highly anticipated Bitcoin Approximately $1.39 billion of option contracts expire today. This amount is lower than last week’s amount of 96,000 contracts.

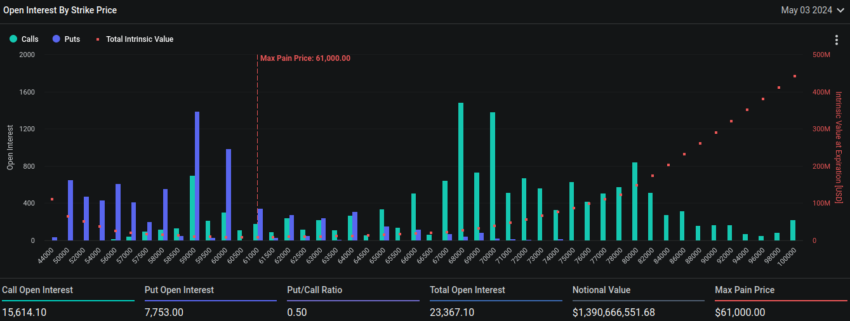

Today, 23,367 Bitcoin contracts worth $1.39 billion expire. According to Deribit, BTC’s put-to-call ratio stands at 0.50. The maximum pain point (the price at which the asset will inflict losses on the largest number of holders) is located at $61,000.

Greeks.live in light of the latest developments crypto- current state of the market emphasized.

“Bitcoin and the cryptocurrency market are still experiencing a deep pullback. April was the sharpest pullback month in almost a year. Dvol fell directly from 74% to 55% this week. Volatility expectations in the markets are falling extremely fast… In the short term, a lower IV and price can be chosen and one can start buying options correctly and profitably now.”

As we reported as Koinfinans.com, in addition to Bitcoin options, approximately 334,248 Ethereum The contract will also expire today.

The face value of these expiring contracts is approximately $1 billion, the put-to-call ratio is 0.36, and the maximum pain point is $3,000.

According to CoinGecko data, despite the strong correction in recent days, the cryptocurrency market has recorded a 4% increase in the last 24 hours. This brought its total capitalization to $2.32 trillion.

Recently, Bitcoin registered a sharp decline below $57,000. However, it later recovered and is trading at $59,324. Ethereum is trading at $3,003, up 1.5%.

However, we must not forget that the effect of option expiration on the price of the underlying asset is short-term. In general, the market will return to its normal state the next day and compensate for strong price deviations.