- Trading platform Robinhood, whose listings are closely followed by the crypto community, has officially listed two more popular cryptocurrencies.

The platform is finally a smart contract platform, an open-source network for currencies and payments and a rival to Ethereum (ETH), popular trading app Robinhood announced on Monday. Avalanche‘I (AVAX) listed.

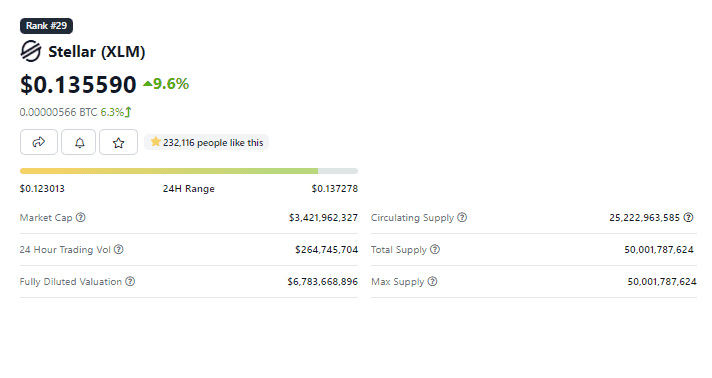

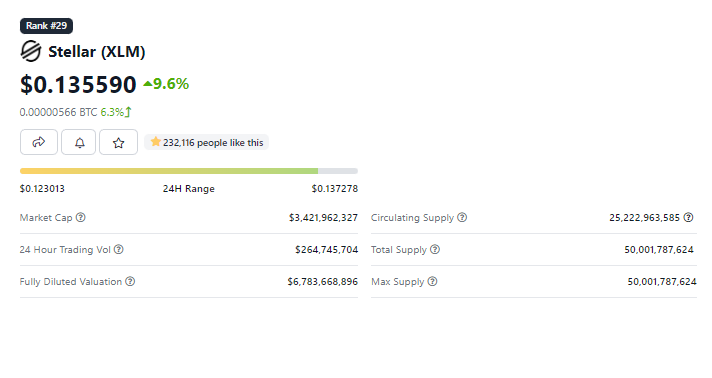

After these listings, both altcoins experienced an upward price movement despite the stagnation in the market. Stellar surged more than 11 percent after listing, reaching $0.13. Avax token, on the other hand, increased by more than 10 percent on the day to reach $ 30.33. Both cryptocurrencies are currently experiencing some pullback.

Known for its tough listing policy for digital assets, the trading platform has significantly expanded its crypto offering this year. at the end of June Chainlink (LINK) The company, which added support for Left (LEFT), Shiba Inu (SHIB) and Polygon (MATIC) had listed.

Robinhood entered the cryptocurrency trading space in February 2018, initially allowing clients to trade Bitcoin and a limited number of altcoins. In July 2018, the meme cryptocurrency Dogecoin was launched on Robinhood Crypto. After that, the company resisted adding new tokens for almost three years despite the massive growth of the crypto industry.

At the height of the Dogecoin craze in the first quarter of 2021, the Bitcoin parody meme coin accounted for more than a third of the company’s crypto-related revenue.

Koinfinans.com As we reported earlier this year, Robinhood started launching crypto wallets that allow users to withdraw their cryptocurrencies from exchanges. In late June, Bloomberg reported that crypto giant FTX was planning to acquire Robinhood, but Robinhood denied that there were active talks about the potential acquisition.

Shares of Robinhood slumped amid declining revenue and a drop in active users. The Menlo Park, California-based company recently cut its headcount by 23 percent. The platform’s latest data, whose revenue nearly halved in the second quarter of 2022, highlighted the company’s dramatic decline after its hype-driven IPO on July 29, 2021.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.