Gold is evaluating interest rate cut clues ahead of the FOMC. Despite the rise in the dollar and the increase in yields, the gold price remains resistant. The Fed’s stance and inflation data will direct the short-term trend of gold.

Gold market outlook ahead of Fed Minutes

Investors are waiting for important information from the minutes of the last meeting regarding the timing of the US Federal Reserve’s interest rate cut. The gold price remains stable against a strengthening dollar and rising Treasury yields. This resistance to typical market pressures indicates that interest in gold is strong.

The upcoming Federal Open Market Committee (FOMC) minutes are a critical focus that is expected to shed light on the Fed’s interest rate strategies. However, the market expects limited surprises due to the Fed’s transparent stance before the latest inflation data is released. As a result, gold’s short-term trend is likely to be driven by technical factors rather than FOMC statements.

Federal Reserve’s position

Fed Chairman Jarome Powell has opposed rapid rate cuts since his January policy meeting. cryptokoin.comAs you follow from , the Fed kept interest rates at 5.25-5.5%. This softened expectations as it signaled only three possible cuts this year. Recent inflation reports support the Fed’s cautious approach. Moreover, this approach is likely to be echoed in the upcoming minutes. Unexpectedly high US inflation data increased doubts that interest rates would be cut immediately, shifting market expectations to a possible cut in June. This change in the interest rate environment affects the appeal of gold as a non-yielding asset.

Gold price short term outlook and tactical picture

Market analyst James Hyerczyk evaluates the short-term outlook for gold. In the short term, the gold price is in a slightly upward trend. The anticipation surrounding the Fed minutes, combined with technical market factors, points to a potential rise in gold prices. The Fed’s renewed focus on inflation generally reduces gold’s appeal. However, the market’s adjusted interest rate cut expectations and gold’s recent resilience point to a cautiously optimistic outlook for the metal. This sentiment is compounded by ongoing global economic uncertainties. Therefore, it positions gold favorably in the eyes of experienced traders.

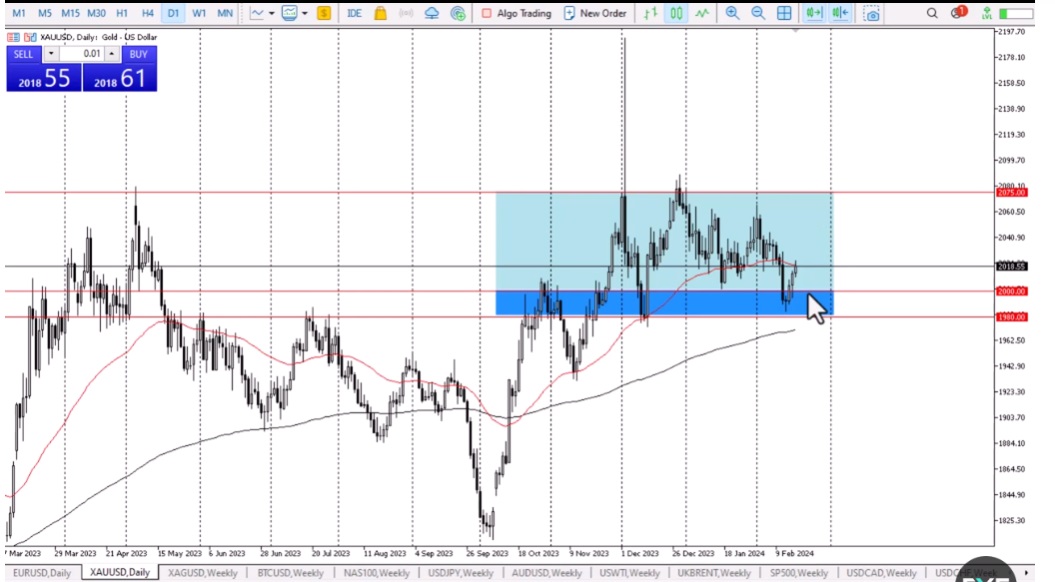

Gold rose for a fourth session on Tuesday as traders approached the 50-day moving average of $2,030.65. The reaction of traders to this level will determine the intermediate trend. If the intermediate trend turns higher, look for a possible short trade towards the $2,067.00 resistance. Failure to exceed the 50-day level of the MA will indicate the resumption of the downtrend. This will likely lead to a short-term test of the static support at $2,009.00 and the recent major low at $1,984.30.

Gold price technical analysis

Technical analyst Christopher Lewis also comments on the technical picture of gold. As you can see, we touched the 50-day EMA on Monday. That’s why the gold price rose slightly during the trading session. The 50-day EMA is of course an area that many people will pay attention to. It is also worth noting that the $2,020 level is an area where we have seen some noise before. However, the market will likely continue to pay a lot of attention to this level. But once we get above this level, we will likely move higher.

So I think we have a decision on our hands that we can step back on a little bit. However, this pullback likely does not create another buying opportunity. If we move above the top of last week’s candlestick, this was very negative around the $2,030 level. Then gold has a chance to reach the above $2,075 level. Below, the area I am most interested in is between $2,000 and $1,980. Because I think this is a support area. And of course, the 200-day EMA is also racing towards it. So it all comes together quite nicely.

Ultimately, at this point, traders continue to look for value and take advantage of it when it appears. I have no intention of short selling in this market. Plus, there are plenty of geopolitical reasons to hold at least some gold in your portfolio. While I would argue that you could get some value here in a short-term pullback that you can capitalize on in a market that is quite volatile, I think he is trying to build the necessary momentum for his next move.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!