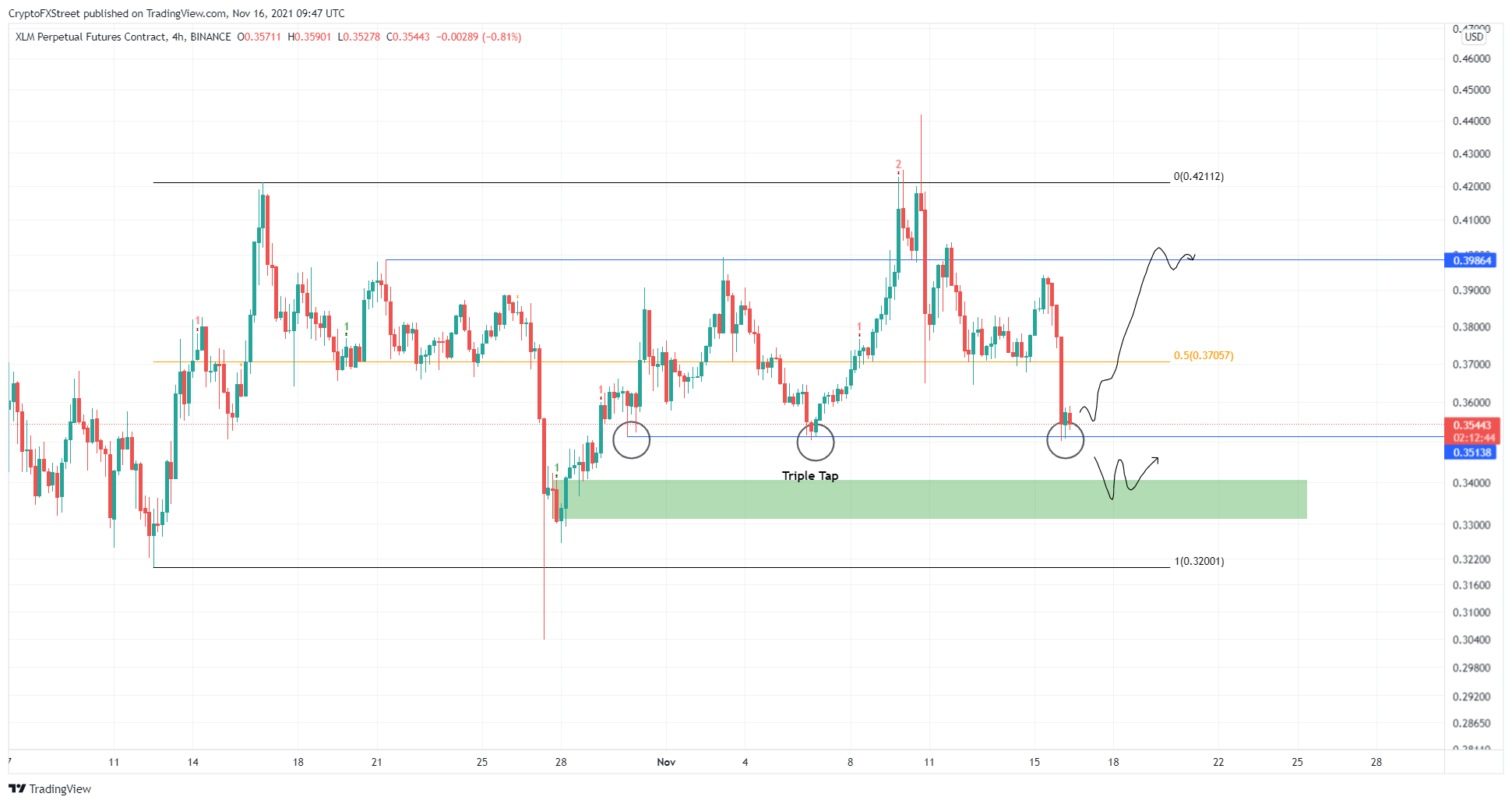

Stellar Lumens (XLM) price is aiming higher price levels as it bounces off the $0.35 support level for the third time. The ‘triple tap’ setup is targeting a rise towards $0.40 even in the most conservative scenario and towards $0.42 in a more optimistic view. The bullish thesis will be invalidated if the price dips below $0.32.

Stellar Lumens (XLM) price had fallen sharply as it failed to break a crucial resistance level on the daily timeframe. The recent drop formed the final piece needed to complete the bottom reversal pattern and rekindled investors’ belief that XLM can wait for a reversal.

XLM price tested the $0.42 barrier three times in the past month to make a comeback but failed. The latest failure on November 10 triggered a 20% drop, creating a swing low of $0.35, the ‘third consecutive low’ since October 30.

On the 4-hour price chart, XLM has now started forming a triple tap setup, also known as the ‘bottom reversal technical formation’. Market participants are now waiting for the XLM price to reverse and run into immediate hurdles.

The 50% retracement level at $0.37 will be the first hurdle Stellar will face. Breaking this level will move towards $0.40, which is a 13% advance. If it is too high, the rise could be extended to $0.42.

While more upsides are possible, the short-term bullish outlook is currently capped at $0.45. Traders can expect a ‘reasonable’ correction after XLM price retests $0.42 or $0.45.

Another key scenario that traders should look forward to would be a retest of the demand zone ranging from $0.33 to $0.34 before the reversal occurs.

While searching for XLM price, a breakout of the said demand zone at $0.33 will create a lower bottom and invalidate the bullish argument. In that case, XLM will likely fall into the lower ranges at $0.30.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.