Dusseldorf A few weeks ago, the income tax was referred to as the “queen of taxes” and as the “highpoint of the tax art of the liberal bourgeoisie”. To determine the base of this tax, all of a taxpayer’s income is summed up and taxed according to a progressive scale, so that strong shoulders carry more than weak shoulders.

This principle is taken into account to a large extent in Germany. According to data from the Federal Ministry of Finance, only six percent of the total revenue from this tax comes from the bottom half of income taxpayers, while 56 percent comes from the top decile and the top one percent contributes almost a quarter of the revenue.

Income up to 10,347 euros is not taxed. According to this, the starting tax rate in the current tax rate is 14 percent, while top earners – including the solidarity contribution – have to pay around 47.5 percent of every additional euro earned to the tax authorities.

Most citizens consider this to be fair. Conversely, however, revenue from the Treasury decreases when taxable income is reduced, for example due to higher income-related expenses.

Top jobs of the day

Find the best jobs now and

be notified by email.

If a top earner can claim 100 euros in additional income-related expenses, they will pay about 47.50 euros less income tax, while the tax burden of a low earner in such a case will only decrease by 14 euros. Anyone who considers the burden of high and rising incomes to be fair should not call the state’s high tax waivers in the event of falling top incomes unfair – as long as the principle of taxation based on ability to pay is not fundamentally questioned.

Cold progression weighs heavily on taxpayers

In addition, there is a second point that needs to be considered: without regular adjustment of the key figures of the tax rate to the development of the price level, it would only be a matter of time before almost every taxpayer would eventually belong to the group of top earners.

The reason for this is the so-called cold progression. If incomes also rose by ten percent with an annual increase in the price level of ten percent, the tax burden for the population would increase by eleven or even twelve percent at the current tax rate.

The real wage would therefore remain constant, while the real tax burden would gradually increase. Inversely, real purchasing power falls. Anyone who works for the minimum wage today would have been a top earner 50 years ago and would have been taxed accordingly.

Prof. Bert Rürup is President of the Handelsblatt Research Institute (HRI) and Chief Economist of the Handelsblatt. For many years he was a member and chairman of the German Council of Economic Experts and an adviser to several federal and foreign governments. You can find out more about the work of Professor Rürup and his team at research.handelsblatt.com.

In order to counteract such secret, inflation-related tax increases, the federal government committed itself in 2015 to regularly adjusting the income tax rate. Federal Finance Minister Christian Lindner (FDP) now wants to implement this with his planned tax reform.

Today’s Federal Chancellor, Olaf Scholz (SPD), also kept to this obligation when he was finance minister in the grand coalition – albeit without being subjected to protests from his own ranks.

Such an adjustment becomes more expensive for the state, the higher the inflation and the associated shift in tariffs. If such tariff corrections were not made, the real tax burden on income taxpayers would rise steadily.

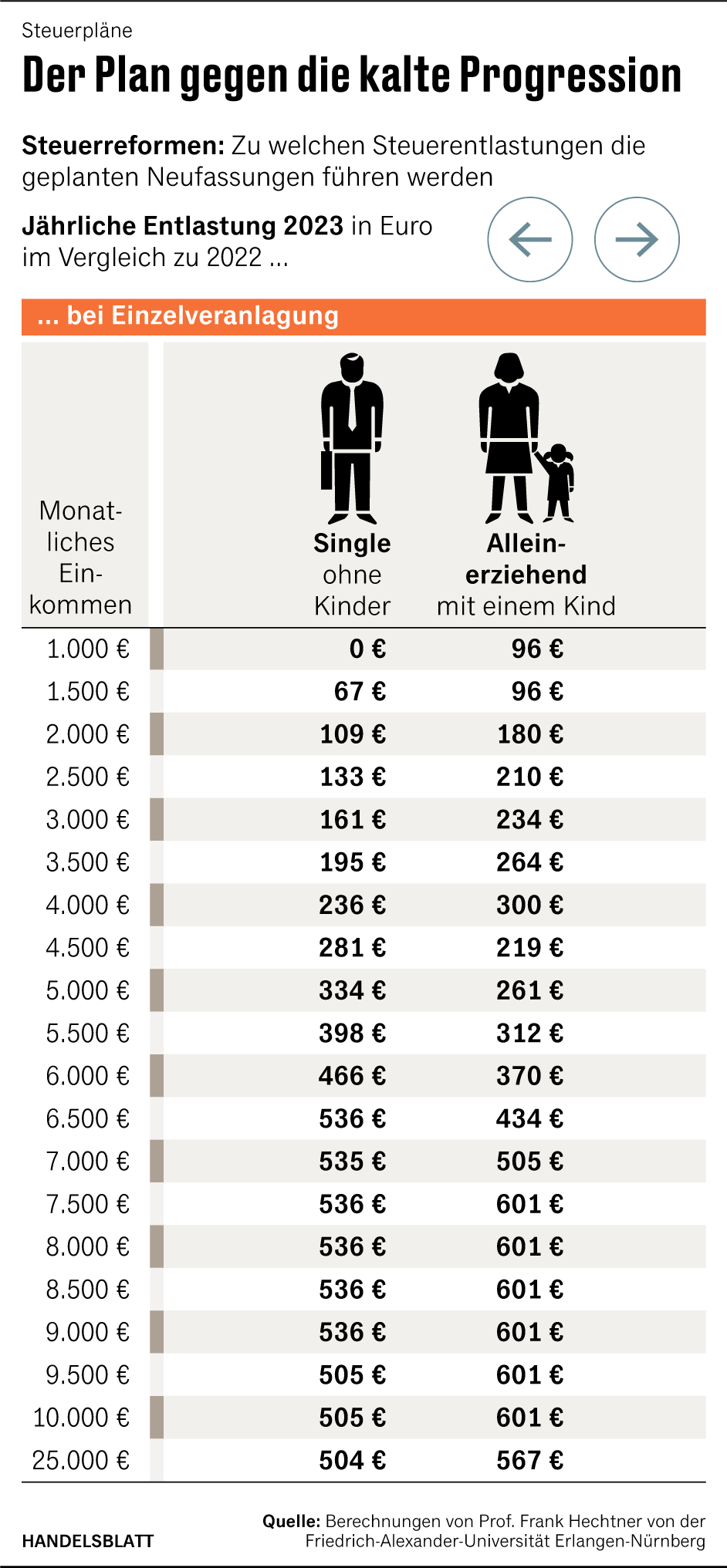

Against this background, a sober analysis of Lindner’s plans shows that the calculated relief of up to 958 euros for married couples in 2023 is not a real relief. Only the real income is kept approximately constant in the event that this income increases in line with the rise in the price level.

Habeck calls for targeted relief

Irrespective of this, there is criticism of Lindner’s plans. SPD leader Saskia Esken warned that such a reform would benefit the highest earners “who do not need our support”.

The Federal Minister of Economics is critical of Lindner’s plans.

(Photo: dpa)

Vice Chancellor Robert Habeck (Greens) emphasizes that he does not see “how we can represent in this situation that those who need less support are absolutely relieved”. Wealthy households and people on low incomes paid the same high energy prices. The rich could cope with this, but not the low earners. “We should therefore act on the principle that lower incomes benefit absolutely more than higher ones.”

DIW boss Marcel Fratzscher criticizes “that the state does not return its inflation gains to everyone, but gives them primarily to people with high and middle incomes”. 40 percent of tax revenue comes from indirect taxes, such as value added tax, which primarily affects people on low incomes. “For these people, the plan does not provide any significant tax relief.”

This criticism of Lindner’s tax plans is not very honest. Because the proposed income tax reform, which envisages an increase in the basic tariff values by six percent in the coming year and by a further 2.5 percent in 2024, is not a real tax cut. It only corrects an additional tax burden due to inflation – and those taxpayers whose income is burdened with high marginal tax rates due to progression benefit in absolute terms from this.

>> Read here: Lindner’s tax plans are met with criticism from coalition partners – “It ignores reality”

On the other hand, if one accepts the principle of income tax inflation adjustment, the adjustments planned by Lindner appear to be rather small in view of the current inflation forecasts. Apparently, the minister underestimated inflation for the current year. Economists are now assuming annual average inflation of around eight percent.

Reform is not a targeted social policy

Relatively speaking, low earners benefit much more from Lindner’s plans than high earners: Those who have around 15,000 euros to pay tax pay ten percent less tax, but with an annual income of 250,000 euros the relief is significantly less than one percent.

Lindner’s foolish communicative error was that he presented his plans as a liberal response to the socio-political challenges that politicians are facing in view of the energy price crisis. Because an income tax reform can never be a precise instrument to protect poor and needy people from real income losses caused by inflation.

Eliminating the cold progression is just as little a targeted social policy as an increase in pensions in accordance with the statutory pension adjustment formula.

In the novel “Satyricon” by the first-century Roman satirist Petronius, in the episode “The Banquet of Trimalchion” it says: Qui asinum non potest, stratum caedit – Whoever cannot beat the donkey, beats the blanket. The same is true of the sometimes shrill criticism of Lindern’s draft law. All parties represented in the Bundestag welcome the regular inflation adjustments to the tax rate introduced in 2015 and at the same time criticize the Federal Minister of Finance for implementing this principle.

Irrespective of this, the socio-political wing of the traffic light coalition is likely to push through further aid for the large number of low-income people. Not least to cushion the financial consequences of the new gas surcharge. Lindner’s problem is then whether and how he can comply with the debt brake that he and his voters appreciate in the coming year.

More: Who will benefit the most from taking down the cold progression