While there is a general consolidation period in the cryptocurrency market, altcoin It is observed that some people experience short squeeze between ‘s. Two prominent altcoins, Arbitrum and Curve, appear to be in a short squeeze period.

Short position squeeze (short selling) describes the situation in which investors who take short positions at the low price of an asset are forced to close their positions when the price rises. In this process, positions are liquidated and the price rises; As the price rises, other positions that are not liquidated continue to be liquidated.

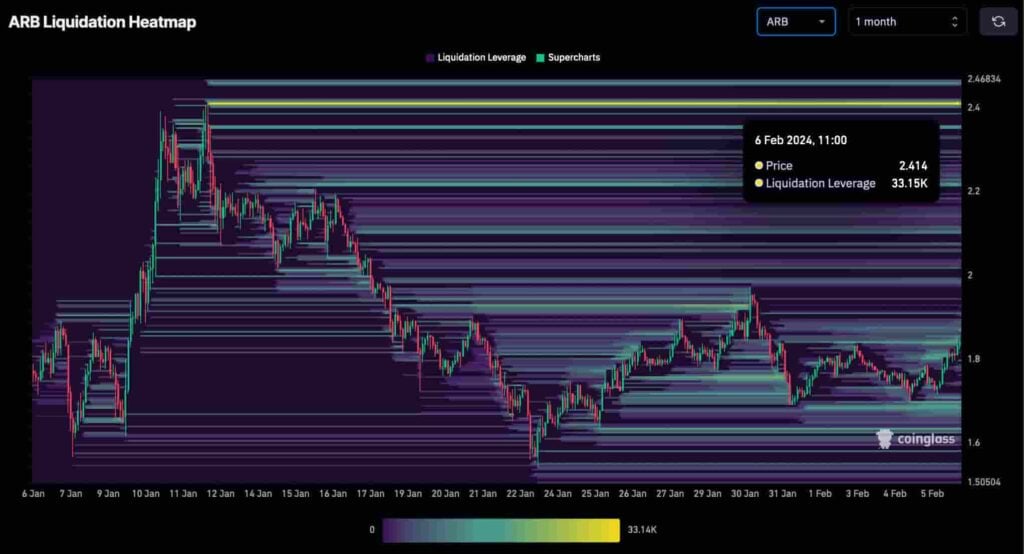

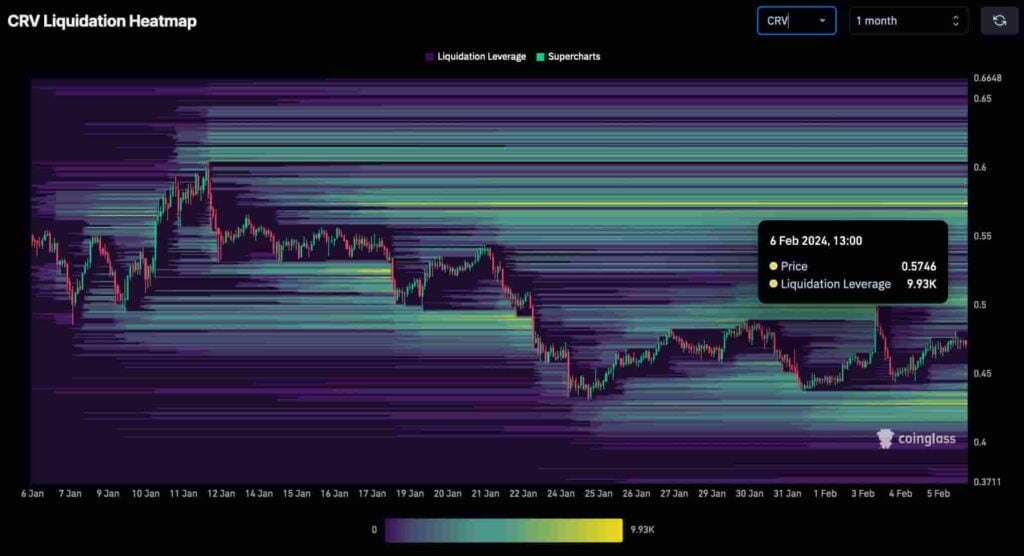

CoinGlass’ liquidation heat map data dated February 6. In particular, the short liquidations accumulated on Arbitrum (ARB) and Curve (CRV) in the monthly period attract attention.

There is a Short Squeeze Opportunity for Arbitrum (ARB) in February

Arbitrum has intense liquidity at the $2.4 price level. More specifically, there is a $33,150 short liquidation at $2,414, making it an attractive target for market makers.

At the time of writing, ARB is trading at $1,838, up 4.75% in the last 24 hours. This bullish price action could catalyze a short squeeze, liquidating minor targets up to $2.4. Interestingly, such a move would see Arbitrum gain over 30% in February.

Short squeeze is another possible candidate for a squeeze event curve DAO’s native token is CRV. It currently has $68.64 million in open interest with an OI/Market Cap ratio of 0.1324 while trading at $0.471.

Coming to the liquidation heat map, CRV has liquidity for both sides. In this context, the token may experience a brief move downward before starting to rise rapidly.

In addition, the most favorable liquidations are at $0.573, but a decline from here could increase short positions and change this scenario for even higher prices, which already has significant liquidity.

However, a shift in sentiment is still required for these short squeezes to occur. Cryptocurrencies are highly volatile assets in a market that changes every day. Therefore, investors should trade carefully by following trends and adapting to each new development.