bitcoin (BTC) had a very strong performance, gaining around 70% in the first quarter of 2023. BTC price is currently consolidating at an average of $27,800.

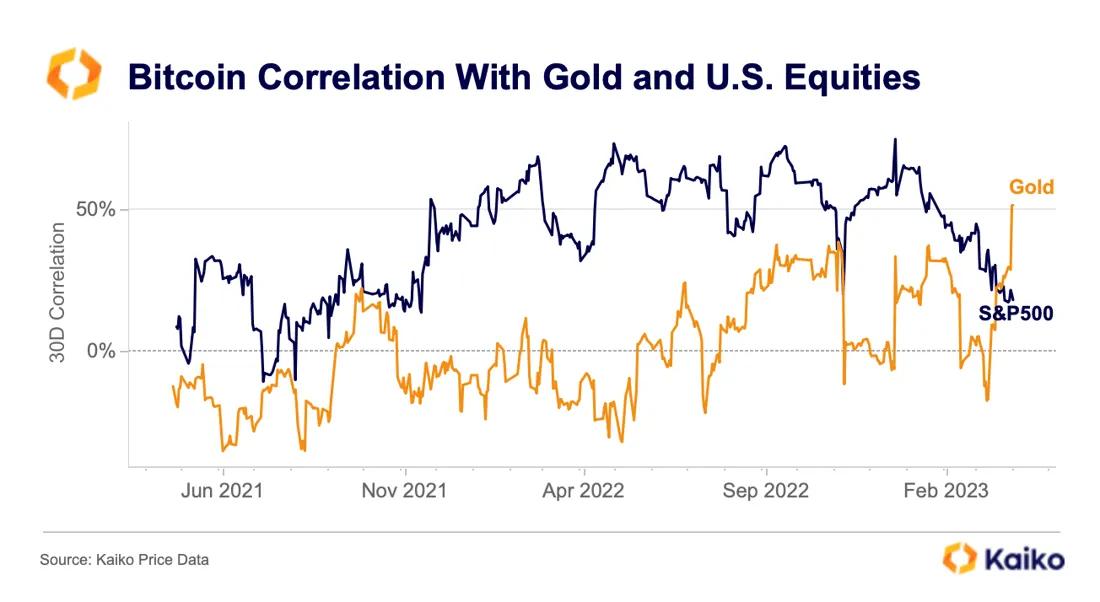

As we reported on Koinfinans.com, Bitcoin has outperformed nearly every other asset class this year, including physical gold and US stocks. Also, according to blockchain analysis firm Kaiko, BTC’s correlation with gold hit its highest level in years last week and is currently hovering around 50%.

This is BTC-Gold means that the correlation has exceeded BTC’s correlation with US stocks. BTC has long been closely correlated with US stocks, but it also managed to outperform all three indices by nearly four times in the first quarter of 2023.

kaikoHe also revealed Bitcoin’s correlation with the S&P 500, which has increased 7.86% since the beginning of 2023. On the other hand, Gold outperformed, gaining around 8.6% in the first quarter. Outperforming all these asset classes, Bitcoin, on the other hand, opened the door to a much higher gain, with an increase of 70% since the beginning of the year.

On the other hand, the number of Bitcoin holders is increasing simultaneously. Amid the current banking crisis, BTC continues to be seen as a safe-haven asset once again.

Bitcoin and Nasdaq Volatility

Bitcoin has always shown a higher correlation with the tech-heavy Nasdaq index of US stocks. Nasdaq 100 The index has also recovered well, gaining more than 20% since December 2022 and technically entering a bull market.

On the other hand, the gap between Bitcoin and Nasdaq volatility reached its highest level since the collapse of crypto exchange FTX in November 2022. Kaiko’s report explains the issue with these words:

The increase in BTC volatility is partly due to liquidity, as market depth is at its lowest level in recent months. This is unlikely to go away as Binance, the largest and most liquid exchange, faces regulatory pressures among market makers that could exacerbate risk aversion.

You can follow the current price action here.