According to the central bank chairman, the Fed is ready to increase the pace of interest rate hikes again.

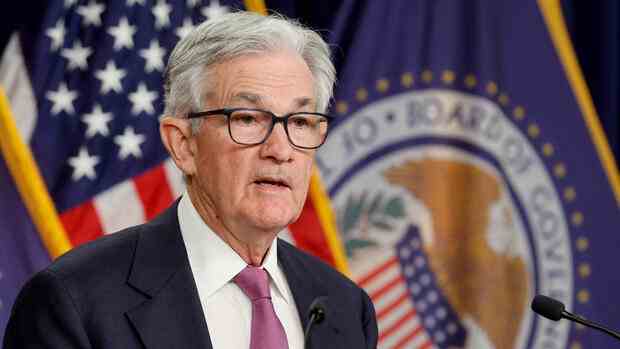

(Photo: Reuters)

Washington The head of the US Federal Reserve, Jerome Powell, believes that larger interest rate hikes are possible again in the future after the pace of interest rate hikes has slowed. “Although inflation has moderated in recent months, there is still a long way to go before a return to 2 percent inflation, which will likely be bumpy,” Powell told a Senate committee in Washington on Tuesday.

The latest economic data was better than expected, said Powell, especially with regard to the labor market figures. This suggests that the final interest rate level will probably be higher than previously assumed. “Should the body of data suggest that faster tightening is warranted, we would be willing to increase the pace of rate hikes,” Powell said. Inflationary pressure is higher than expected at the last Fed meeting.

At the February meeting, the Fed slowed the pace of rate hikes again. It raised key interest rates by 0.25 percentage points to a range of 4.50 to 4.75 percent. In December, it had increased the key interest rate by 0.50 percentage points. Previously, it had raised interest rates four times in a row by 0.75 percentage points.

Fed Chairman Jerome Powell had previously announced further rate hikes. However, it will probably take until 2024 for inflation to reach the Fed’s target of two percent again, he stressed.

Economists point to the still very strong labor market, which makes it difficult for inflation to fall. The US economy will be slowed down by higher interest rates. So far, however, the tight monetary policy has not had any visible effects on the booming job market in the world’s largest economy.

More: ECB Governing Council member expects four more rate hikes this year