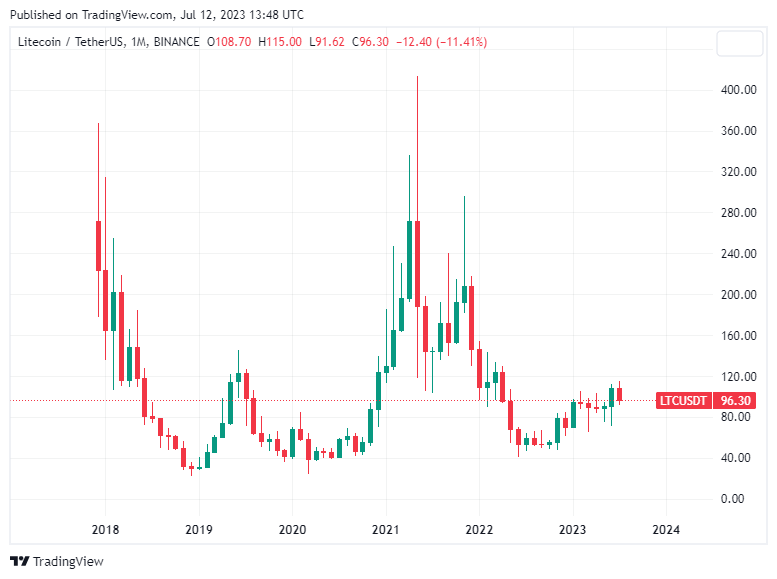

Historical data is never a guarantee of future results. However, Litecoin’s (LTC) price action is currently reminiscent of late 2016 and early 2017, just before the epic 100x rally. In addition, it will go through its third halving cycle in August. Can altcoin fly with these developments?

Litecoin returns with 100x signals: Altcoin bulls lay the groundwork

The 100x signal in question comes out with the 9-day Bollinger Bands and Bollinger Bandwidth. Bollinger Bands are the second tightest band in Litecoin history. This metric is a volatility tool that uses a simple moving average and two standard deviations.

Bands widen at high volatility and narrow at low volatility. A low volatility situation called a squeeze always ends with a significant move. It then turns into a shocking burst of volatility. However, volatility is only a measure of the price distribution over a period of time.

Also, the Bollinger Bandwidth has been narrowing lower for six full years. If the downtrend pattern is broken, the biggest move of a half-decade could come. As crypto analyst Tony “The Bull” puts it:

Litecoin’s volatility has been contracting for six years. Lowest volatility since LTC in 2017 from $3 to $300 (100x). Those who are patient will be rewarded. The longer it takes, the greater the movement. When it starts, it will be a sight to behold.

Weeks away from the next Litecoin halving

Litecoin price rose 5% on July 11 to retest $100. However, historical data shows that LTC will most likely bounce back as the halving date approaches. The highly anticipated third halving is scheduled to take place on August 2, 2023.

On the other hand, historical data reveals Litecoin’s extraordinary “price down” trend in the weeks before the previous halving cycle in 2015 and 2019. Ahead of Litecoin’s first halving in 2015, the price of LTC surged to $7.54 on July 10. It then fell 42% to $4.40 on the August 5 halving date.

A similar pattern occurred in the 2019 cycle. LTC price surged to $142 on June 23, 2015 and fell 53% to $93 on the August 5 halving date. The post-halving downtrend continued for several months before Litecoin entered another rally in January 2020.

Altcoin miners run out of reserves ahead of halving

After gaining 300,000 LTC in June, Litecoin miners started depleting their LTC reserves in July. IntoTheBlock data shows that between July 5 and July 11, Litecoin miners sold 90,000 LTC.

Meanwhile, Litecoin’s hashrate also recorded a drop reflecting miner exit. The same trend continued to apply to Litecoin’s falling miner revenues.

cryptocoin.comAs you follow, Litecoin became the most used cryptocurrency for payments last week, while recording a decline in the above metrics.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.