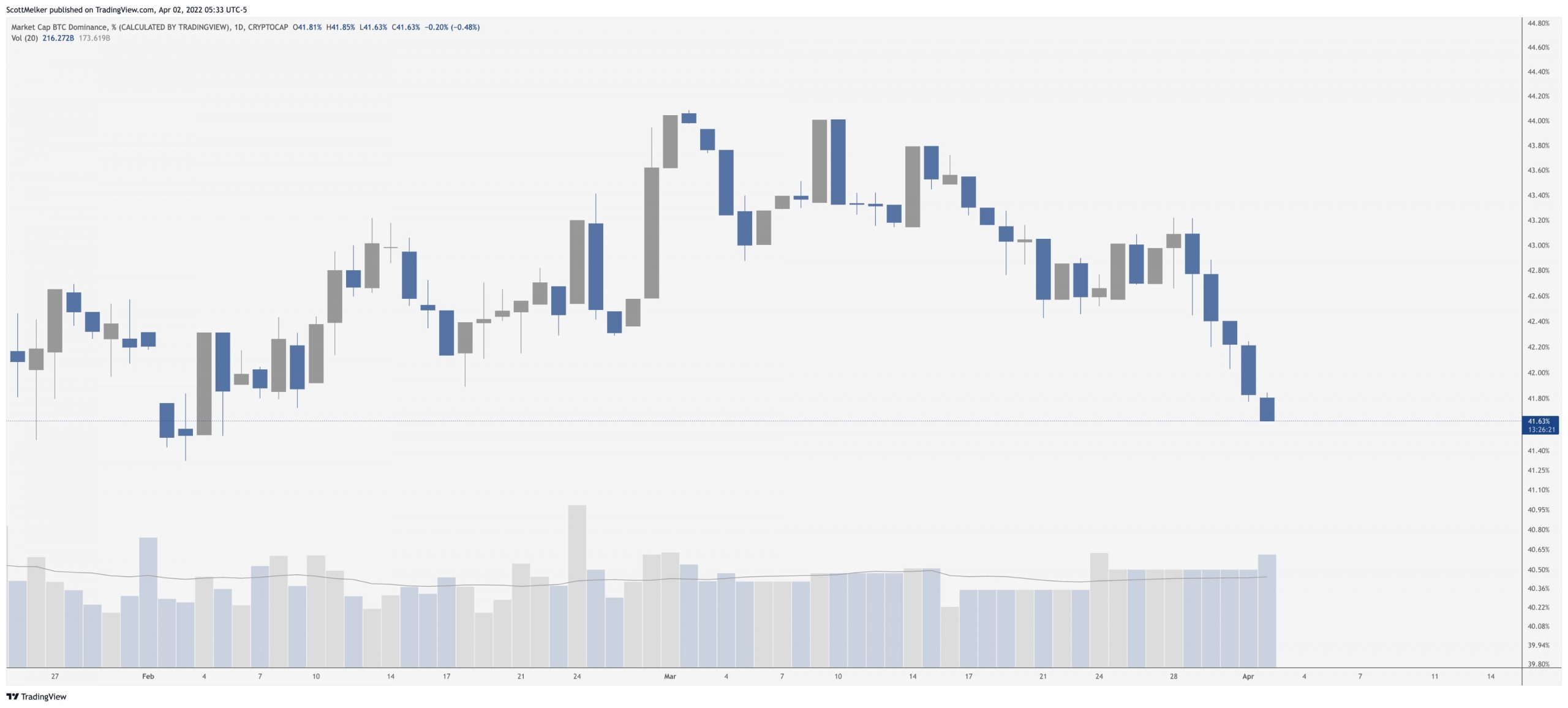

Bitcoin (BTC) Its dominance has dropped drastically in the last two days. The biggest reason for this decline may be the latest rally in the crypto markets. A greater leaning of investments in altcoins may have produced such an outcome.

Bitcoin market dominance remained at 40.9% on Saturday, resulting in a drop from 42% on Thursday. Bitcoin performed worse compared to altcoins, posting more than 5% gains over the week.

Despite all the data, it is a fact that the share of BTC in the rally in March is very important. The rise of Bitcoin to the levels of $ 48,000 increased the sentiment in the markets.

Altcoins Overtake Bitcoin

Ethereum (ETH), Solana (SOL), Terra (LUNA) and Avalance (AVAX) are up 11% to 38% over the past seven days. While Ethereum (ETH) gains are at the lower end of this range, the upcoming transition to the proof-of-stake (PoS) model has been a major trigger that has fueled interest in many other altcoins.

Proof-of-stake Solana (SOL) was the top-earning altcoin among its peers during the week. SOL also managed to surpass $40 billion in market capitalization, making it the sixth largest cryptocurrency.

LUNA rose 25% to a record high of $112 as the massive BTC purchase by its community and a steady burn rate supported the token. The LUNA community continues to buy Bitcoin to use as a reserve for its stablecoin, TerraUSD, as part of an aggressive effort to make it the largest stablecoin.

Altcoin Rallyes Tend to Reduce Bitcoin Domination

The lowest BTC dominance ever was the 37% observed during the initial launch of several altcoins in 2017. While BTC’s dominance has since rebounded sharply to over 70%, the massive rally in 2021 saw BTC weight return to around 42% where it has been since then.

Bitcoin’s dominance tends to decline when the market sees a long rally and the latest bull run yields similar results. It is not yet clear whether this trend will continue.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.