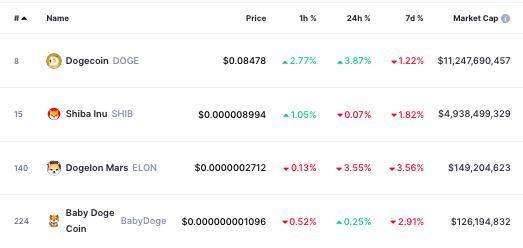

Bitcoin and Ethereum valuation started to stabilize yesterday. The leading crypto asset BTC is holding the $16,500 level, while the altcoin king is trading around $1,200. Its total market value is around 830 billion dollars. Struggling in the meme coin world BabyDoge Coin trying to get stronger.

Only two meme coin prices rose in the past day. One of them was BabyDoge. BabyDoge is trying to stay positive, although it has risen slightly in the last 24 hours. Traded at $0.000000001134 meme coinraising its market cap by around 2.60% to $130,482,685.

BabyDoge, on the other hand, continues to burn to narrow its supply regardless of price. According to the data of the burn follower, 4.16 trillion BABYDOGE tokens have been burned in the last 24 hours. Looking at all the data, 47% of the total supply was burned.

🔥🔥🔥

In the past 24 hours, 4,161,523,152,839 (~$4,653) #BABYDOGE tokens have been burned. So far, 199,425,416,771,840,640 #BABYDOGE tokens (47.482%) have been burned from the total supply of 420,000,000,000,000,000. #BabyDogeCoin #BabyDogeArmy @BabyDogeCoin— Burn BabyDoge (@babydogeburn_) November 25, 2022

The assets held by existing investors also increased. There is also a good increase in the number of new investors starting to invest in BABYDOGE. Recently, 1.64 million tokens were bought by 213 different new investors.

In the past 24 hours, #BABYDOGE has gained 213 new holders. The total number of #BABYDOGE holders is now 1,641,634. #BabyDogeCoin #BabyDogeArmy @BabyDogeCoin

— Burn BabyDoge (@babydogeburn_) November 25, 2022

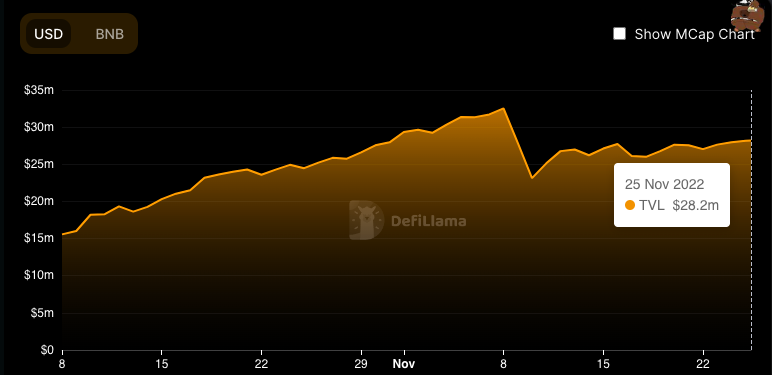

As a matter of fact, an increase can be seen in the number of ‘locked total assets’ on BabyDogeSwap. From the November 10 low of 23.1 million, currently $28 million in assets are locked in.

As Koinfinans.com reported, these developments did not result in a serious price increase in the short term. On the other hand, the correction and stabilization in the market was also found in the price of BABYDOGE. However, it was slightly weaker against other meme coins.

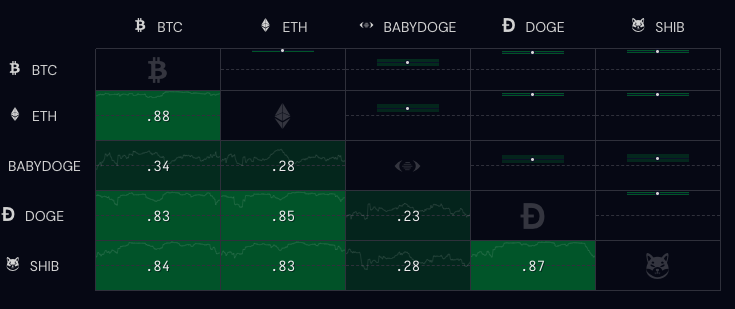

Its weekly correlation with Bitcoin and Ethereum is only 0.34 and 0.28. As a matter of fact, the Dogecoin correlation was 0.23, and the Shiba Inu correlation was 0.28.

Therefore, BabyDoge should focus on its own ecosystem rather than relying on the broader market to help it survive the post-parabolic recovery fiasco.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.