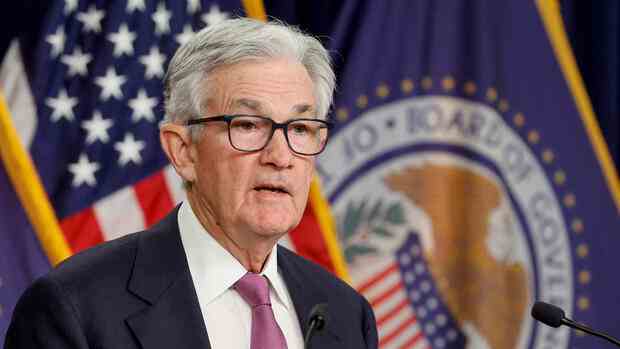

“We have to be patient,” said the Fed chair, referring to inflation.

(Photo: Reuters)

Washington The US Federal Reserve wants to align its future course with the economic development and, according to its boss Jerome Powell, remains flexible when it comes to interest rate increases. If, for example, the data continues to be stronger than expected and the central bank sees more need for increases than indicated in its latest interest rate outlook, it will act accordingly: “Then we would certainly raise interest rates more,” he emphasized on Tuesday at the Economic Club of Washington.

He sees the better-than-expected labor market report for January as a sign that the central bank has not yet reached the end of the road when it comes to interest rates.

A return to the Fed’s inflation target of 2.0 percent is only expected in the course of 2024. Against this background, interest rates would have to remain at a restrictive level for some time: “We have to be patient,” he added. In its outlook before the turn of the year for the end of 2023, the Fed management team had estimated an average key interest rate of 5.1 percent.

The Federal Reserve wants to curb inflation in the country and also cool down the overheated labor market with higher interest rates. An updated interest rate outlook will be presented in March. Despite rising interest rates and a sluggish global economy, the US job engine started the new year at full speed. More than half a million new jobs were added in January, far more than experts expected. The unemployment rate fell to 3.4 percent – the lowest level since 1969.

In view of the falling inflation, however, the Fed recently shifted down another gear and increased the key interest rate by only a quarter of a percentage point – to the new range of 4.50 to 4.75 percent. After a series of relatively large interest rate hikes, some normality is returning to monetary policy. Powell declined to comment in the Economic Club on whether knowledge of the strength of the job market would have affected the quarter-point rise in interest rates last week.

Powell says rate cuts in 2023 not appropriate

Immediately after the interest rate hike, Powell made it clear that there was “more to do” in terms of monetary policy. The current outlook suggested weaker growth, a modest rise in unemployment and a gradual decline in inflation. If the economy is broadly developing in line with these expectations, then it is not appropriate to cut interest rates this year, he stressed. If, on the other hand, inflation recedes more quickly, this will be taken into account in monetary policy.

In view of the ongoing job boom and high inflation, the head of the Minneapolis Federal Reserve District sees a need for interest rate hikes to a level well above the five percent mark. Neel Kashkari called the January jobs report a surprise on CNBC on Tuesday.

The President of the Fed subsidiary Minneapolis is pushing for sharp rate hikes.

(Photo: imago/ZUMA Press)

This shows that the central bank has not yet affected the strength of the job market with its series of sometimes sharp interest rate hikes: “No one should overreact to a report, but the fundamental strength of the service sector of the economy is still very robust.” He still sees a need to raise the key interest rate to around 5.4 percent.

Fed chairman Atlanta can also well imagine a sharp rate hike.

(Photo: Reuters)

Another US central banker also sees a sharp rise in interest rates as appropriate. If Friday’s jobs report doesn’t turn out to be anomalous, “it probably means we have to do a little more,” Atlanta branch Fed President Raphael Bostic told Bloomberg on Monday. The US Federal Reserve could also consider raising the interest rate by half a percentage point.

More: Turnaround in monetary policy or business as usual? Japanese government must nominate new central bank governor