As June progresses, investors who trade cryptocurrencies face three major hurdles. Indeed, these barriers have a case of causing volatility in the crypto market. Among these issues is the worrying drop in trading volume. Concerns include liquidity issues and a significant increase in selling pressure.

Cryptocurrency trading volume drops

The transaction momentum and expectations were high in the first quarter of this year in the cryptocurrency market. However, there has been a decline in trading volume on all major centralized exchanges since then. Accordingly, the total daily trading volume of May fell from $ 23 billion to $ 9 billion. cryptocoin.com As we mentioned, this downtrend indicates a decrease in speculative interest. It also points to a growing lack of interest in the cryptocurrency market. On the other hand, analyst Will Clemente emphasizes indifference and surrender for this decline. Looking at the distribution of the overall trading volume by exchanges, it is clear that Binance has experienced a decline. Market share fell to 56%, down 15% from its peak in the second half of 2022. Rather, this drop supported exchanges in other categories, which include platforms like Huobi, Kraken, and Kucoin.

The regulatory environment in the United States remains unclear. Offshore exchanges continue to dominate the cryptocurrency trading ecosystem. They make up a staggering 86% of all trading volume. It is predicted that this trend will intensify. Surprisingly, even Coinbase, traditionally recognized as a viable alternative to other crypto venues, has announced the introduction of its own offshore derivatives venue, Coinbase International Exchange.

liquidity crisis

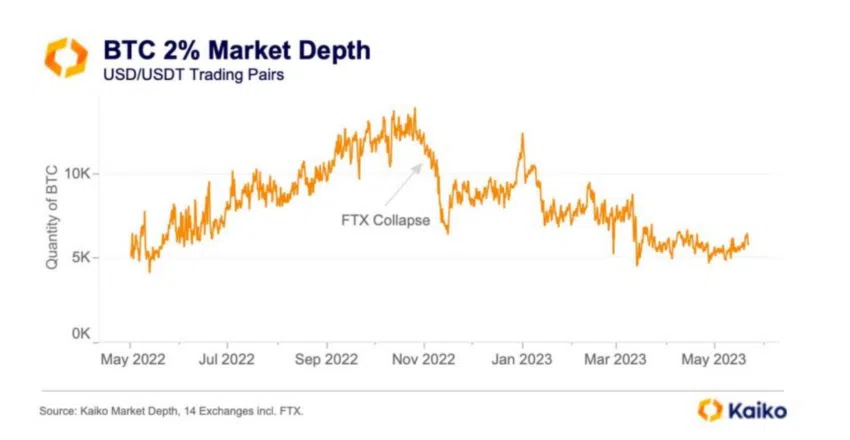

The second major problem that casts a shadow on the cryptocurrency market is the liquidity crisis. This is especially important for Bitcoin and Ethereum. Market depth in USD remained somewhat flat. However, liquidity remained stable as measured by the 2% market depth for cryptocurrencies, i.e. the depth of bids and requests within 2% of the current trading price. This is a sign of growing apathy towards the crypto market. The drop in liquidity caused two market makers, Jane Street and Jump Crypto, to take different decisions. It has revealed its statements revealing its plans to downsize its crypto operations in the US due to regulatory uncertainties. Jane Street has gone even further, announcing that it will withdraw its crypto operations on a global scale. The consequences of reduced liquidity in the crypto market are significant. Liquidity is a critical aspect of any financial market, including crypto. It refers to the ease with which assets can be bought and sold in the market without affecting their price.

High liquidity levels create a safer and more efficient market. Therefore, the fact that participants can easily enter and exit trades leads to tighter spreads. On the other hand, low liquidity has its drawbacks of course. Accordingly, it may hinder market participants’ ability to execute larger trades without incurring price effects, also known as slippage. The slippage in the cryptocurrency market shows the difference between the expected price of a contract and the spot price at which the transaction is actually made. In practical terms, if a trader wants to sell a significant amount of crypto and there are not enough buyers, the price may need to be lowered to make it attractive. This process creates a downward spiral of prices. In this context, it will cause prices to drop and possibly a sale.

Increased sales pressure

The third issue that emerged in June 2023 is the increasing selling pressure as Bitcoin drops below $27,000. The cryptocurrency community is watching key price levels carefully. However, after the legislative activities in the USA, concerns about liquidity increased. Antoni Trenchev, managing partner of crypto lender Nexo, makes an interesting point. The descriptions are as follows:

“Bitcoin faces a number of potential problems in June. Now the debt ceiling drama seems to have passed. The market will likely face a flood of treasury bond issuances once the Senate supports debt-limit legislation. This will likely shift liquidity away from risky assets like Bitcoin.”

The US House of Representatives recently approved an agreement to suspend the $31.5 trillion debt ceiling. This could result in the issuance of up to $1 trillion in US Treasury bonds, putting additional pressure on Bitcoin and the cryptocurrency industry. Still, Maartunn, Community Manager at CryptoQuant, believes that despite the recent increase in selling pressure similar to previous sales, it could peak soon and BTC could bounce back. Let’s see if the analyst will be right in his views.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.