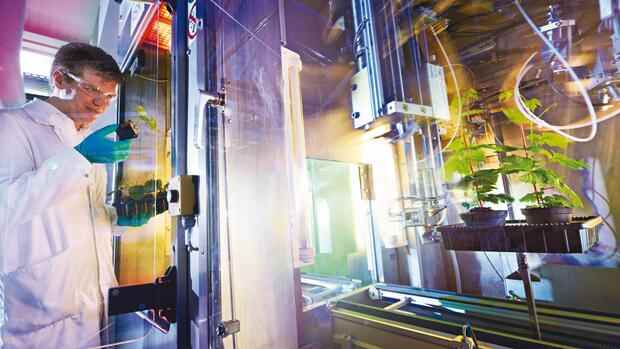

In the agricultural business, Bayer is benefiting from significant price increases.

(Photo: Bayer AG)

Dusseldorf At Bayer AG, the Crop Science agricultural division is developing into the strongest profit driver. In the first quarter of 2022, the Leverkusen-based group benefited from the tense situation on the global agricultural markets, which led to sometimes high price increases for crop protection products and seeds. Bayer sales jumped 14 percent to 14.6 billion euros, adjusted profit (Ebitda) by 28 percent to 5.3 billion euros.

The weed killer glyphosate is currently twice as expensive year-on-year. Other crop protection products are also in demand in the important agricultural markets of North and South America, Europe and Asia. One reason for this is that farmers want to keep their crop yields high because deliveries of wheat and corn from Ukraine and Russia are canceled or only available in limited quantities.

In addition, the supply is limited because of the expensive energy. This was particularly evident with glyphosate, where several Chinese producers cut production due to high gas prices or lack of supplies. The Herbicides division, which includes the glyphosate and other weed killer businesses, increased sales by 60 percent. For fungicides to combat fungi, it was 19 percent.

Overall, the Crop Science agricultural division, which has been expanded to include the acquired US group Monsanto, increased quarterly sales by 22 percent to 8.5 billion euros. Adjusted profit was 50 percent higher at 3.7 billion euros, which corresponds to a profit margin of 44 percent. The division was thus well above the values forecast by analysts. This also applies to Bayer’s overall quarterly results.

Top jobs of the day

Find the best jobs now and

be notified by email.

In contrast, the analysts had expected slightly higher profits in the prescription drug business. At the start of the year, the Pharmaceuticals Division posted sales of EUR 4.7 billion (up 2.6 percent). Adjusted profit fell by seven percent to 1.39 billion euros. Bayer justifies this with further investments in the development and marketing of new drugs.

Cancer drug records sales increase of 60 percent

The new cancer drug Nubeqa achieved a sales increase of 60 percent, and the long-standing sales generator Eylea for eye treatment continues to grow strongly. However, Bayer lost sales of its absolute top product, the anticoagulant Xarelto, because new government tendering procedures in China led to a price drop there.

Bayer increased sales of over-the-counter health products in the Consumer Health division by 17.2 percent to EUR 1.51 billion. There, remedies for colds and allergies were particularly in demand. Adjusted profit rose 33 percent to 388 million euros.

Possible negative effects of the war in Ukraine on Bayer’s business have not yet become apparent in the first quarter. The group still does not expect any significant effects. Bayer is continuing to supply medicines and seeds to Russia and points out the vital importance of these products.

“Despite the high degree of uncertainty regarding the stability of the supply chains and energy supply, we are confident about the rest of the year and confirm the currency-adjusted forecast for the full year published in March,” said Bayer CEO Werner Baumann. The group then expects sales to increase by five percent and profits to increase to twelve billion euros.

More: Bayer wants to show strength in 2022: profit should increase to twelve billion euros.