A widely followed crypto strategist has pointed out an important metric with a history of accurately predicting Bitcoin (BTC) bottoms.

The analyst, known by the alias Rekt Capital, told 303,000 Twitter followers that BTC’s Relative Strength Index (RSI) has reached a critical level. told. The level in question marks a jump on the horizon for the historically leading crypto asset Bitcoin.

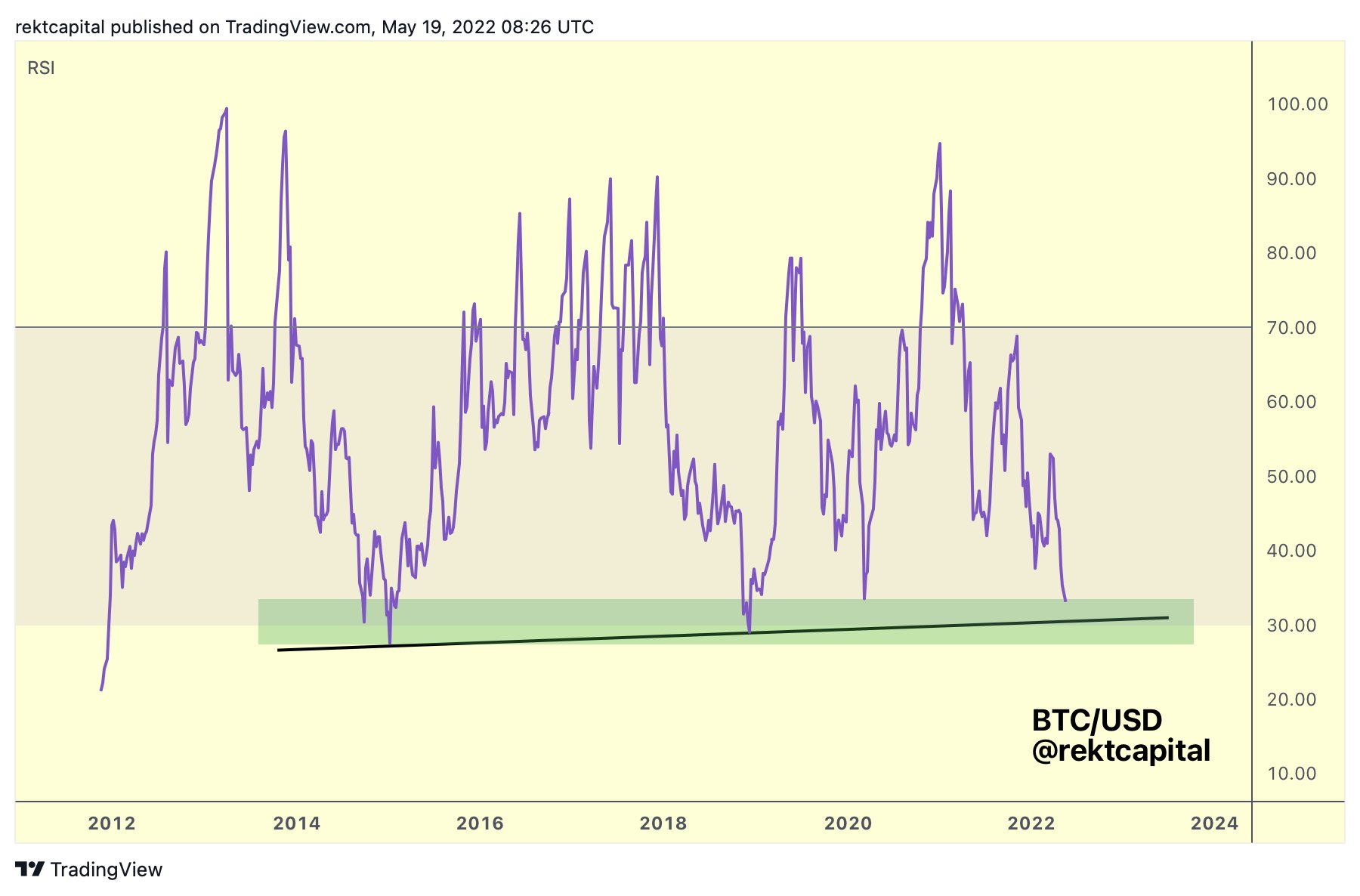

“BTC’s RSI reaching March 2020 levels represents the best-case scenario where BTC bottom is very close.

However, the RSI levels hit the bottom of the bear market, bottoming much lower in 2015 and 2018.

If the RSI levels drop, the black higher low could be a reversal point.”

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements to determine whether it is oversold or overbought in a given time frame.

According to the crypto analyst, Bitcoin reached a bear market bottom in its three previous dips to the area where its RSI is currently close, followed by a recovery.

“The Bitcoin RSI is entering a period that historically precedes large investment returns for long-term investors.

Previous returns in this area include January 2015, December 2018, and March 2020. They’re all bear market bottoms.”

Finally, Rekt Capital said that BTC’s RSI has reached the same level as it was in March 2020, before the leading digital asset started a rally that continued until the end of the year.

Bitcoin is trading at $29,240 at the time of writing, down over 6% from its seven-day high of $31,319.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.