US-based crypto exchange in the past seven days, according to new data from a crypto intelligence platform. CoinbaseIt has been revealed that approximately 10,000 Bitcoin (BTC) has left the stock market.

Coinglass shows that as Bitcoin continues to struggle below the $50,000 level, Coinbase Pro users have collectively pulled in 9,951 BTC worth $467.28 million in the past week alone.

The analytics firm also revealed that the Seychelles-based digital asset exchange OKEx recorded 2,196 BTC outflows worth $103.12 million in the same time frame. OKEx Its users have withdrawn 748 BTC worth $35.12 million in the last 24 hours.

Coinbase and OKEx are seeing significant decreases in their Bitcoin balances, while Binance and Bitfinex are seeing increases in BTC inflows.

Coinglass shows that users of global crypto exchange Binance deposited 10,880 BTC worth $510.94 million in just one week. Meanwhile, digital asset exchange Bitfinex bitcoin He noted that his balance increased by 3,505 BTC ($164.33 million) over the same period.

Taking into account net inflows and outflows, Coinglass reported that the total Bitcoin balance across all crypto exchanges has moved (up) to 14,166 BTC ($664 million) over the past seven days.

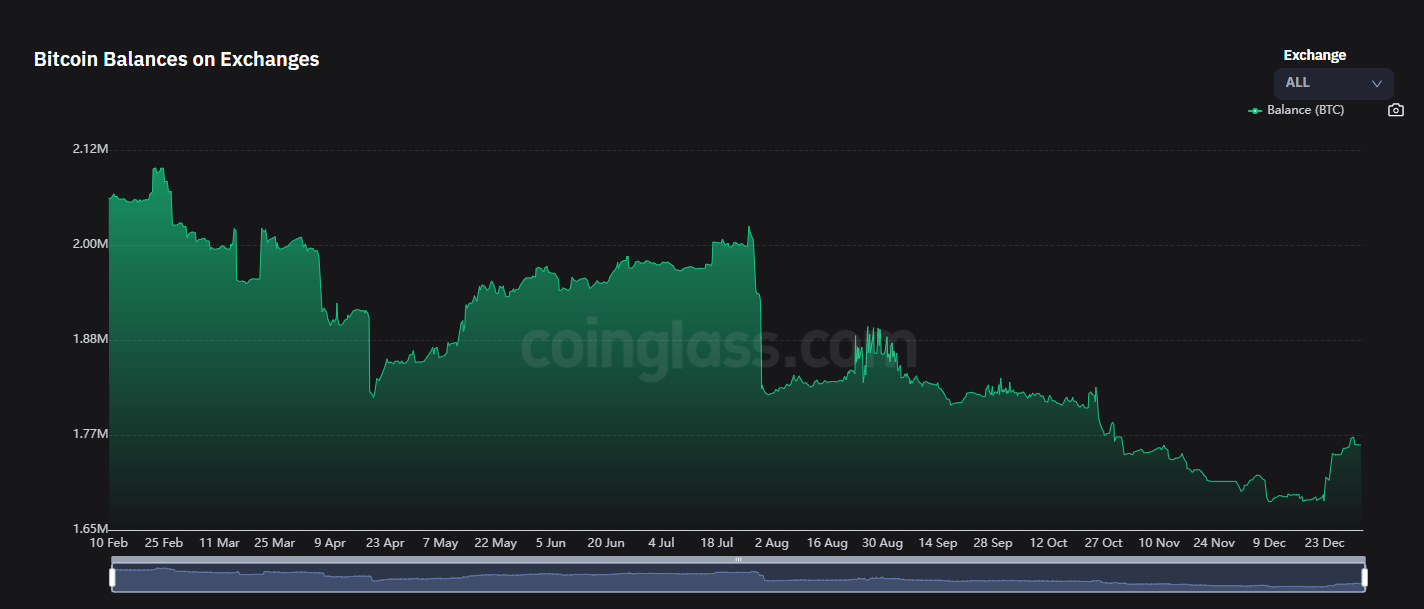

While the amount of BTC stored on digital asset exchanges has seen a modest increase this week, Coinglass reveals that the metric of Bitcoin balances across all exchanges continues to trend downward. Data from the analytics firm shows that crypto exchanges currently hold 1.76 million BTC, down about 17% from the 2.1 million Bitcoin balance in February 2021.

Popular on-chain analyst Willy Woo says that Bitcoin is undergoing a massive supply transfer trend from whales or assets holding 1,000 BTC or more to shrimp or those holding less than one BTC.

“Whales currently hold 24% of the supply.

Rates held as of January 1 in previous years:

2021 – 27%

2020 – 27%

2019 – 29%

2018 – 32%

2017 – 39%

2016 – 44%

2015 – 46%

2014 – 48%

2013 – 52%

2012 – 54%

Shrimps are buying the bottoms, whales are slowly disappearing as usual. (BTC gets a better distribution every year through this process).”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.