Investing is important for all of us, but unconscious investment can lead to great regrets later. Katılım Emeklilik is one of the companies that can be preferred with the professional services it offers.

with whom we have been close for years in Turkey. high inflation, forced us all to become investors. Because citizens are looking for ways to prevent the money they hold from losing value any further. While some people hide money under their pillows, others can generate returns They prefer investment instruments.

Of course, this process is not that easy. There are many investment instruments you can invest in today. Of course, there are some risks in all of these. It is undoubtedly the most risk-free investment. private pension systems. At this point, providing professional services Participation Pension, researched how investment trends are changing in Turkey and what citizens can do. Let’s get into the details.

Especially while working life continues, a peaceful pension Investors who want to direct their savings by dreaming, best and highest return They aim to increase the quality of life by providing In this field they professional support There is also a tendency towards institutions that offer

Here is the one that started to serve in 2013 and has continued until today. more than 1 million Participation Pension, which provides private pension and more than 300 thousand insurance policies, is one of the leading institutions you can choose. What about Katılım Emeklilik? highlights what?

“Participatory” approach to fund evaluation

Participation Pension’s Fund Assistant service as well alternative investment It opens a new area for investors. While the Fund Assistant aims to make the best use of savings, it provides personalized advice on which BES funds to choose and how to distribute them. financial guidance offers.

Digital consultancy service

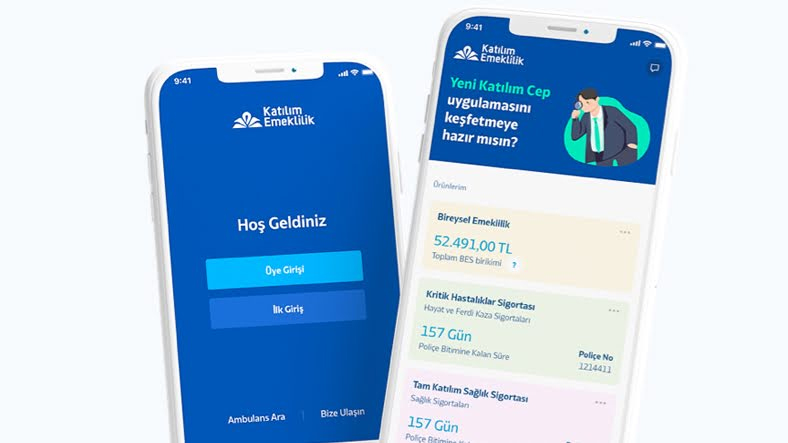

It is a service available only to customers in Katılım Emeklilik’s mobile application. Fund AssistantBy following the current market conditions, it gives investment suggestions about your retirement funds in accordance with your age and risk preferences.

Fund Assistant Their profiles include Low Risk, Medium Risk, High Risk and High Risk profile. Participation MobileAfter logging in, you complete the Risk Return Profile (RGP) test by following the Fund Assistant step and determine your risk profile. The main purpose of the Fund Assistant is to help the investor’s retirement preference. prospective earnings and to contribute to its transformation into accumulation in a professional context.