US cryptocurrency exchange in November of FTX Investors are flocking to decentralized exchanges (DEX) due to its bankruptcy and rising regulatory pressure around the world.

According to the latest data prepared by crypto industry follower DeFiLlama, the transaction volume on decentralized exchanges reached 133 billion dollars as of March, reaching the highest level in the last 10 months.

According to the report, in the United States Binance, Kraken And coinbase Investigations opened to the stock exchanges had a great impact on the growth of the sector. Securities and Exchange Commission SEC; While the staking service offered by Kraken and Coinbase were under the spotlight, the CFTC filed a lawsuit against Binance.

USDC Crisis Affects Decentralized Platforms Positively

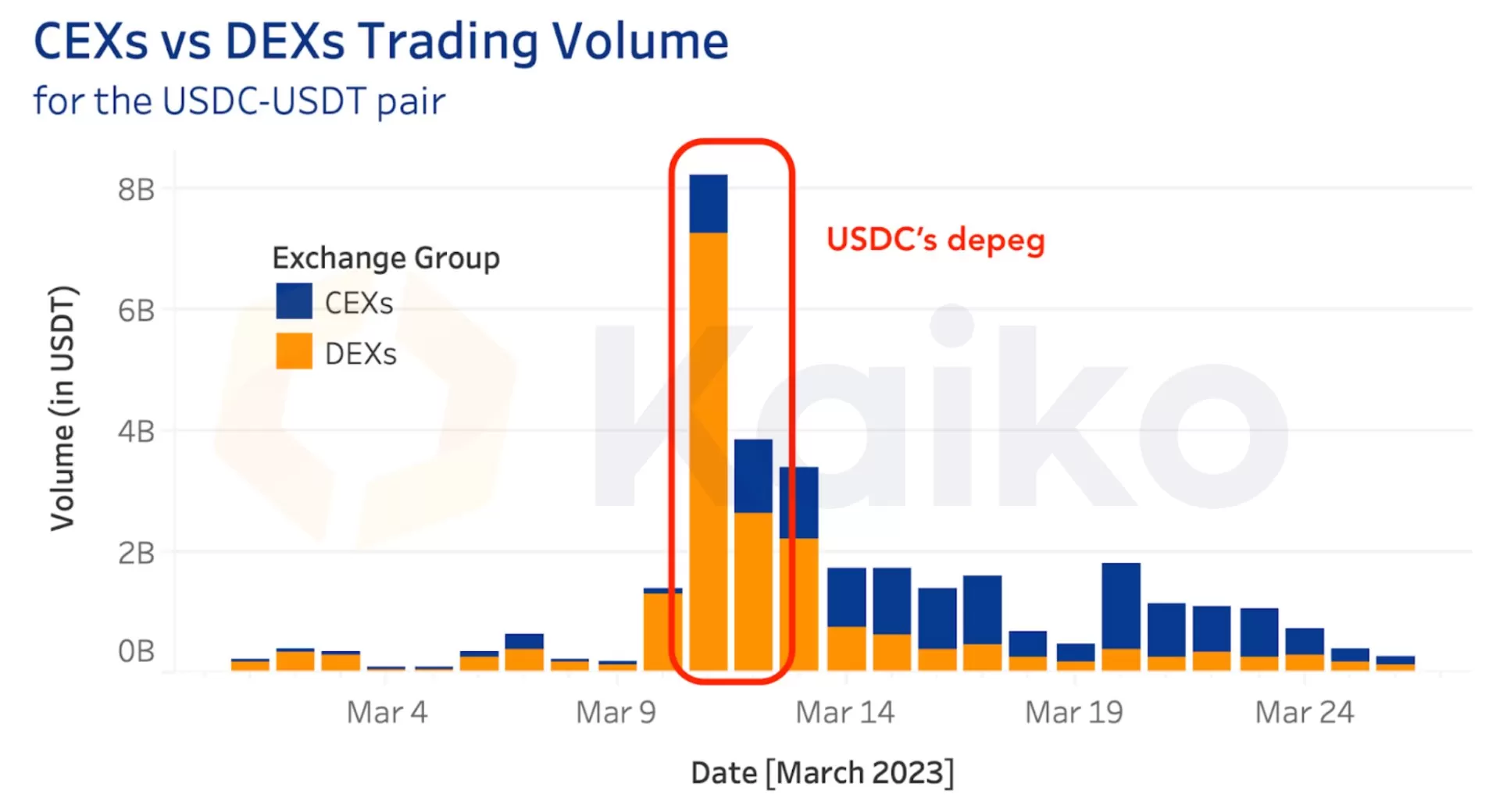

Analyzing the increase in the transaction volume of DEXs from a different perspective, Kaiko experts determined that as a result of the banking crisis, users flocked to decentralized platforms with the panic environment experienced over Circle’s stablecoin USDC.

Kaiko researchers think that investors turned to DEXs due to the liquidity problem in centralized exchanges after USDC lost its peg to $1. Although the crisis is valid for a short time, the lost trust has not yet been fully restored.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!