Dogecoin has been active in the last month like the whole market. DOGE, which entered April at $ 0.075, broke its monthly record by breaking above $ 0.10. The popular meme coin, which lost this 30 percent rise towards the end of the month, is trading at $ 0.081 at press time. So, in which regions are the important levels for Dogecoin? How will May be for Dogecoin? How many DOGE investors are in profit or loss? The answer to all these questions is in the rest of our news.

Source: IntoTheBlock

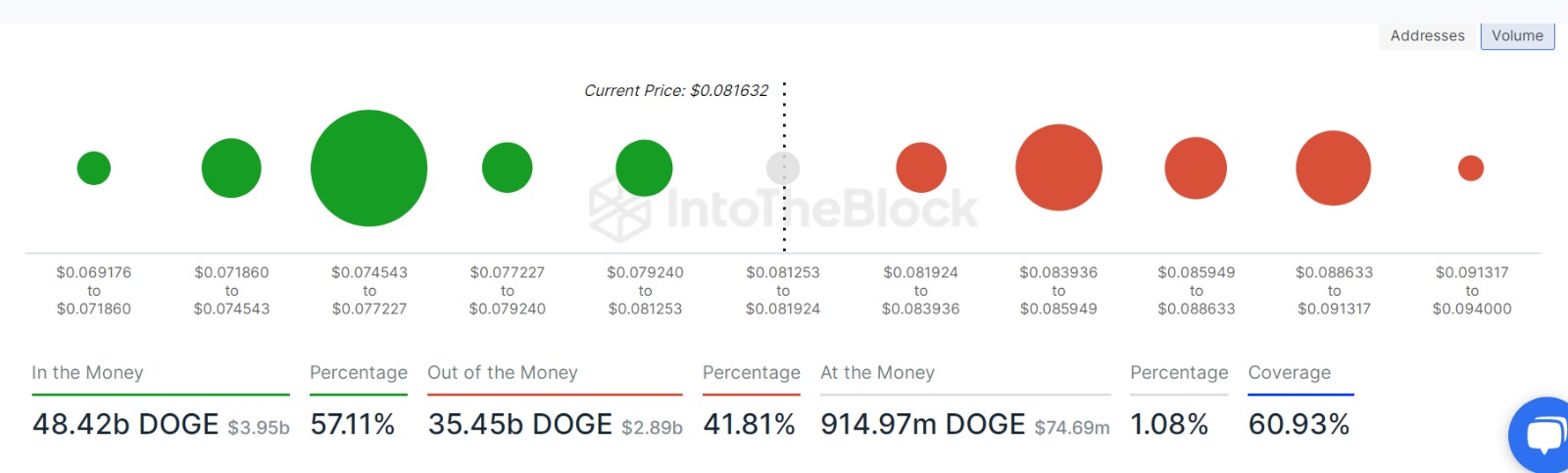

This image gives us pretty good data. In the image, we see clusters in three different colors. Of these clusters, the green ones show the DOGEs that are in profit, while the red clusters show the DOGEs that are in the loss. The gray cluster shows DOGEs where the price is at the breakeven point.

In general terms, 54 percent of the Dogecoins in the market are in profit, while about 39 percent are in loss. A relatively large portion, about eight percent, is at the breakeven point. This data shows us that a substantial proportion of retail investors are at a loss if we extract very low-priced whale accounts. With this data, we can also make inferences about the main support and resistance points. We can see that the main support points for the popular meme coin are around $0.066 and $0.0756. This meme is a data that also shows parallelism with coin price movements. Between the points where the needle was thrown in April, the levels of $ 0.0756 are encountered. The main resistance points are $ 0.085 and $0.11.

Source: IntoTheBlock

Source: IntoTheBlock

This image is a closer look at the price of our first data. Here we can see the closer level support and resistance points. Our first and closest support point is $0.0802. Our second close support point is at $0.0782. If we look at the close resistance point, the $0.083 level comes across.

The importance of these points has increased considerably in recent days. Bitcoin, which made sharp movements up and down, also shook the lower parities hard. As a matter of fact, investors who made transactions based on these points came out of these harsh movements with the most loss or profit. These points are especially important as we enter the FED week.

You can follow the current price action here.