- A popular Ethereum (ETH)-based altcoin has announced that it has partnered with interbank messaging system SWIFT. Aside from that, the popular altcoin is also seeing an increase in whale activity, which is seen as the key to the rally, according to data from Santiment.

SWIFT chooses Chainlink for cross-chain crypto transfer project

Interbank messaging system SWIFT is the oracle network that provides price feeds and other data to blockchains to work on a proof-of-concept (POC) project that will allow traditional financial firms to transact over blockchain networks. Chainlink (LINK) announced its partnership with

CCIP (Cross-Chain Interoperability Protocol) is expected to help interbank network communicate across all blockchain environments by enabling SWIFT messages to instruct on-chain token transfers.

Speaking about this collaboration at the SmartCon 2022 conference in New York City on Wednesday, Chainlink co-founder Sergey Nazarov said it will help accelerate the adoption of distributed ledger technology (DLT) blockchains and benefit various institutions in the capital markets.

SWIFT is using the Cross-Chain Interoperability Protocol (CCIP) in an initial proof of concept.

CCIP will enable SWIFT messages to instruct on-chain token transfers, helping the SWIFT network become interoperable across all blockchain environments.https://t.co/8GOBNhzwCk pic.twitter.com/Pvm0Cex45e

— Chainlink (@chainlink) September 28, 2022

Company explores CBDCs to facilitate fast payments

However, transactions on the SWIFT network may take several days to complete. The company is exploring blockchain and DLT technology and central bank digital currencies (CBDCs) to facilitate faster payments.

Chainlink states that this collaboration with SWIFT enables financial institutions to gain blockchain capability without modifying, enhancing, and integrating new connectivity into legacy systems, which would require significant changes at an “extraordinarily high” cost.

Last year, SWIFT announced plans for a series of experiments in the first quarter of 2022 to improve the exchange of information between participants and systems that interact throughout the lifecycle of tokenized assets.

Interoperability gained popularity

Jonathan Ehrenfeld Solé, SWIFT’s Director of Strategy, also said that working with Chainlink on CCIP was successful because of the “undeniable interest” of institutional investors in crypto.

Solé said that traditional finance (TradFi) players want to access a variety of digital and traditional assets on a single network that can connect different asset classes.

“The cross-chain interoperability collaboration between Chainlink and SWIFT will help TradFi institutions bridge the gap between traditional and digital assets.”

The demand for interoperability has gained popularity in recent months, with it being touted as the next big development not only for crypto users but also for TradFi investors looking to diversify digital assets.

On September 22, cryptography network Lit Protocol said it has raised $13 million in a Series A round led by crypto investment firm 1kx to recruit developers to create decentralized ownership and interoperability across protocols.

Besides that, in August several Solana-based projects came together to create the Open Chat Alliance, an interoperable messaging platform.

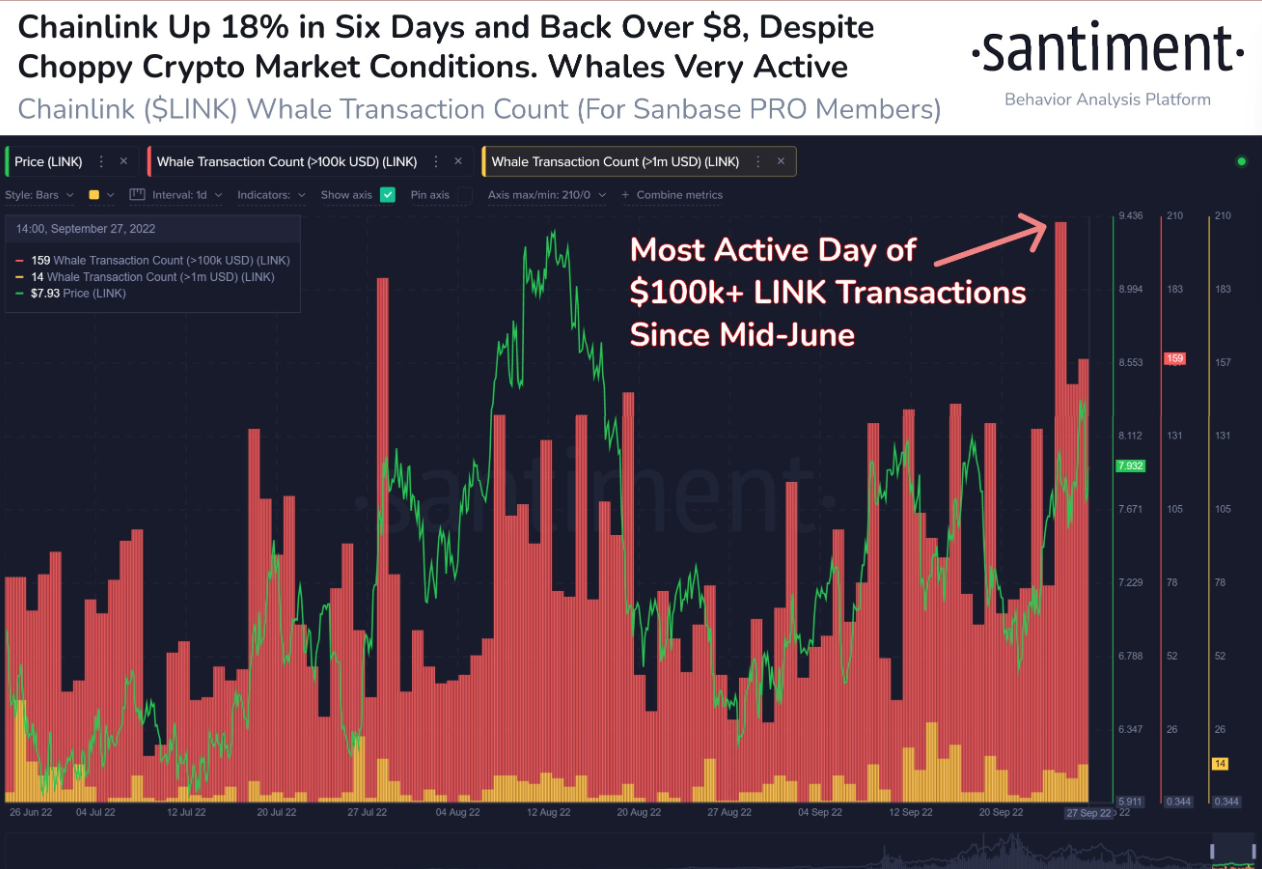

Santiment says crypto whales are “very active” on Chainlink

Crypto analytics firm Santiment reports that Chainlink has recently experienced an increase in whale activity. According to the firm, the decentralized oracle network Chainlink (LINK) Earlier this week, it is experiencing its most active days since mid-June in terms of whale operations.

The analytics firm says increases in whale activity are “often the key to sustained rallies.”

LINK is trading at $7.74 at the time of writing. The 22nd-ranked crypto asset by market cap has dropped more than 6.5 percent in the last 24 hours, but is still up more than 16 percent over the past seven days. The altcoin has outperformed most of the crypto market during this time.

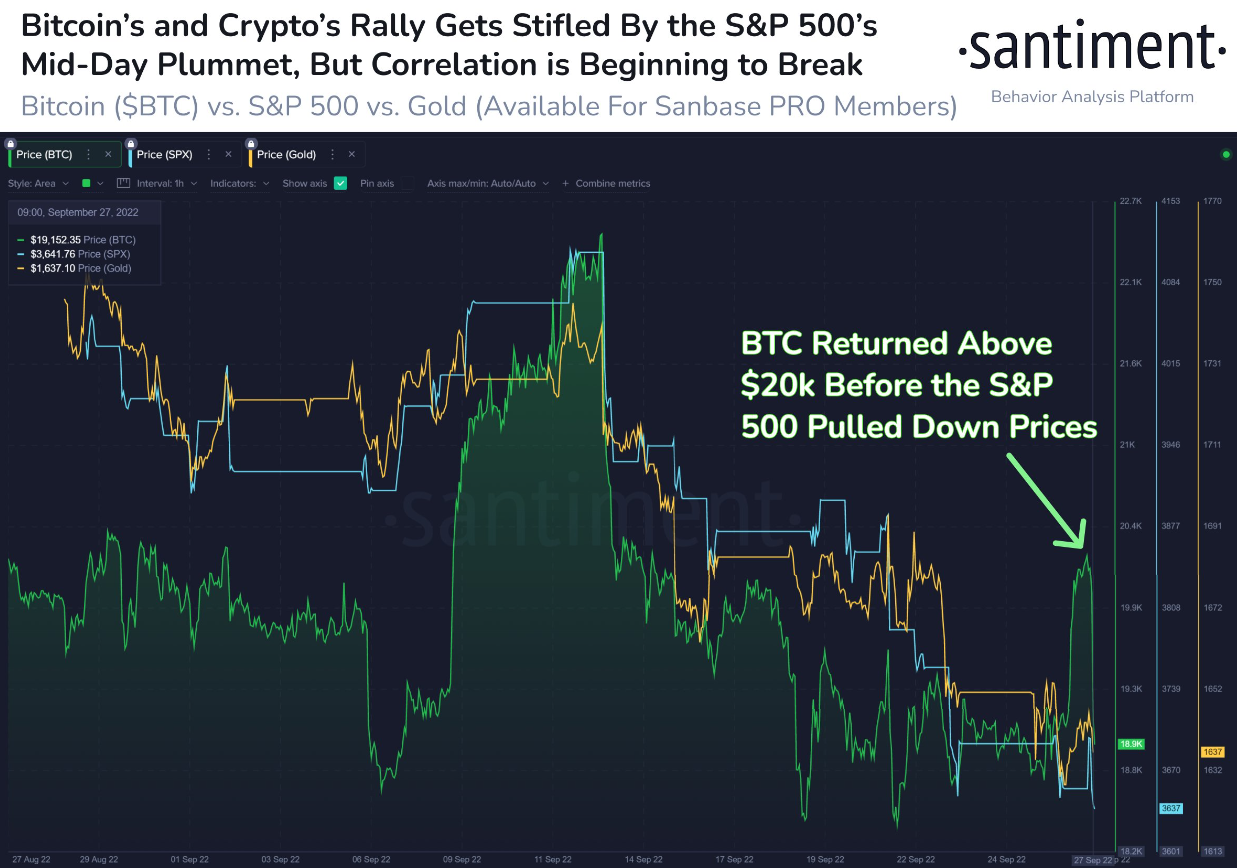

In terms of the overall market, Santiment says crypto could break out of stocks.

“Things have been going well for crypto this week until the S&P 500 suffered another drop, dropping BTC, ETH, and other digital assets. However, there are signs that the tight relationship between sectors is breaking.”

Santiment also notes that Bitcoin (BTC) trading volume is also “warming up.”

“During the big drop on Tuesday, BTC peaked at its highest trading level since June 14. Volume has gradually increased all year since bottoming out at the end of January.”

BTC is trading at $19,452 at the time of writing. The top-ranked crypto-asset by market cap has increased by nearly 2% in the last 24 hours.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.