The new CEO Bert Habets wants to invest more in the core business.

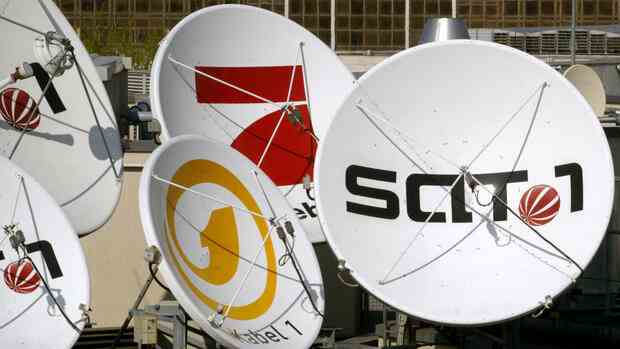

(Photo: Reuters)

Munich From now on, the new head of Pro Sieben Sat 1, Bert Habets, wants to invest primarily in the core business of entertainment. “I am convinced that in this way we will strengthen our leading position in the German-speaking entertainment market and achieve our medium-term sales growth target of an average of four to five percent per year,” Habets said on Tuesday.

The Dutchman has been leading Germany’s largest private broadcasting group since last November. Now he has commented on the strategy of the MDax-listed company for the first time. The group’s own streaming platform Joyn will play an even more important role than before.

According to Habets, Joyn will in future be the center of “the digital entertainment presence” and should become a lifestyle brand for the whole family in German-speaking countries.

Pro Sieben Sat 1 leaves the financial targets open

In a statement, he also promises more local content. The new in-house newsroom will also contribute to increasing the reach across all distribution channels. In addition, Habets promised higher advertising revenues. The former head of rival RTL wants to convince advertising customers with more targeted digital offers. In addition, acquisitions are possible.

Habets wants to hold on to the company’s digital holdings. A good ten years ago, predecessor Thomas Ebeling began to give advertising time to start-ups, in return Pro Sieben Sat 1 gets a stake in the up-and-coming companies.

The Dutchman has been leading Pro Sieben Sat 1 since November.

(Photo: dpa)

However, essential questions remain open. Aside from planned sales growth, Habets did not comment on financial targets on Tuesday. It is also unclear when the subsidiary ParshipMeet Group will go public. The dating division was supposed to be on the floor, but the issue was postponed indefinitely last year.

>> Read also: Pro Sieben Sat 1 unsettles investors – the share collapses

In addition, the balance sheet presentation for the past year is pending. At the end of February, Habets canceled the date for the presentation of the figures at short notice. The reason for this is regulatory questions about the business of the subsidiaries Jochen Schweizer and Mydays, Pro Sieben had announced.

The area is negligibly small for the TV group. According to company insiders, Habets and the chairman of the supervisory board, Andreas Wiele, were startled by the problems with the voucher provider. Now they would take a close look at the entire set of figures, they say.

Media group: Habets has to deliver the numbers by the end of April

The management team is under time pressure: the balance sheet must be available by the end of April at the latest, as required by the stock exchange. Pro Sieben Sat 1 is listed in the MDax and could be dropped from the index if the deadline for publication of the figures is exceeded. However, a new date has not yet been communicated.

>> Read also: Ex-DFL boss Donata Hopfen is to move into the supervisory board of Pro Sieben Sat 1

But there are not only balance sheet difficulties to be cleared up, but also personal details to be clarified. The Czech financial group PPF, which recently became a major shareholder, is pushing for a seat on the supervisory board.

“PPF is of the opinion that Pro Sieben should ensure fair representation of all important shareholders on the supervisory board,” the company recently announced. A few weeks ago, PPF increased its stake to a good ten percent and is the second largest shareholder.

The vacancies on the supervisory board of Pro Sieben Sat 1 are currently being fought over. Three mandates expire this year, and one position is vacant after Habets moved from the supervisory board to the executive chair in the fall.

PPF’s largest shareholder is competing for seats on the control body: MFE-Mediaforeurope, a company controlled by former Italian Prime Minister Silvio Berlusconi. MFE holds 29 percent of the shares and, according to industry circles, claims two seats on the supervisory board.

The stock market, meanwhile, barely reacted to Habets’ new strategy. In early trading on Tuesday, the share price fell by around one percent to around 8.80 euros.

More: Breaking up of Gruner + Jahr – Why are 134 million euros missing in profit?