The concept of money, which emerged with the transition from the era of “give chicken, buy beads” to money, has been defined in different ways over time. A decision taken in 1971 had a very negative impact on all existing balances, for almost all people.

In American movies, we can see families owning homes in the suburbs. At that time almost every AmericanHe was starting life by buying a house as if playing Sims. Although the welfare level in the rest of the world was not equal, it was possible to see that people were able to meet their basic needs.

There was a very simple explainable reason for this: Coins were stored as gold and precious metals. In other words, 1 lira in your pocket was equivalent to 1 gold. As a matter of fact, the whole system depended on a balance, and this balance was based on gold. in 1971 On the other hand, gold, which is the cornerstone of the monetary system, which we can liken to an inverted pyramid, was removed from the system.

Let’s get to know the man who started it all: Richard Nixon

Initiating US-China relations, the country expelled from vietnam and a president who made some needed reforms in the country would normally be glorified in the United States. Nixon, on the other hand, is the past of the USA in many lists. the worst heads mentioned among. He is a famous person who has been involved in many scandals. Watergate scandal a president who later resigned. The biggest crime of his time – when we look at the effect on the world – is that he ended the gold standard in his head.

Value for all money in the Nixon era as gold was held, and gold meant US treasury. The gold of the countries that wanted to recover during and after the Second World War belonged to the USA. 2 grams of every 3 grams of gold in the world was in the USA. While European countries are getting up, their new wealth will come from the USA. taking back their gold they were using their own money to strengthen it. This situation, of course, began to disturb the USA, which does not want a rival to the dollar. Richard Nixon as a solution to this situation Bretton Woods system took a decision that would collapse no need for gold Announced. This brought the end of the gold standard.

What is Bretton Woods?

actually a small town at Bretton Woods The United Nations Monetary and Financial Conference was held in 1944. In these negotiations, the famous economist Keynes came up with the idea of a money called Bankor. International Monetary System (UPS) In the so-called system, an international structure would produce a currency called Bankor in exchange for gold. International trade would be carried out on this currency, and the bankor value would be determined according to gold. White, on the other hand, accepted the system, but on one condition, that US dollars printed by the US Federal Reserve would be used instead of Bankor. That too White Plan it was said. Before the end of the war, 44 countries were included in the White Plan. Basically, this system only used dollars instead of bankors. However, the use of the USA, which increased its capital exports after the war, the price of the dollar constantly increased.

Wars are expensive things. The Vietnam War was also not cheap for the United States. As a result, the USA at the cost of reducing capital power went to print money. As the value of the dollar fell, currencies indexed to the dollar began to fluctuate.

Some people started in 1971 While attributing the economic break to Bretton Woods, some people’s approaches to the subject may be different. The reason why the abandonment of the gold standard is emphasized in this article is that, in a sense, the coins are now tied to the US dollar without any equivalent. In a sense, non-material money began to appear.

Returning to 1971, “Money without material?” why?

“Money goes as it comes, nothing we see in our wallet” Are you one of those who say? Technically, having money in your pocket is a much rarer possibility than not. Because the money you can find in cash in the world is the total money in the markets. less than 10% more. Let’s break it down, because from here on out of the story, we’ll see what money has done to us.

Another important point is the graphics that we will see shortly. to the USA belonging The situation is worse for us. The situation is more dramatic because we see what happens in the meantime, whether it’s a memorandum, a coup, a coup attempt, an economic crisis.

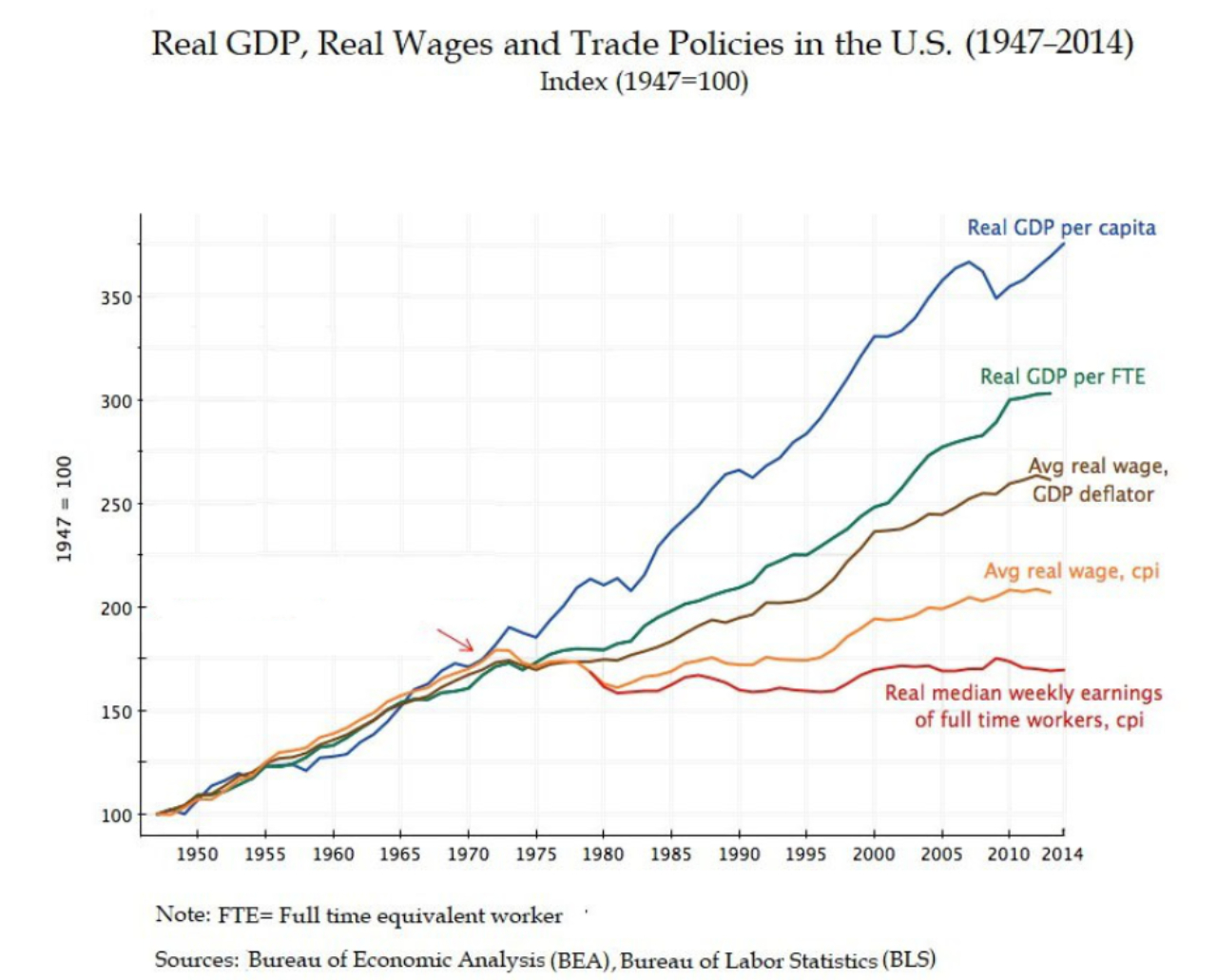

Let’s take a look at the breaks created by the changes in 1971:

Increasing day by day: Inequality

Let me first explain what the graph above is telling. Until 1971, all lines proceeded more or less in the same way, after 1971 per capita income (Real GDP per capita) is increasing. Isn’t it beautiful? It’s fine, of course, but there’s that red line at the bottom, huh, that’s the median salary of salaried employees. In other words, when all salaries are written from top to bottom, the median salary becomes whatever the middle value is. The per capita salary has always increased, but the median value has remained the same.

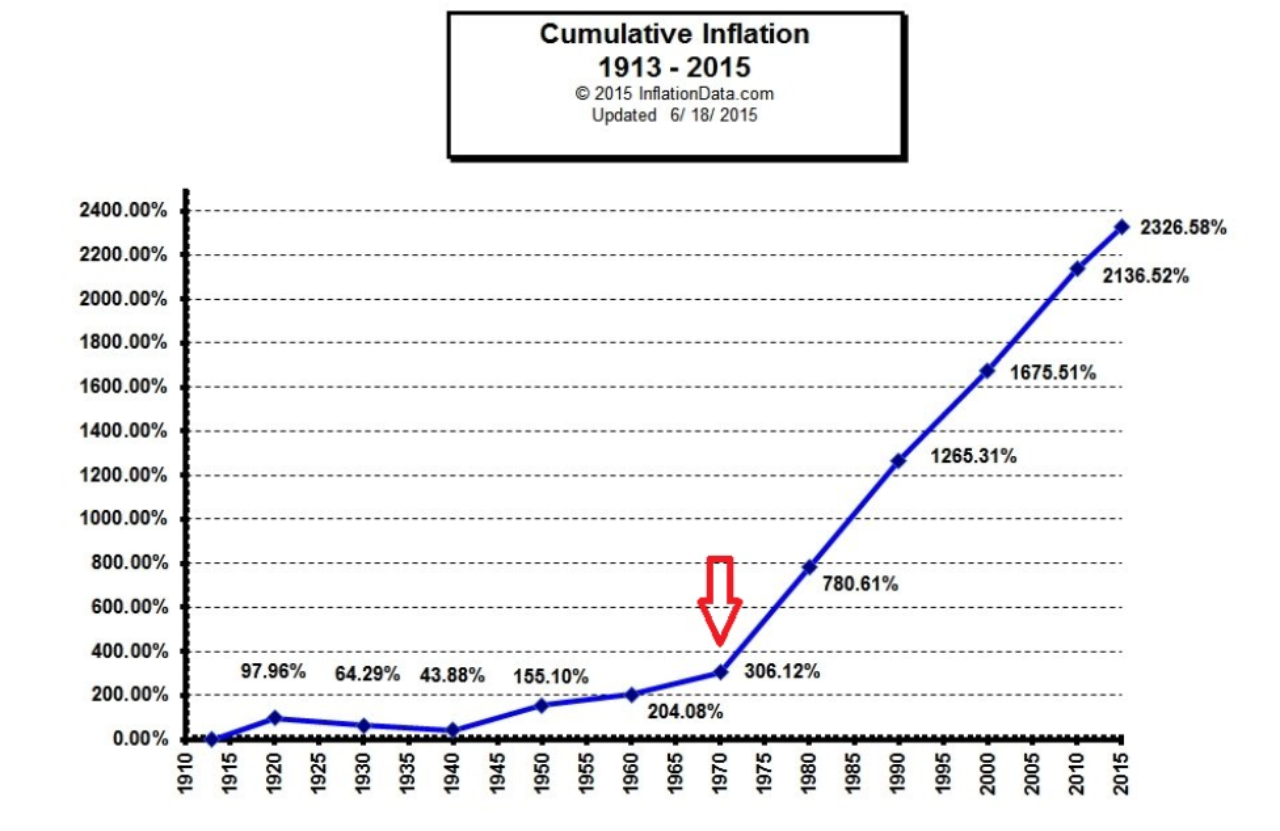

“Inflation” formerly depicted as a monster

For a while, the number one subject of every newspaper and every news broadcast in our country was the inflation monster. Cumulative inflation, which was steady before 1971, has increased tenfold in just 50 years. value which is 10 cents the price of anything over time for 1 dollar came.

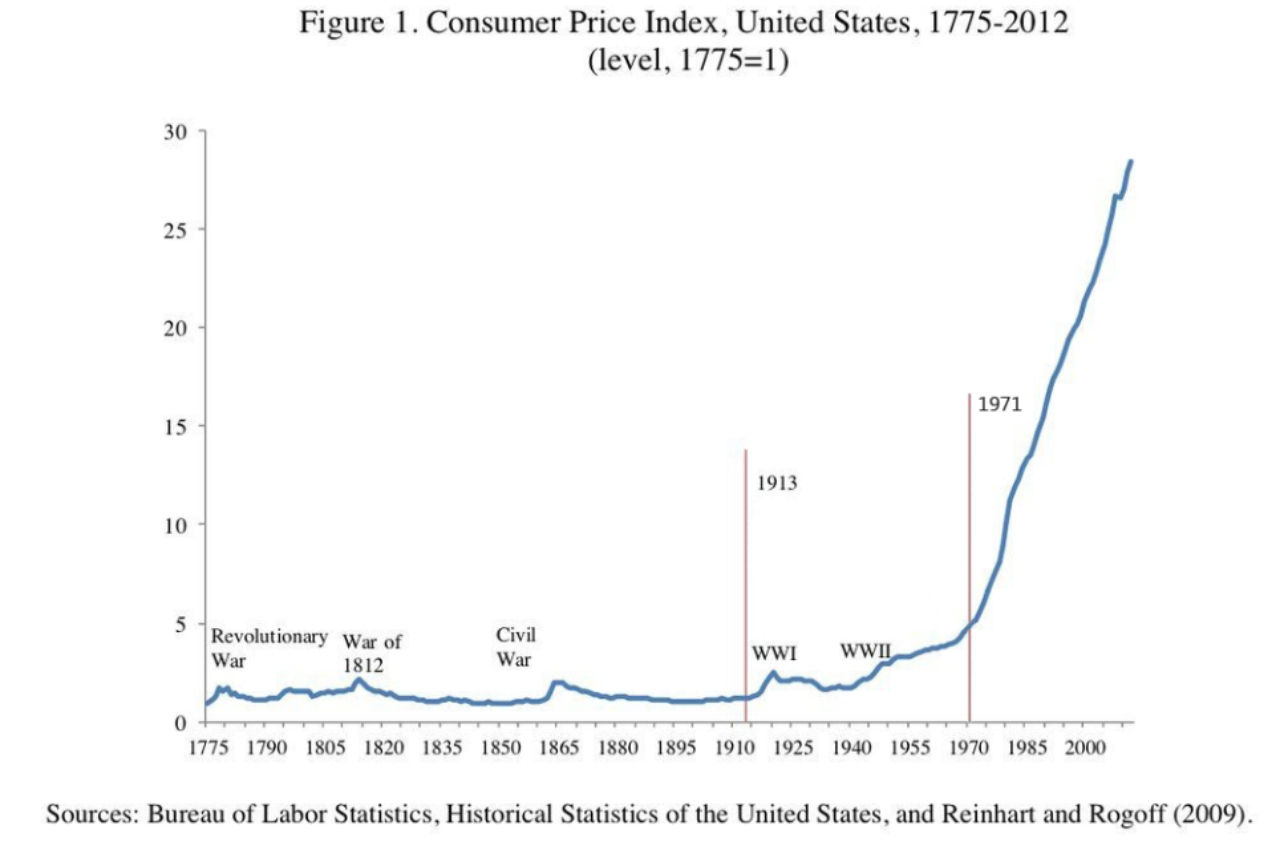

This is also known as CPI, that is, the consumer price index graph. It is possible to see how prices move after the line that says 1971. After 1971, price increases are much more.

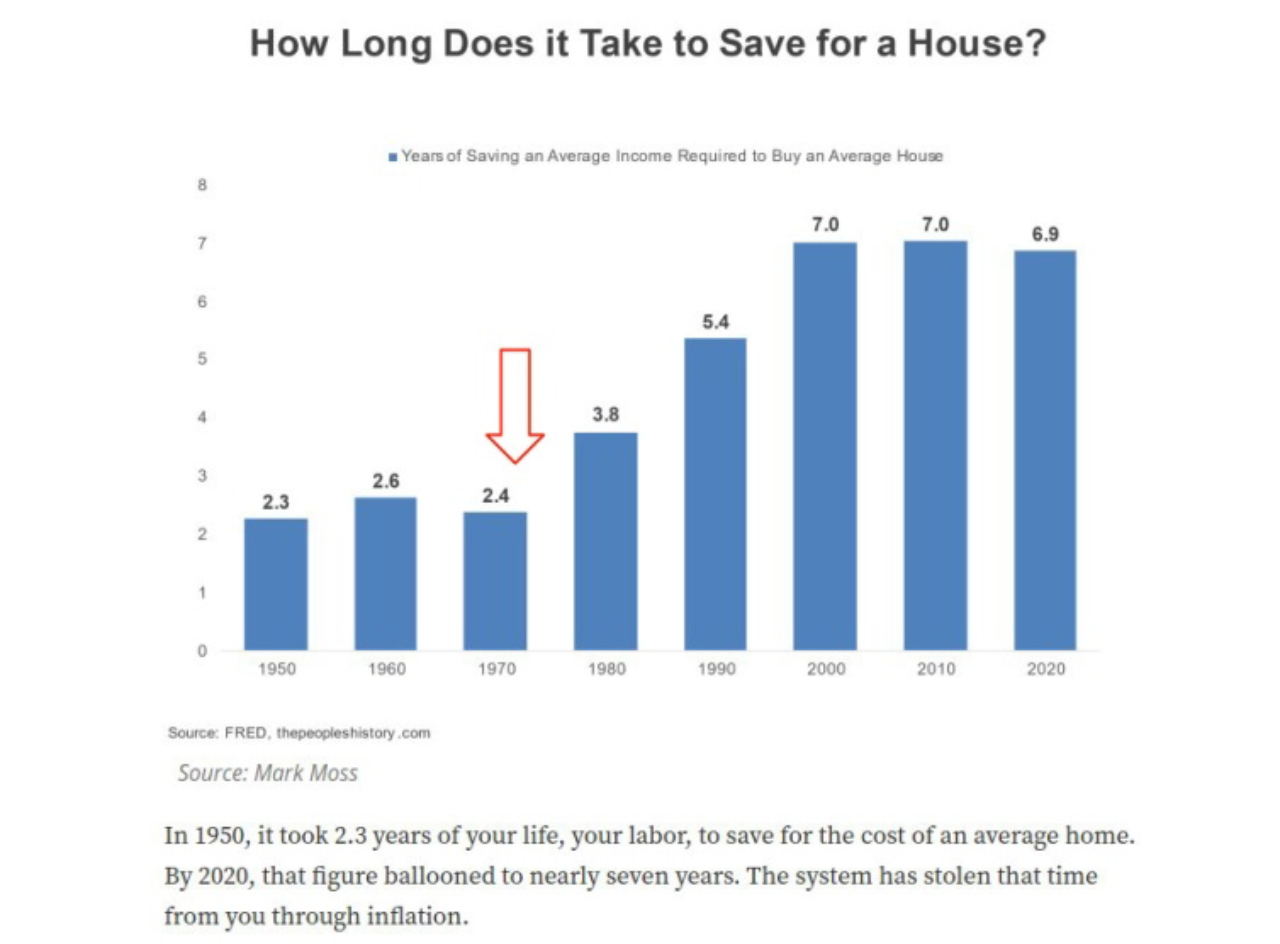

Let’s take a look at the “real estate” wing.

This is my favorite chart. Here we can see the time it takes for a person with an average income to buy an average house. This period, which was 2.4 years before 1971, has increased over time. up to 7 years is out. There is a similar situation in the prices of house rents, house rents increased 6 times in this process. When we remember that the salaries are more or less at the same level, the money we can allocate to buy a house from the salary also decreases.

Could giving up gold cause that much change?

all the money in the world on free printable papers In a system based on fiat money or fiat money, growth can be very rapid. As a result, central banks have the right to freely print money. Governments as well as much money as they want can use. When we look at this in a global sense, we see that especially countries with strong money create crazy debt and grow with this debt.

As the value of money falls inflation started to become more effective. The rich continued to increase their wealth. Inflation began to melt people’s purchasing power. While salaries have increased, the number of things salaries can receive has decreased.