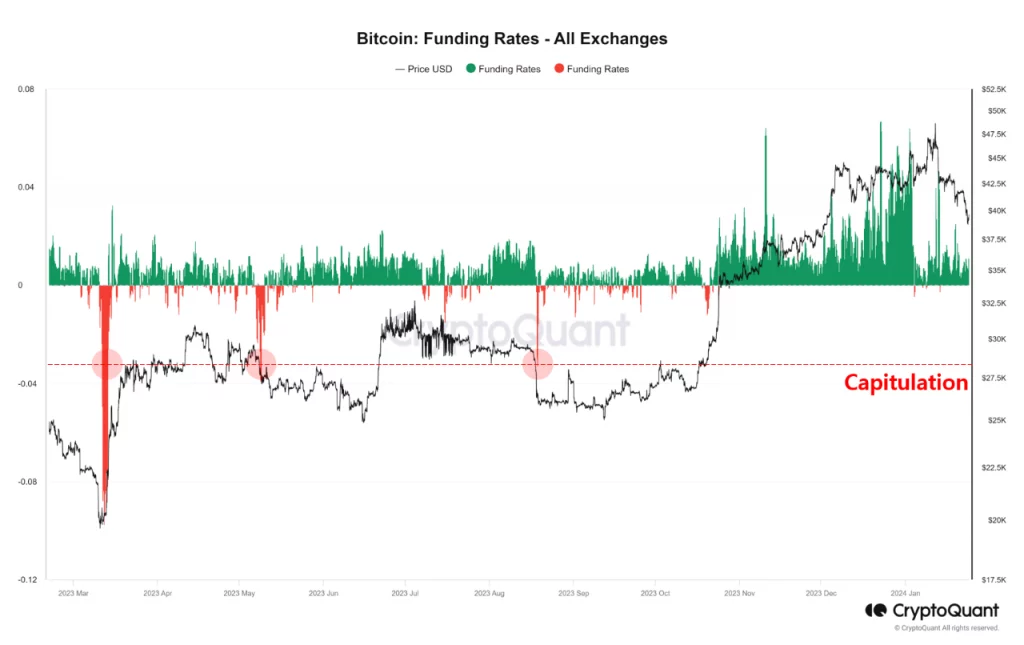

Bitcoin The funding rate for (BTC) futures contracts has fallen strongly over the past few days, signaling that the market has cooled and may be ready for a reversal.

According to data from crypto analytics platform CryptoQuant, Bitcoin funding rate It rose to 0.049% on January 2, 2024, indicating that long positions were overheated and created the risk of a long squeeze. However, this decline reduced the funding rate to 0.01% as of January 24, 2024, indicating that the market is more balanced and less prone to liquidations.

The funding rate is a measure of the cost of holding a futures position. It is calculated by multiplying the difference between the permanent contract price and the spot price by a constant. A positive funding rate means that those taking long positions are paying off those taking short positions, and vice versa. A high funding rate means the market is up and overleveraged, while a low or negative funding rate means the market is down and underleveraged.

The fact that the funding rate has been positive recently indicates that futures traders are still bullish on the market and are keeping their bets on the upside. Therefore, it is necessary to wait for a capitulation signal from market participants to end the BTC downtrend.

This is because for the downtrend to end, a large number of leveraged long positions must be liquidated and there will be no volume left to sell. This will create strong buying pressure and push the price up.

If the price drops sharply on the 1-hour chart and the funding rate becomes negative, this could mean that leveraged traders are overly pessimistic about the market, which could be a good opportunity to buy Bitcoin back.

According to CoinGecko, at the time of writing, BTC is trading at $40,000, up 2.3% in the last 24 hours.