Inflation in the euro area recently reached a record level of 9.1 percent.

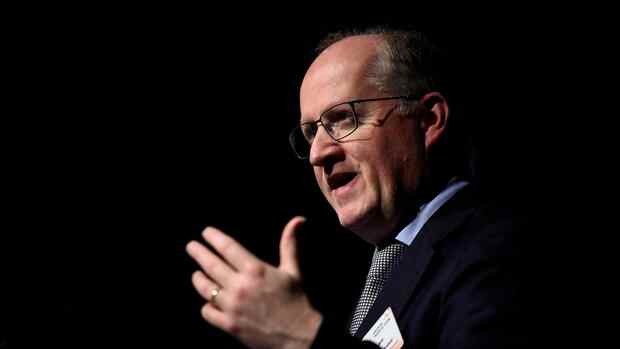

(Photo: Reuters)

Frankfurt ECB chief economist Philip Lane signals further rate hikes. The latest 0.75 percentage point hike last week was a big step in the transition towards interest rate levels that would ensure the 2 percent inflation target is met, the European Central Bank’s (ECB) chief economist said in a speech on Wednesday.

“Based on our current view, we anticipate that this transition will require us to raise interest rates further in the next few meetings,” he added. This will slow demand and prevent the risk that inflation expectations will continue to move upwards. Lane is actually considered a dove, i.e. a supporter of a soft monetary policy course.

In July, the ECB initiated the turnaround in interest rates in view of escalating inflation and on Thursday raised the key rates for the second time in a row. In July, it first raised the three main interest rates by 0.50 percentage points each, followed last week by an even larger rate hike of 0.75 percentage points. It was the largest interest rate hike since the introduction of euro cash. Central bank chief Lagarde also signaled further rate hikes.

>> Read here: Record hike – ECB raises interest rates by 0.75 percentage points

Top jobs of the day

Find the best jobs now and

be notified by email.

Lane said that individual steps would be all the more powerful the wider the gap to the final interest rate and the greater the risks to the inflation target. In his view, energy prices will remain a key driver of inflation. “It is quite clear that the appropriate monetary policy for the euro zone should continue to take into account that the energy shock remains a dominant driver of inflation developments and the general economic outlook,” he explained.

Lane’s new statements caused uncertainty on the markets. The Dax increased its losses in the afternoon and was recently 1.3 percent lower at the important mark of 13,000 points.

Inflation in the euro area climbed to a new record of 9.1 percent in August. Energy even went up by 38.3 percent. The economists at the ECB are now assuming that inflation in the currency area will still be above the ECB target at 2.3 percent in 2024.

The head of the Cypriot central bank, Constantinos Herodotou, also emphasized that following the recent sharp interest rate hikes, it is not certain where the ECB’s interest rate journey will end. “The hike we decided last week does not mean that the ultimate level of interest rates is a foregone conclusion,” the ECB Governing Council member said on Wednesday. The monetary authorities would have to regularly reassess the monetary policy course against the background of new data.

Herodotou had already commented on the current course of the ECB on Monday. Among other things, he had pointed out the danger that high inflation expectations and higher prices could take hold. These are strong signals that require “strong action”.

More: The Underrated Drama – Why U.S. and Europe Inflation Have Different Reasons