Most major altcoins like Bitcoin and MATIC are witnessing aggressive selling at higher levels. According to crypto analyst Rakesh Upadhyay, this indicates that the bears are trying to make a comeback. What levels do Bitcoin and altcoins have to defend if the bulls want to keep their chances alive for the continuation of the upside? The analyst examines the charts of the top 10 cryptocurrencies to find out.

An overview of the cryptocurrency market

cryptocoin.comAs you follow, JPMorgan Chase emerged victorious in an auction to buy the deposits and “significant majority of its assets” of troubled bank First Republic. This marked the failure of the third regional bank in the US since March. It also revealed the vulnerabilities in the old banking system. Meanwhile, Bitcoin surged for four consecutive months from January to April. Crypto last achieved this feat in 2013. Will the recovery continue in May?

Historical data gives no clear advantage to bulls or bears in May. Performance is split right down the middle, with five positive and five negative monthly closes in May, according to Coinglass data.

The recovery in Bitcoin faces a tough hurdle above $30,000. This indicates that the bulls are cautious about buying at higher levels. This could be due to the upcoming Fed meeting on May 2 and 3, which is known to cause an increase in short-term volatility.

BTC, ETH, BNB And XRP analysis

Bitcoin (BTC): Bears aggressively defend overhead resistance

The long wick on Bitcoin’s April 30 candlestick chart shows that the bears are aggressively defending the overhead resistance at $30,000.

The price declined on May 1st and turned bearish. However, the fact that the bulls are fiercely guarding the 50-day SMA ($28,146) is a minor improvement. This shows that BTC will fluctuate between $26,942 and $30,000 for a while. Usually, a narrow trading range is followed by a range expansion. If the price continues to drop below $26,942, a drop to the key $25,250 support level is possible for BTC. On the contrary, if the range rises above $30,000, BTC is likely to rally to $31,000 and then to $32,400. A break above this level will signal a recovery in momentum.

Ethereum (ETH): Bears try to turn 20-day EMA into resistance

The bulls are struggling to push and sustain ETH price above the 20-day EMA ($1,896). This shows that the bears are trying to turn this level into resistance.

The 20-day EMA has started to drop gradually. Also, the RSI has dipped below 45. This shows that the bears have a slight advantage. If the bears lower the price and hold it below $1,785, a drop to $1,663, the 61.8% Fibonacci retracement level, is possible for ETH. Contrary to this assumption, if the price turns up from the current level, the bulls will again try to push ETH above the psychological level of $2,000. If they are successful, ETH is likely to rally to the tough overhead resistance of $2,200.

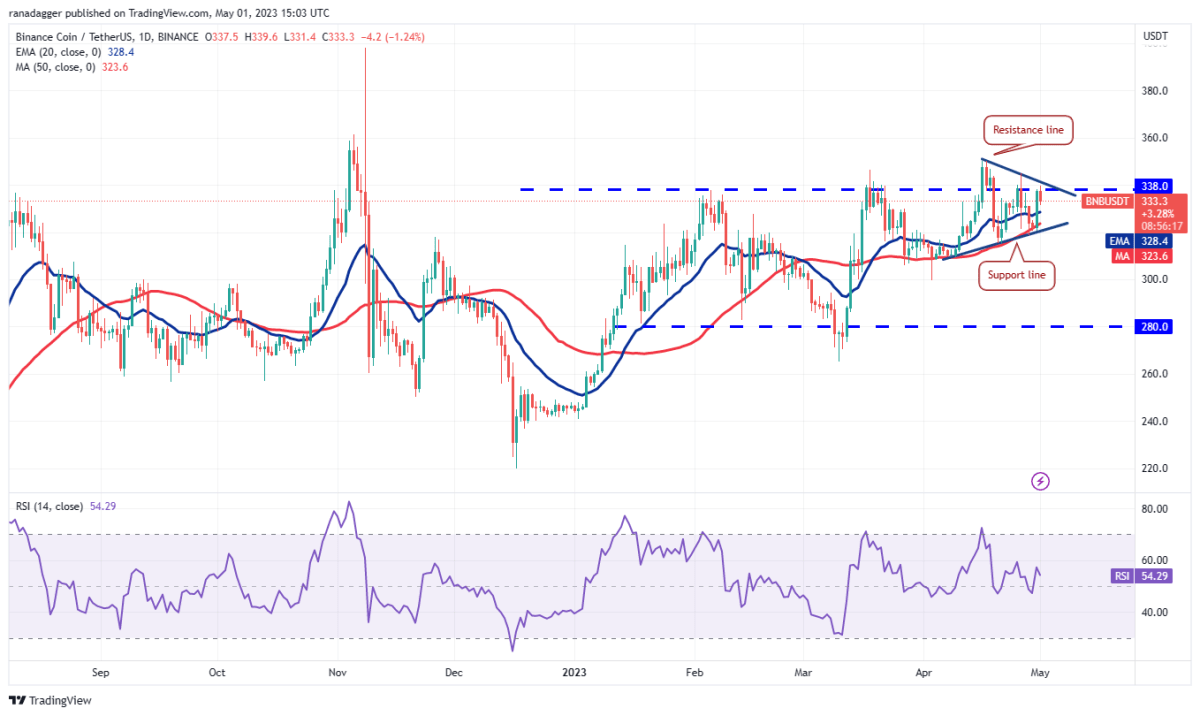

Binance Coin (BNB): Bulls hold this level in full force

BNB rebounded from the 50-day SMA ($323) on April 30. Thus, it showed that the bulls continue to hold this level in full force.

The price action of the last few days has formed a symmetrical triangle formation, which indicates indecision between buyers and sellers. The 20-day EMA ($328) is gradually rising. Also, the RSI is just above the midpoint. This marks a minor advantage for the bulls. If buyers push the price above the triangle, this will mark the start of a new upward move. BNB is likely to move higher towards the $380 formation target and then towards $400. In the meantime, the bears are likely to have other plans. The bears will attempt to push BNB below the support line of the triangle and deepen the correction to $280.

Ripple (XRP): Traders sell in rallies

XRP recovery hit a wall at the 20-day EMA ($0.47) on April 29. This shows that sentiment is negative and traders are selling on rallies.

The bears will try to push the price towards the strong support level of $0.43. This is an important level to consider. Because if it breaks, it is possible for XRP to drop to the next major support level at $0.36. The first sign of strength would be a break and close above the 20-day EMA. Such a move would indicate that the bears are losing control. This is also likely to open the doors for a possible rally towards the resistance line. If the bulls break this barrier, it is possible for XRP to rally towards $0.56.

ADA, MATIC, DOGE and SOL analysis

Cardano (ADA): Bears fiercely hold this level

Buyers have a hard time pushing the Cardano above the neckline. This shows that the bears are keeping the level fiercely.

A minor positive point in favor of the bulls is that they did not allow the price to drop below the 50-day SMA ($0.38). The RSI is in the negative territory and the 20-day EMA ($0.40) is flattening. This shows that the bears are trying to gain the upper hand. Selling could intensify if ADA price dips below $0.37. Also, it is possible for ADA to drop to the next support level at $0.33. On the upside, the bulls will need to break the neckline hurdle to create a retest of $0.46. A break above this level will mark the start of a new uptrend.

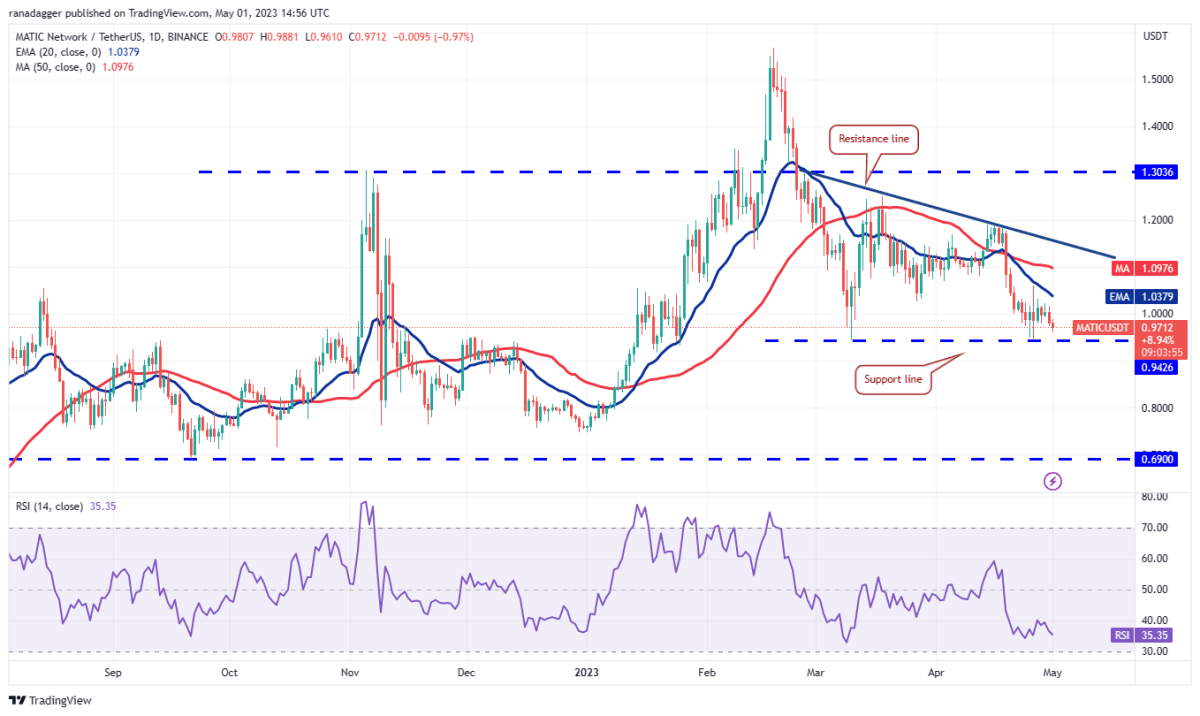

Polygon (MATIC): Bears sell in rallies

MATIC is facing selling off by the bears on relief rallies as the bulls try to defend the $0.94 support.

This narrow trading range is unlikely to continue for long. The downward sloping 20-day EMA ($1.03) and the RSI in the negative zone indicate that the path of least resistance is to the downside. If the bears pull the price below $0.94, MATIC price is likely to decline towards $0.69. On the contrary, if MATIC price turns up from the current level and rises above the 20-day EMA, it indicates the start of a stronger recovery. In this case, it is possible for the MATIC price to rise to the resistance line, where the bulls will again face heavy pressure from the bears.

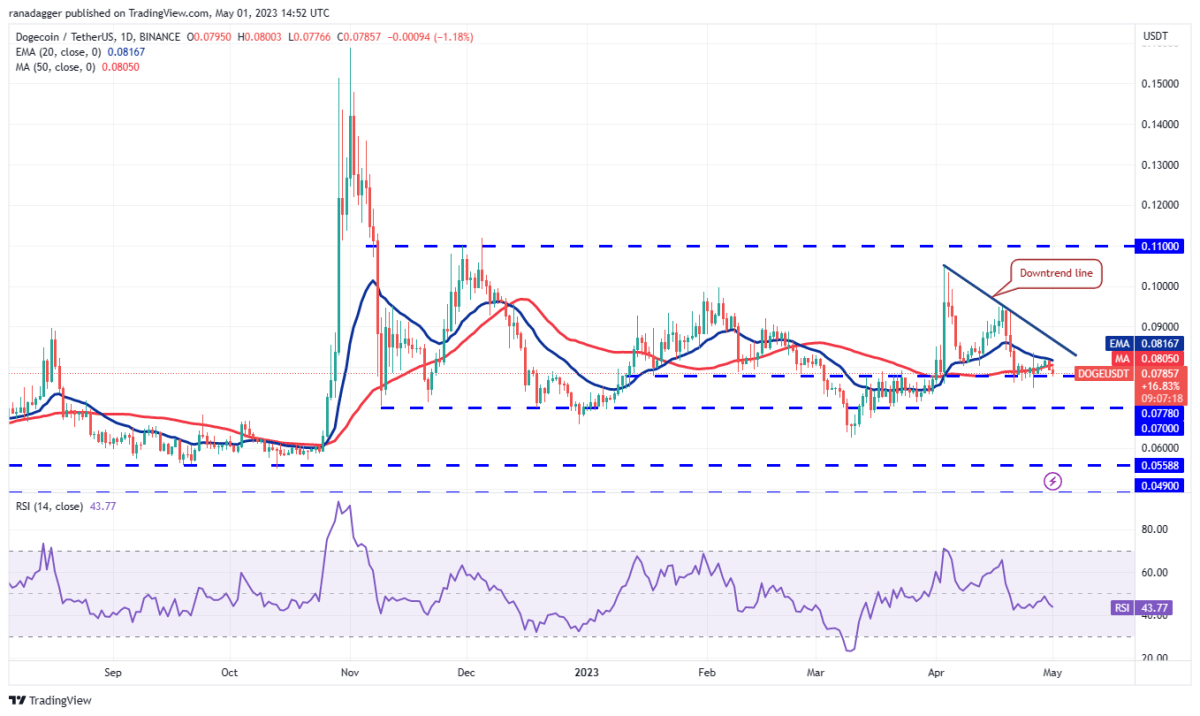

Dogecoin (DOGE): Bears sell rallies

DOGE’s turn down from the 20-day EMA ($0.08) on April 30 shows that sentiment is downside and the bears are using the rallies to sell.

The price reached support around $0.08. Exceeding this level will indicate that the bears have taken control. Sellers will then try to build their advantage and push DOGE to the next support level at $0.07. The bulls are expected to defend the region between $0.07 and $0.06 with all their might. On the contrary, if the price bounces off the current level and rises above the 20-day EMA, it indicates that the bulls are accumulating lower. The upside momentum is likely to increase after the buyers pierce the downtrend line. It is possible for DOGE to rally to $0.11 later.

Solana (SOL): Bears are active at higher levels

Solana dropped from $24 on April 30. Thus, it showed that bears are active at higher levels. The price has reached the 50-day SMA ($21.74), an important level to consider.

The short-term advantage will be in favor of the bears if they manage to push the price below the 50-day SMA. SOL is likely to drop to the strong support level at $18.70 later. Buyers are likely to hold this level strongly. If the price recovers from $18.70, the bulls will again attempt to break through the $24 barrier. If they manage to do so, SOL is likely to attempt a rise to $27.12. A pullback from this level could result in a price move between $27.12 and $18.70 for a while. Alternatively, if the bulls push the price above $27.12, the next stop could be as high as $39.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.