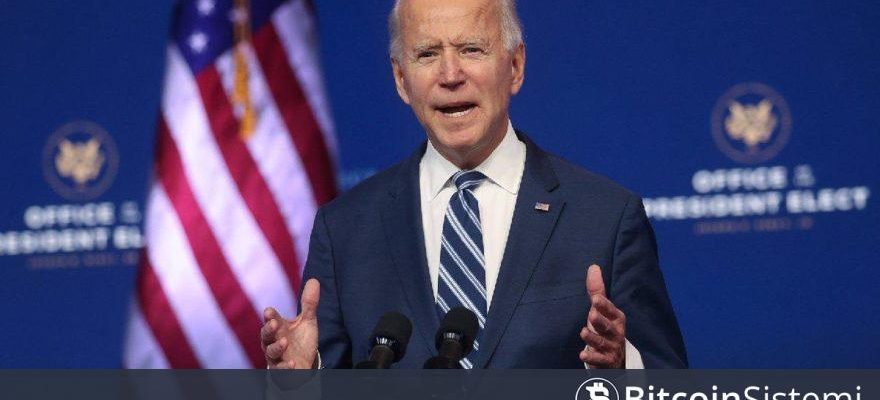

While the 2024 Presidential election race continues rapidly in the USA, the White House presented its budget proposal to the US Congress, which includes government expenditures for the 2025 fiscal year, which will start on October 1.

In US President Joe Biden’s $7.3 trillion budget proposal for the 2025 fiscal year, taxes on the rich and large companies were increased. At this point, the budget proposes that billionaires pay at least 25 percent of their income as taxes, while tax rates for large companies have also been increased.

These moves are aimed at reducing the budget deficit, reducing costs for American families, and preventing large multinational corporations from avoiding taxes. u

Cryptocurrency Detail in the 2025 US Budget Proposal!

In Biden’s 2025 budget proposal cryptocurrency The detail also attracted attention. Accordingly, the US Treasury Department, which prepared the budget proposal, included the sectors that are expected to generate income in 2025, as in the 2024 budget. cryptocurrency transactions and mining He also added his activities.

In the “2025 Fiscal Year Revenue Proposals” report published by the US Treasury Department, it was stated that digital assets are not adequately regulated in the current legal framework, and it was announced that a consumption tax is planned to be applied to cryptocurrency mining transactions in order to fill this gap.

In its proposal, the Ministry proposes that cryptocurrency mining companies that use electricity in their activities should pay an additional 30% tax and that their companies should be obliged to report the amount and value of the electricity used.

If this proposal is approved and becomes law, the cryptocurrency taxes in question will begin to be implemented as of December 31, 2024 and will be gradually implemented over three years; It will be applied at 10 percent, 20 percent and finally 30 percent.

While this offer draws reaction U.S. Senator Cynthia Lummis openly opposed this tax proposal. Lummis argued that the inclusion of cryptocurrencies in the federal budget and the 30 percent tax would negatively affect the presence of the cryptocurrency industry in the United States.

Apart from Lummis, vice president of research at Riot Platforms Pierre Rochard crypto tax decision BitcoinHe said he believed it was aimed at weakening and promoting CBDC, a centralized digital currency.

Biden administration is proposing a 30% tax on electricity used by #bitcoin miners, even if you are off-grid using your own solar and wind generation. All of the reasons they provide are pretextual, their real reason is that they want to suppress Bitcoin and launch a CBDC. pic.twitter.com/juNHvO2NBx

— Pierre Rochard (@BitcoinPierre) March 12, 2024

As you may remember, Biden’s tax proposal on cryptocurrencies was rejected last year after long discussions.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!