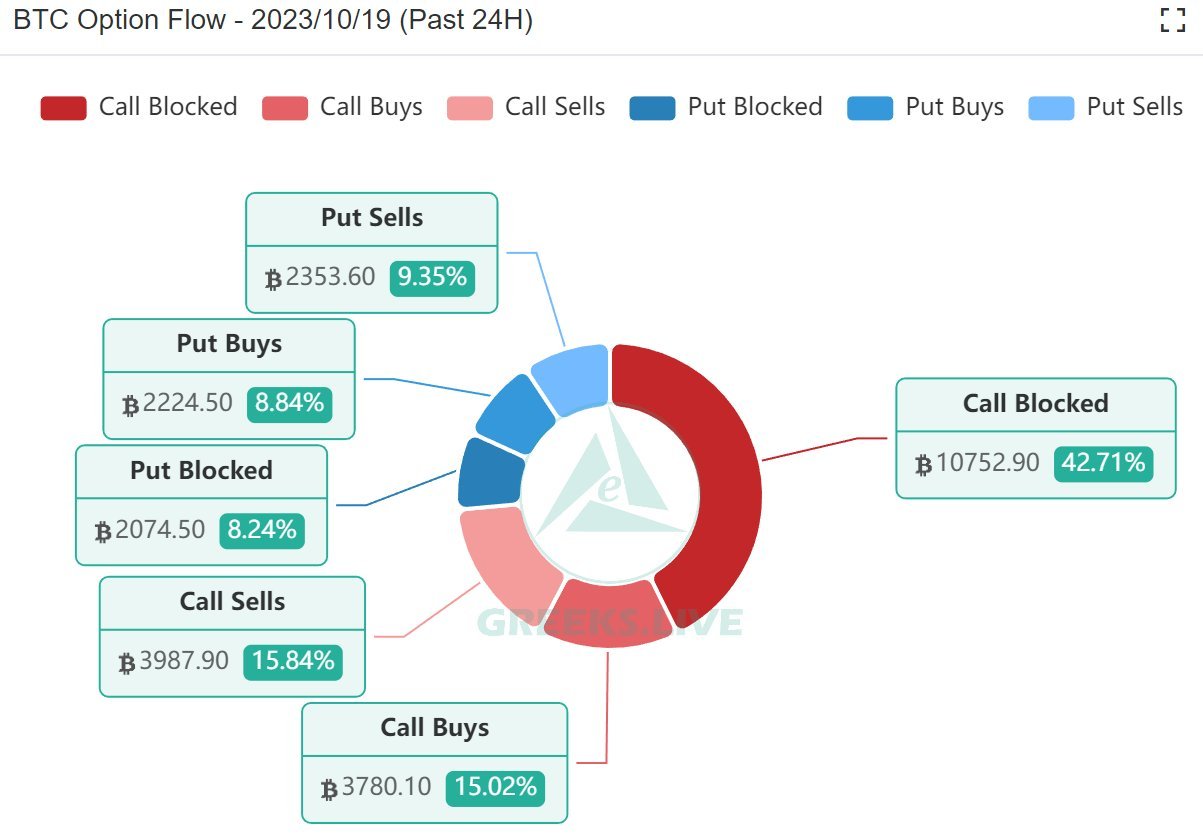

As Koinfinans.com reported, Bitcoin options data shows that long-term increases in BTC price are gaining strength. Options market data shows increasing confidence in long-term Bitcoin price increases. Today, more than 10,000 BTC block call options were traded. The total value of these transactions was recorded at approximately $300 million, representing more than 40% of the day’s total option activity.

This distribution is notable because it involves selling short-term in-the-money (ATM) calls while buying longer-term out-of-the-money (OTM) calls using the premium from the sale. While it may not signify an immediate rise for Bitcoin in the short term, it does represent a bullish outlook for BTC’s long-term prospects.

BTC Price continues to show strength lately despite its sharp moves earlier this week. The asset managed to stay above $28,000 amid growing optimism about the approval of a spot Bitcoin ETF.

Popular crypto analyst Michael van de Poppe stated that Bitcoin’s price does not show a strong follow-through at the moment. He thinks a period of consolidation in this price range for a few days before further movement would be preferable.

However, as liquidity needs to be cleared, there is a possibility of a test between $27,600 and $27,800. Key support zones are at both $27,700 and $27,300, indicating potential areas of interest for long positions.

A key support area for Bitcoin from $26,700 to $26,285 has emerged as a battleground where bulls and bears are fiercely fighting. Support levels in this zone are of great importance as they mark a decisive juncture for BTC’s short-term direction.