Matrixport Research, which frequently comes to the fore with its cryptocurrency predictions, Bitcoin It renewed its bullish outlook for its price and issued a long-term forecast for the coming months and years.

Matrixport’s latest report, published in the midst of the fifth ongoing Bitcoin bull market, is quite similar to previous predictions. Matrixport expects BTC to reach $63,140 by April 2024 and reach $125,000 levels by the end of 2024. This bold prediction is based on a comprehensive analysis covering various important factors, including geopolitical developments, monetary policies and macroeconomic impacts.

The report also puts the current Bitcoin bull market in context, drawing parallels with historical trends. The report notes that previous bear markets in 2014 and 2018 were followed by three-year bull markets, indicating a cyclical pattern. Following the 2022 bear market, which saw a 65% decline, Matrixport’s analysis predicts another three-year bull market, adapting to this cycle, and points to an impressive 123% increase in 2023.

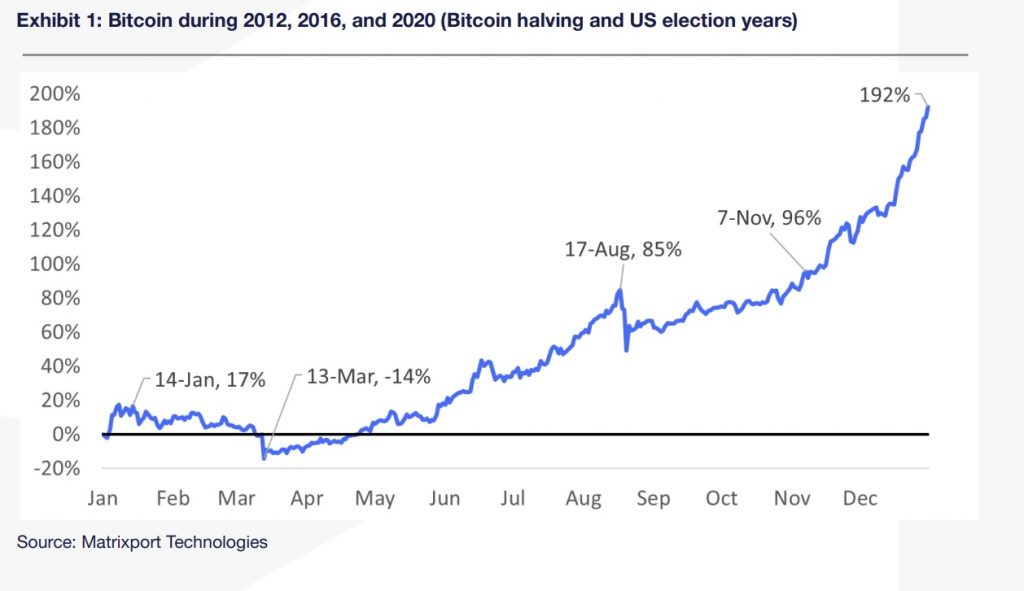

An important aspect highlighted in the report is the historical correlation between Bitcoin’s price increase and mining reward halving events. The years 2012, 2016, and 2020, when BTCmining rewards were halved, witnessed significant upward trends, with staggering price increases of 186%, 126%, and 297% respectively. Matrixport highlights that miners tend to accumulate BTC ahead of halving events, which is in line with their predictions of the price reaching $125,000, potentially contributing to a 200% price increase.

Moreover, Matrixport’s analysis examines the macroeconomic landscape, suggesting a strong tailwind for cryptocurrencies. The inflation model predicts a decrease in inflation rates, which may cause the Federal Reserve to begin cutting interest rates. This strategic monetary support, combined with geopolitical crosscurrents, is expected to push Bitcoin to unprecedented highs in 2024.

The report’s comprehensive evaluation combines technical analysis, historical trends, and macroeconomic factors to support the firm’s bullish outlook on Bitcoin. The report serves as a guiding beacon for investors and enthusiasts navigating the volatile but promising cryptocurrency market.

However, it is important to note that these projections are based on extensive analysis and historical models and may not guarantee future results in the highly volatile crypto space. Investors should exercise caution and conduct thorough research before making investment decisions, considering the risks inherent in the cryptocurrency market.