After struggling to hold on above $65,000 over the past few days, Bitcoin (BTC) price has now broken resistance at $63,000. After the token hit lows near $60,000, the bears gained the upper hand and had a significant grip on the rally. During the same period, altcoins experienced a similar decline, with prices of major crypto assets stuck in a range. This suggests that bearish momentum is slowly increasing and the likelihood of an “altcoin season” in this range is decreasing.

On the other hand, when looking closely at the dominant rally, altcoin The market appears to be experiencing the final short-term correction before breaking above All Time Highs (ATH). The previous resistance zone during the 2019-2020 rally has now turned into a strong support zone, creating a strong foundation to trigger a recovery. Therefore, the current pullback can be considered the last volatility variance and may be the last opportunity for altcoins to enter before starting an aggressive bull run.

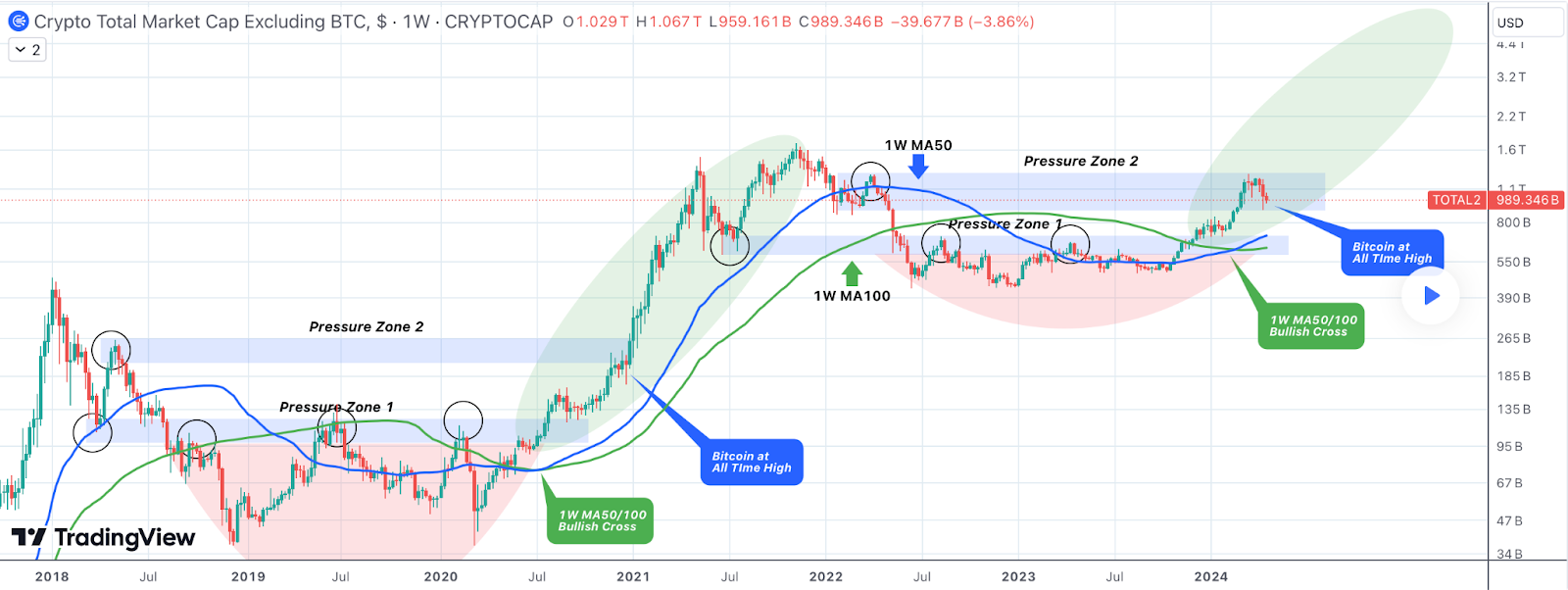

The chart above shows similar lag times as the previous cycle, with BTC exceeding its historical ATH. Based on historical data, it is predicted that the current trend may not differ from this one. Therefore, it is predicted that the markets may experience an extremely aggressive altcoin season in the coming days.

Differences and price movements on the chart show that the altcoin market cap has fallen below the critical $1 trillion level. However, these levels still remain in the bullish range and are therefore thought to trigger a strong rise, but may be preceded by further losses. Therefore, the total market cap outside of BTC is expected to drop to around $800 billion; because it is estimated that altcoins will continue their downward trend for another week or two.

Once temporary lows are established, it is thought that levels may remain low for an extended period of time and maintain a healthy rise for the remainder of the year. This could bring the potential to reach new highs of over $4 trillion by 2025.