Crypto lending platform Celsius has recently filed for bankruptcy, leaving its investors in limbo. Altcoin investors are planning a community-led “CEL Short Squeeze” to save their money, as they believe the platform will not be able to continue trading.

Altcoin investors plan CEL short squeeze

“CEL Short Squeeze” is not new. Celsius is causing this operation as it stopped withdrawals on June 13. The CEL price has climbed above $1 multiple times since last month due to short-term tightness. For example, she saw a big short squeeze from June 20-21. This resulted in an increase in the CEL price of over 150%.

CEL is down an additional 20% today as reports of bankruptcy filings emerge. “#CELShortSqueeze” started trending on social media as customers rioted that they would not get their money back. Some investors are sharing their concerns on Twitter.

“We commit suicide”

In a thread titled “I’m suicidal,” one user shared his frustrations hours after Celsius posted the announcement:

I have saved all my savings in Celsius for 20 years. I do not know what to do. My 2nd child is on the way and I have a mortgage to pay… My wife doesn’t know. I am so afraid of what to do. I’m just thinking of finishing it. It would be easier than suffering that great loss. my whole life. Gone. I don’t know where to go or what to do.

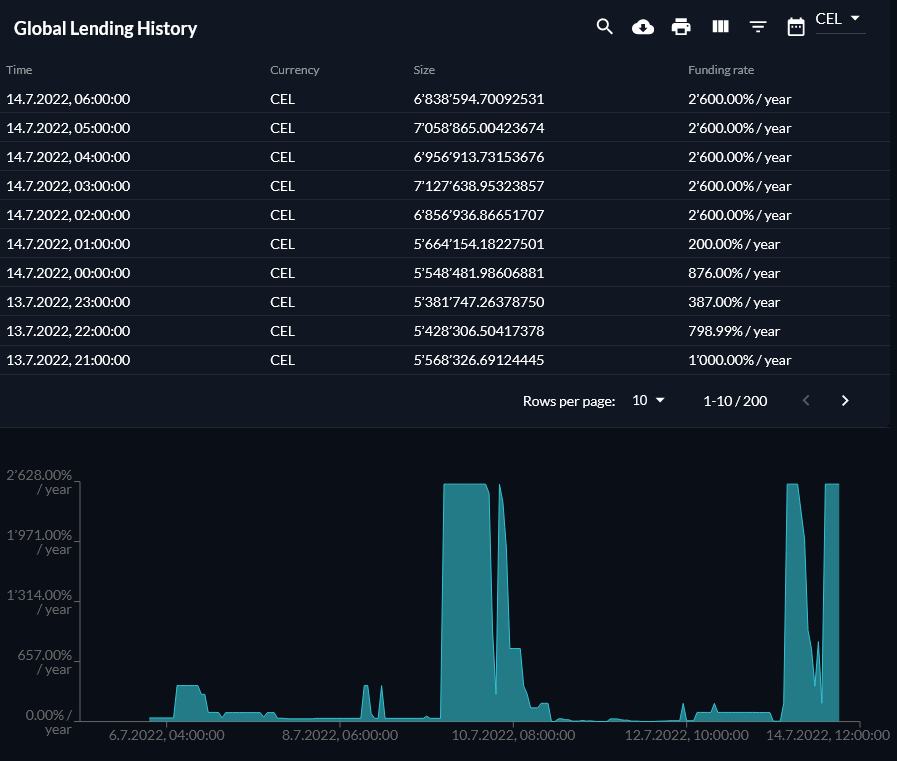

CEL short rate on exchanges exceeded 80%

In the last 12 hours, more than 80% of open interest on major exchanges including FTX, Huobi and Okex were on the short side. Celsius does not sell CEL tokens to the market. Spot shorts on FTX are bound to buy CELs to close their positions. Currently, FTX has only about 364,000 CELs, with 6.6 million CEL open positions.

According to data from Coinglass, large short positions have been liquidated in the past few hours. The losses were realized as the CEL price climbed above $0.60. Meanwhile, shorts have started releasing CEL tokens as many cryptocurrency influencers push for “short squeeze.”

File bankruptcy for altcoin

cryptocoin.com As we reported, Celsius released a press release on Wednesday. He confirmed that he had applied for Chapter 11 protection in the United States Bankruptcy Court for the Southern District of New York. In the announcement, the firm’s CEO, Alex Mashinsky, said filing was the “right decision” for the company.

Celsius currently has $167 million in cash, according to the statement. It also plans to continue operating. At its peak, the firm had $20 billion in assets under management. However, it faced a liquidity crisis as the crypto market collapsed. It has become one of the few crypto lenders to freeze customers’ withdrawals while causing a market-wide meltdown accelerated by other factors, such as the collapse of the Terra ecosystem and the contagion from a bankrupt crypto hedge fund.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.