With the statements from the FED and the effect of the African variant, the uneasiness in the global markets was also reflected in the crypto money markets. Escape from risky products led to an increase in sales in Bitcoin and altcoins, while losses reached serious proportions.

When we look at the on-chain data part, we observe that Bitcoin still has not reached its peak and the price has cooled down without entering the overheating zones. Although this causes us to maintain our medium and long-term expectations, it does not change the fact that some technical indicators have moved into the negative territory of the recent decline.

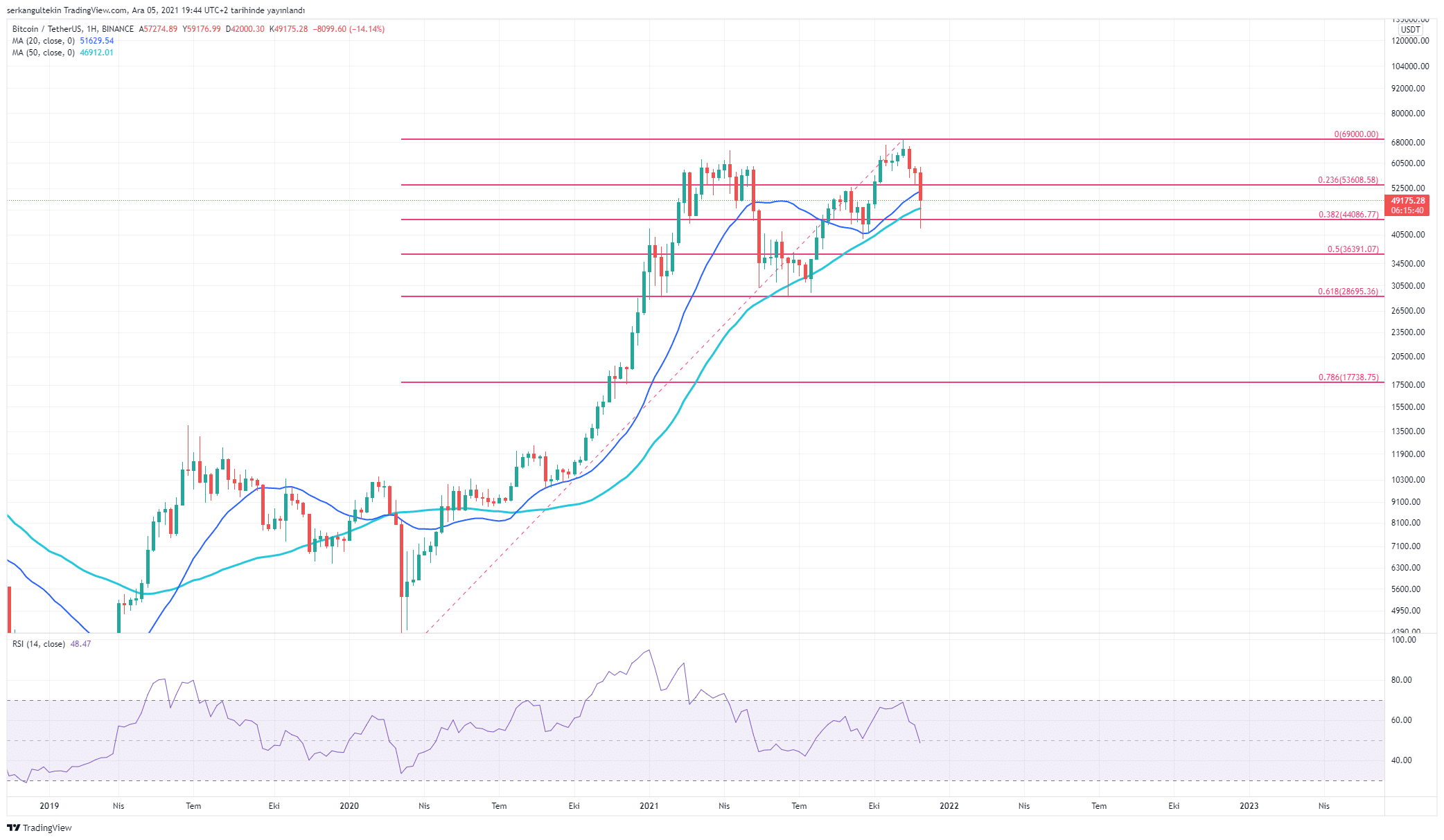

While the breaking of the rising trend from July has curbed the risk appetite of some investors, we see that we have fallen below the important averages with the last decline.

At this point, falling below the weekly MA20, which we followed after the April collapse and the July rally, appears as negative data.

To understand the importance of the weekly ma20 in Bitcoin rallies, you can read our news dated June 13.

We will need to rise above the weekly ma20 again for risk appetite in Bitcoin and altcoins to rise. If the price can stay above the weekly ma20 then it could be a good buying opportunity for the new rally. As long as we stay below the weekly ma20, we can go down to lower supports again.

If we rise above this level quickly in the coming weeks, the declines experienced this week will remain as a bear trap.

The weekly ma20 is currently at $51600 and the weekly ma50 is at $46912.