The Greek economy could exceed all expectations this year.

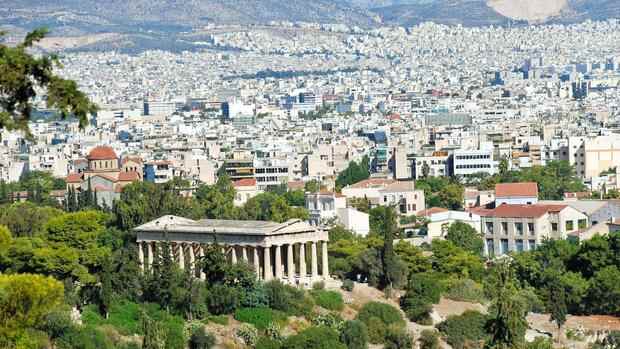

(Photo: imago/Panthermedia)

Greek Finance Minister Christos Staikouras wanted to raise twelve billion euros on the capital market this year. That was the issuance plan of the state debt agency PDMA. The PDMA placed bonds for 6.9 billion in the first seven months. It should stay that way for the time being. In view of the exploding bond yields, further issues are currently out of the question.

The shift to the right in Italy is putting pressure on Greek debt securities. The bond yields of the two countries have developed largely in parallel in recent years.

Greece and Italy are the front runners in the euro zone when it comes to public debt. Athens’ debt ratio was 189.3 percent of gross domestic product (GDP) in the first quarter, ahead of Italy’s 152.6 percent.

In this respect, the sharp price losses of the Greek papers are not a big surprise at first. But they are not only related to the Italy election. The selling pressure also reflects growing concerns about political stability in Greece.

Top jobs of the day

Find the best jobs now and

be notified by email.

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue