Arthur Hayes, co-founder of BitMEX derivatives exchange and one of the leading names in the cryptocurrency world, attributed the recent rally in cryptocurrency markets to increasing costs associated with hawkish US foreign policy rather than the expectation of a Bitcoin exchange-traded fund (ETF). Here are the details…

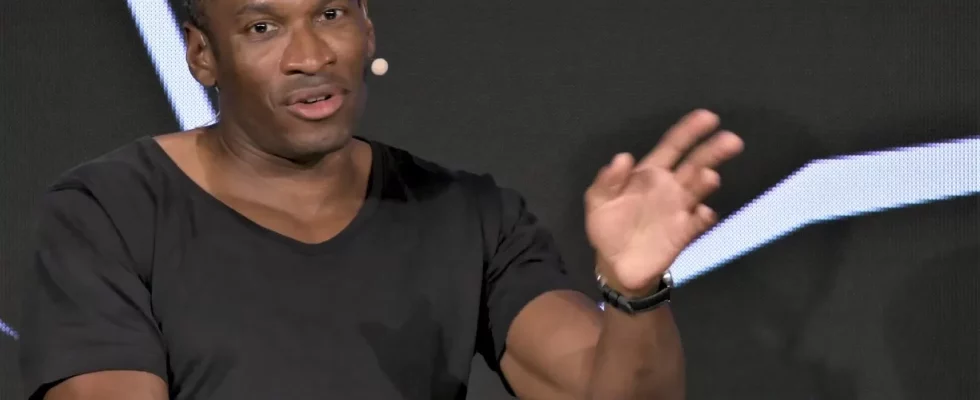

Arhur Hayes shared his views on cryptocurrency

Hayes expressed his views in an article titled “The Periphery” published on October 24. He pointed to US President Joe Biden’s commitment to support Israel’s war effort and ongoing military actions in Ukraine as the driving forces behind the volatility in crypto markets. “When Ukraine’s bill is added in, America’s military budget will really explode,” Hayes said. “This will increase future government borrowing, and the sky is the limit when it comes to the amount of capital a war can waste,” he said.

According to Hayes, institutional investors have already started selling bonds and treasury bills in anticipation of increased US military spending. They are now seeking returns from alternative asset classes. “If long-term U.S. Treasury bonds do not provide safety for investors, then their currencies will look for alternatives,” Hayes said. “Gold and most importantly Bitcoin will begin to rise on real fears of global wartime inflation,” he said. these comments cryptokoin.com As we reported, it comes at a time when Bitcoin is up 19.5% in just seven days. Many experts attribute this move to progress in BlackRock’s Bitcoin ETF application. However, Hayes argues that this is due to the rising costs of US foreign policy.

Market value increased

The total value of cryptocurrencies increased by 12.6% during the same period. Gold in particular has also increased by 8.6% since the outbreak of conflict in Gaza. Arthur Hayes’ perspective highlights the complex interplay between geopolitics and financial markets. As the United States becomes more involved in global conflicts, the risk of worldwide escalation increases. Investors are taking refuge in assets like gold and Bitcoin. It remains to be seen whether Hayes’ theory will be correct. But for now, it adds an intriguing layer to the ongoing debate about what is driving the crypto market’s recent rise.

As a result, macro concerns began to be voiced even louder this quarter with the increasing presence of war. Billionaire investor Ray Dalio, founder of the world’s largest hedge fund Bridgewater Associates, recently announced a “3. He determined the probability of development of the “World War II” scenario as 50%. “I hope that the leaders of the major powers will wisely step back from the brink while they must prepare to be strong enough to successfully fight and win a hot war,” he wrote in an Oct. 12 LinkedIn post.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.